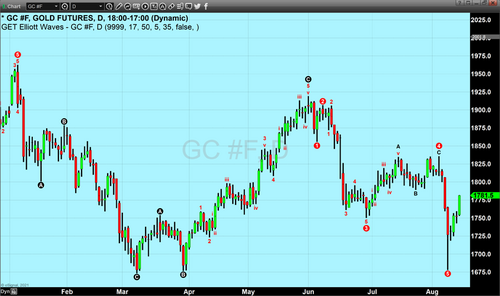

In yesterday's opening letter, we talked about the potential for gold to stage a corrective upside rally based upon our current Elliott wave count using daily charts. Today we saw another 29 dollars taking gold prices substantially higher. As of 5:34 PM EST, Gold futures basis the most active December 2021. Comex contract is currently fixed at $1781.50, after factoring in today's net gain of $29.70.

Today's continuation to the upside is a result of dollar weakness, as well as data released by the University of Michigan consumer sentiment index, which fell to 70.2 in August. This is the lowest level since the most difficult period of the pandemic in April 2020. In July, the consumer sentiment index was at 81.2.

According to Brian Lundin, editor of the gold newsletter and reported by MarketWatch, "Gold futures had become "oversold" following sharp losses last Friday and on Monday. The rebound in prices seen since then is "largely due to investor recognition that the crash was simply short-term market manipulation and no real reflection on the supply/demand dynamics for the metal." He also told MarketWatch that, "the market has also seen "growing concerns over the delta variant and the economic repercussions from its spread, as evidenced by the dramatic fall in consumer sentiment" reported Friday. It's all contributing to a general view that gold is undervalued at these levels."

Unquestionably gold pricing has been more volatile than we have seen in recent months as a result of two opposing forces. The strength of the global economic rebound which is occurring concurrently with a rebound of the infection rates of the delta variant of the Covid 19 virus. Add to that the current uncertainty as to when the Federal Reserve will begin to taper and return to a pre-pandemic monetary policy in terms of asset accumulations. Currently the belief is interest rates will remain between zero and 25 basis points most likely until the beginning of 2023. However, many analysts believe that the Federal Reserve will begin to taper its quantitative easing monetary policy early next year. While not much is expected to come out of the Jackson Hole Economic Symposium scheduled to begin on the 26th of this month. However, it is widely believed that real timelines for the beginning of tapering will be presented at one of the two remaining FOMC meetings this year.

According to Jeff Klearman, portfolio manager at Granite shares, Most of the move higher more recently for gold this week is due to increasing inflation concerns in light of the Fed "maintaining its ultra-accommodative monetary policy in the belief current high inflation is transitory,"

speaking to MarketWatch, he said that, "Extremely low and negative real yields, reflecting expectations of continued accommodative monetary policy, support gold prices because they eliminate the opportunity cost of holding gold while increasing gold's safe-haven desirability due to possible upside."

Unquestionably this has been one of the greatest tests of the global economy's ability to recover from a severe and devastating pandemic. There has never been a time in history when central banks worldwide provided such a tremendous amount of capital to support the economies of their countries. Only time will tell what repercussions the increased expenditures and mounting debt will have on the global economy.

Contributing to kitco.com

Kinesis Money the cheapest place to buy/sell Gold and Silver with Free secure storage