Above: The Amazon logo is seen at the Young Entrepreneurs fair in Paris

Image Credit: Reuters / Charles Platiau

Amazon is in the blockchain business in a big way. Its Amazon Managed Blockchain is a fully managed service designed to help companies quickly set up blockchain networks of their own that are scalable and easy to create and manage. Originally announced at the company’s re:Invent event in late 2018, Amazon Managed Blockchain has been in preview for months. It’s now generally available, arriving first in northern Virginia before expanding to other regions over the course of the next year.

In a press release, Amazon told businesses that they “can quickly set up a blockchain network spanning multiple AWS accounts with a few clicks in the AWS Management Console,” doing away with what it describes as the typical cost and difficulty of creating a company network. AMB supports two frameworks — your business’ choice of Ethereum or Hyperledger Fabric. The latter is the fruit of the combined labors of IBM and the Linux Foundation — part of the Hyperledger Project, which in turn is part of IBM Blockchain, a performance-as-a-service offering. Notably, Ethereum isn’t actually supported yet, but that’s also scheduled for later in the year.

In an email interview, an Amazon representative did not explain why Ethereum isn’t yet available, and he didn’t clarify when it would be, other than to repeat the press release’s “later this year” line. He did, however, delineate the respective advantages of Hyperledger Fabric versus Ethereum.

“Hyperledger Fabric is well-suited for applications that require stringent privacy and permission controls with a known set of members,” he said, using the example of a financial application in which sensitive information is shared only with select banks. He contrasted that with Ethereum’s use for situations where transparency for all members is key and a blockchain network needs to be highly distributed. “[An example would be] a customer loyalty blockchain network that allows any retailer in the network to independently verify a user’s activity across all members to redeem benefits. Alternatively, Ethereum can also be used for joining a public Ethereum blockchain network,” he said.

“Customers simply choose their preferred framework, […] add network members, and configure the member nodes that process transaction requests. Amazon Managed Blockchain takes care of the rest, creating a blockchain network that can span multiple AWS accounts and configuring the software, security, and network settings,” Amazon’s press release reads.

The company said that AMB supports thousands of applications running millions of transactions. Amazon also provides its AMB customers with the Amazon Quantum Ledger Database (QLDB) for when companies want to perform additional analysis.

Blockchain is often erroneously conflated with cryptocurrency. The association between the two is indeed close, but that’s because blockchain is the technology that allows crypto to function. On stage at the initial re:Invent announcement, an Amazon spokesperson said that before the company embarked on its AMB journey, Amazon had more closely examined what sort of business use cases businesses wanted from the technology. Amazon Managed Blockchain’s services and feature set is what emerged from those efforts.

An inherent tension seems to exist between the decentralized promise of blockchain and the — for lack of a better term — centralized nature of Amazon’s fully managed service. But an Amazon representative explained to VentureBeat via an email interview the various ways individuals maintain control.

“Each customer owns their own membership and has a copy of the data and has the ability to endorse a transaction (or not),” the representative said. “This gives all members in a network the ability to make decisions, achieve consensus, and have ownership.” He pointed out that what Amazon brings to the table is an assurance that applications “will be highly available, scalable, and fault tolerant.” He continued, “This allows customers to build enterprise-grade applications that leverage key properties of a blockchain on top of AWS’ industry-leading cloud infrastructure.”

The membership drives scalability, up or down, and it gives the network some internal efficiency. “Consortiums can form without specific owners and all members need to decide who can join or be removed. This again ties into decentralization for enterprise applications,” he said. He used the example of trade chain that requires numerous parties across international boundaries. “Each stakeholder wants to independently verify the documentation related to the trade and doesn’t want any single entity to own the record of activity,” he said. “The current process requires trade-related paperwork (for example, a letter of credit) to go back and forth between the stakeholders, which can take five to 10 business days to complete.”

But on a blockchain, each member in the trade process has a copy of the transaction ledger, and this is where smart contracts — enabled by blockchain technology — can smooth the process. “The business contract, such as a letter of credit, can be written as a smart contract in the blockchain application and can automatically execute as soon as all the parties provide a consensus to record the transaction,” he said.

There’s still no word on a timeline for further service rollouts, but pricing information is available on the Amazon Managed Blockchain page.

Update, 9:35 p.m. Pacific: Amazon replied to our questions after this article was originally published. We updated it with additional information and context.

Original article https://venturebeat.com/2019/04/30/amazon-managed-blockchain-hits-general-availability/

Five Canadian banks now let customers digitally verify their identities in a “privacy-enhanced and secure way” using blockchain technology.

