It is incredible how fast a year can fly by. Once again, the Kitco News team is getting ready to launch its annual Outlook Series to help gold investors navigate what are expected to be turbulent financial markets in 2022.

Kitco News’s Outlook feature will be launched on Monday. We are already compiling stories to give you the best information available.

Not to give you any spoiler alerts, but so far, the general sentiment among some of the biggest international banks is that gold is expecting to see renewed investor demand as inflation continues to heat up. This is good news for what has been a disappointing year for some.

Not surprisingly, inflation remains the most prominent story heading into 2022. Friday, the U.S. Labor Department said that its Consumer Price Index saw an annual rise of 6.8% last month. This is the highest inflation reading in 39 years, and according to some analysts and economists, there is room for inflation to go higher.

Looking to next year, many economists are expecting inflation pressures to peak in the first half of 2022 and then moderate in the second half of the year; however, consumers can expect to see inflation well above historical norms. Economic forecasts look for inflation to trend between 4% and 6% next year.

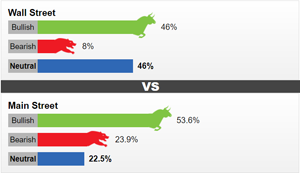

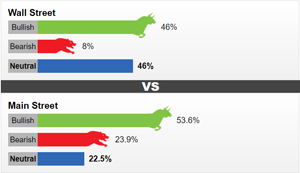

Gold is done falling and the Fed's announcement can't change that - Kitco's gold price survey

Economists and market analysts also see 2022 as an important transition year as the Federal Reserve looks to tighten its monetary policies. Because of the growing inflation threat, markets expect the U.S. central bank to raise interest rates as early as June. Surprisingly, markets are pricing in a total of four rate hikes next year.

So what does all of this mean for gold? Before gold bulls start to swoon over the idea of four rate hikes next year, it is important to look at the big picture. Most analysts see current market expectations as too aggressive. Pretty much every economist that we have talked to in recent weeks does not expect the Federal Reserve to get in front of the inflation curve.

There is still a lot of uncertainty in the global economy. The last thing any central bank wants to do is risk making a policy mistake.

According to many analysts, real interest rates are going to remain in low to negative territory next year because of inflation. The precious metal, which has had a lackluster 2021, is expected to see some renewed interest as investors try to protect their wealth and purchasing power.

By Neils Christensen

For Kitco News

Buy, Sell Gold and Silver, with Free Storage and Monthly Yields