The first quarter is behind us, and the second is off to a bang with Silver +2.09%, Platinum +1.9%, Gold +0.86%, and Copper +0.45%. What is the best performer, you might ask? Crude Oil +3.52%. The Jobs Report came in at +916,000, and in observance of Good Friday, the markets are effectively closed, leaving us with a free day of mapping out some second-quarter predictions.

If you know me personally, I'm a numbers guy, and looking deeper into the Jobs Report, the most interesting number was the 110,000 construction jobs created. Booming construction is often the driver for a "Commodities Super-Cycle" and an excellent indicator for the economy's strength. Looking at basic materials used in construction (Copper, Cotton, Crude Oil, Lumber, Gasoline) gives us some of our "Best Idea" commodity long plays. Last week I wrote an article on how Copper is setting up technically bullish and how increased demand should outstrip supply leaving a potential multiyear supply deficit.

Another best idea, "core long," for this quarter is Crude Oil. We know that as long as the vaccine rollout is effective, Crude Oil demand will see an underlying bid on prices through increased travel consumption. What about OPEC flooding the market? Thursday, Saudi Arabia announced that it would only "gradually increase" production in the coming quarter, which created a knee-jerk reaction in the market, sending prices straight-up $2.12/barrel on the day.

Now that we know inflation is here in housing prices and at the gas pump, what about food prices? Wednesday, the USDA announced that "ending stocks" for Corn fell drastically, and the American Farmer intends on planting one of the tightest crops seen in years. Within minutes of the USDA release, Corn futures skyrocketed "limit-up," leaving little room for any weather disruption this coming summer. Where opportunities remain are in some of the more exotic food commodities such as Sugar and Cocoa. Cocoa should get a boost in the back half of the year once Europe lifts its social distancing restrictions.

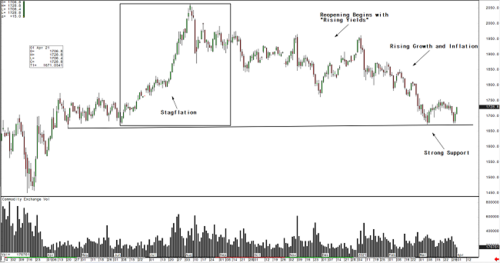

I know what your thinking by now, "enough with the commodity talk" I'm here for the nuts and bolts (Gold and Silver). Last week I mapped out a level on Gold with a strong "technical base" to play against in the $1680-1675/oz level. Using Gold futures as a tradable contract with 23-hour access, we can navigate in and out of the market tactically. The reality is that Gold will continue to face headwinds as yields continue to rise, leaving rallies as selling opportunities and steep corrections seen as opportunities to position for Q3 and Q4. The third and fourth quarter is when economic growth will get a reality check, and the market could go back into a "Stagflation" environment. Stagflation backtested is proven to produce the best results for Gold. We created a guide that will provide you with all the Technical analysis steps to create an actionable plan used as a foundation for entering and exiting the Gold market. You can request yours here: 5-Step Technical Analysis Guide to Gold.

Silver is still where I see the best potential for upward price movements. Governments globally are working to fight carbon emissions, and the best way is to focus is on wind and solar energy. As solar technology continues to see boosts in wattage, the prospects for tighter Silver supplies remain. We are setting up for another opportunistic Silver option play for early 2022. If you would like to be up to date on the developments of our specific strategies in the futures and commodities markets, please register for a Free two-week trial by clicking on the link here: The Blue Line Express Two-Week Free Trial Sign up.

By Phillip Streible

Contributing to kitco.com

Use Gold and Silver for everyday business and earn yields - Find out more