This afternoon the Federal Reserve released the minutes from last month’s FOMC meeting. Unanimously Fed officials agreed that the central bank should slow the pace of its aggressive rate hikes. This would allow them to continue to ratchet up the cost of credit to curb inflation. They continue to be worried that market participants have an inaccurate perception of hoping for rate cuts this year. However, they left the door open to tightening even more aggressively if inflation rises.

"Most participants emphasized the need to retain flexibility and optionality when moving policy to a more restrictive stance."

Most importantly they continued their stern doctrine to raise interest rates to just over 5% by the end of this year. "No participants anticipated that it would be appropriate to begin reducing the federal funds rate target in 2023,"

.png)

Gold prices maintained the morning gains following the release of last month’s FOMC meeting minutes at 2:00 PM EST. Gold futures opened today at $1845.20 and traded to an intraday high of $1871.30. As of 2:45 PM EST, the most active February 2023 contract is fixed at $1857.40 after factoring in today’s price gain of $11.60.

Silver futures basis the most active March contract opened at $24.17, traded to a low of $23.745, and is currently fixed at $23.92 after factoring in today’s $0.316 decline.

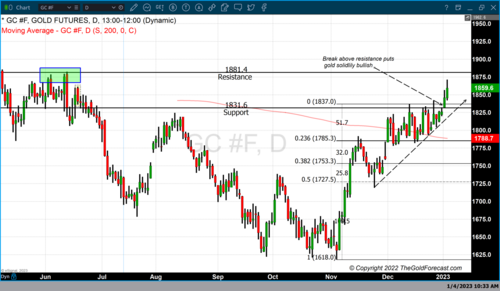

Levels to watch in gold futures for Q1 2023

It is a fact that market sentiment for gold had a major price reversal from exceedingly bearish to bullish beginning in November 2022. Our technical studies indicate that the current level of major support is $1831. This support is based on yesterday’s low. Resistance occurs at $1881.50, based on two tops that occurred in mid-November and mid-June 2022.

By Gary Wagner

Contributing to kitco.com