Volatility continues to be a prominent factor in gold pricing today. The volatility revolved around the release of the Labor Department’s jobs report for January. Earlier this week ADP released its private-sector jobs report. Economists polled by the Wall Street Journal were expecting an additional 200,000 jobs to be added in January. The ADP report came in well below forecasts indicating that over 300,000 jobs were lost in January, the largest single-month drop since 2020.

The ADP report brought into question the projection for the Labor Department’s jobs report released today. Estimates for today’s report predicted that 150,000 jobs were added last month. Because of the ADP report, economists stated that we could see a negative number in today’s report. In the case of the last two reports economists polled by various new sources were way off the actual numbers. Today’s jobs report revealed that there were 467,000 new jobs created in January, with the unemployment rate remaining unchanged at 4%.

Reuters news service reported today that, “The U.S. economy created far more jobs than expected in January but despite the disruption to consumer-facing businesses from a surge in COVID-19 cases, pointing to underlying strength that should sustain the expansion as the Federal Reserve starts to raise interest rates.”

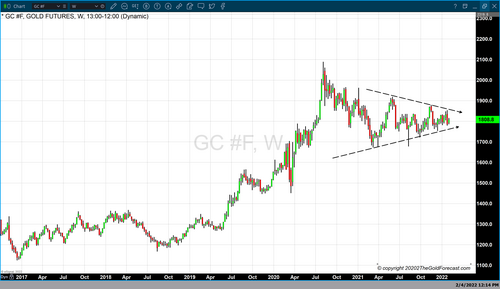

These factors created volatility in gold pricing over the last couple of days. As of 4:40 PM EST gold futures basis, the most active April 2022 contract is currently fixed at $1807.90, after factoring in today’s net gain of $3.80. That being said, gold opened at $1805.40, traded to a high of $1815.80 and a low of $1792.10.

What is noteworthy is the resilience of gold prices to remain above $1800 in light of such a strong jobs report today. Today’s moderate gain was accompanied by the largest weekly gain since November of last year. Even with the perception that the Federal Reserve continues to maintain a hawkish tone in regards to adjustments made to its monetary policy gold has shown resilience. This indicates that market participants continue to focus upon inflationary pressures above the monetary tightening by the Federal Reserve.

Gold’s resilience to remain above $1800 per ounce was highlighted in a Bloomberg article released two days ago which was titled, “Looks like there’s a whale snapping up gold bullion below $1800”. The article reported, “Spot gold is again bobbing along near $1,800 an ounce, as it has been since mid-2020. The stickiness of that level, particularly as fundamentals turned more bearish, suggests there’s a big buyer somewhere in these waters…Since breaking above the round number in July 2020, the gold price dipped below it 19 times on a closing basis, only to regain its footing.”

By Gary Wagner

Contributing to kitco.com

Time to buy Gold and Silver on the dips