For the effort, Canadian Imperial Bank of Commerce (CBIC), Royal Bank of Canada (RBC), Scotiabank, Toronto–Dominion (TD) Bank and Desjardins Group have integrated with a mobile app called Verified.Me, developed by SecureKey Technologies.

SecureKey announced the news Wednesday, explaining that the app – available for both iOS and Android – is built on IBM Blockchain, which in turn is based on Hyperledger Fabric v1.2. It will further be interoperable with Hyperledger Indy projects – a distributed ledger system designed for decentralized identity solutions.

Peter Tilton, senior vice president of digital at RBC, said:

“Security and trust are two expectations that consumers have when it comes to their personal information and digital identity. Creating seamless and convenient experiences that consumers have come to expect, based on these imperatives of security and trust, are fundamental to meeting their evolving digital needs.”

Sun Life Financial has also signed on as the first North American insurer on the service, SecureKey said, adding that two other banks – BMO Bank of Montreal and National Bank of Canada – will also use the product soon.

“We are entering a new era in which Canadians can clearly and confidently assert when, why and with whom their digital identity assets are shared,” said Katie Greenberg, vice president for digital products and retail payments at Scotiabank.

Verified.Me is a joint initiative between various government agencies and companies, including the Digital ID and Authentication Council of Canada, the U.S. Department of Homeland Security Science and Technology Directorate, credit rating agency Equifax and EnStream, a joint venture of Canadian telecoms firms.

Smartphone user image via Shutterstock

original Article https://www.coindesk.com/five-banks-now-let-users-verify-their-identities-using-a-blockchain-app

Starbucks is moving to give consumers more information on its coffee products using a blockchain system that will track beans from “farm to cup.”

For the effort, the coffee chain is working with Microsoft to harness its Azure Blockchain Service in tracking coffee shipments from across the world, bringing “digital, real-time traceability” to its supply chains, according to an announcement from Microsoft.

With the partnership, Microsoft’s blockchain service will record all changes along the journey of the coffee on a shared ledger, providing participants with a “more complete view” of the supply chain.

Starbucks will use all that information to bring a new feature to its mobile app, giving consumers details on where the coffee was sourced and roasted, as well as on tasting notes.

As part of its commitment to ethical sourcing, it’s also hoping that the blockchain system can help benefit growers too, by providing them with data such as where their beans end up in consumers’ cups. According to the release, Starbucks sourced beans from over 380,000 coffee farms in 2018.

“I firmly believe that by empowering farmers with knowledge and data through technology, we can support them in ultimately improving their livelihoods,” said Michelle Burns, SVP of Global Coffee & Tea at Starbucks.

The app will also inform consumers of how Starbucks is supporting these growers, Microsoft indicated.

“This kind of transparency offers customers the chance to see that the coffee they enjoy from us is the result of many people caring deeply,” said Burns.

While a date for the launch of the new service has not been revealed, the digital traceability concept was demoed to shareholders at Starbuck’s annual meeting in March.

The firm is currently talking to coffee farmers in Costa Rica, Colombia and Rwanda to find out more about how the project can best benefit them, Burns added.

Starbucks is notably working with the Bakkt digital assets and bitcoin futures platform being developed by Intercontinental Exchange, the parent firm of the New York Stock Exchange. The coffee company was said last August to be working to develop “practical, trusted and regulated” applications for consumers to convert digital assets into U.S. dollars.

Starbucks image via Shutterstock

original article https://www.coindesk.com/starbucks-to-track-coffee-using-microsofts-blockchain-service

The World Bank and the Commonwealth Bank of Australia (CommBank) have teamed up to enable recording of secondary market bond trading using blockchain tech.

The institutions announced Wednesday that their successful recording of a secondary transaction for bond-i, a blockchain-operated debt instrument, on a distributed ledger shows the “vast potential” of the technology, and marks the first bond to have both issuance and trading recorded on a blockchain platform.

Bond-i was first issued last August by the World Bank, with the CommBank being a sole arranger. The experiment helped the World Bank raise $81 million at the time.

World Bank vice president and treasurer, Jingdong Hua, said:

“Enabling secondary trading recorded on the blockchain is a tremendous step forward towards enabling capital markets to leverage distributed ledger technologies for faster, more efficient, and more secure transactions.”

The blockchain platform was built and developed by the CommBank’s Blockchain Centre of Excellence on top of the ethereum network, and was reviewed by Microsoft regarding its architecture, security and resilience.

CommBank Innovation Labs’ head of experimentation & commercialization, Sophie Gilder, commented:

“Blockchain has the potential to streamline processes for raising capital and trading securities, improve operational efficiencies, and enhance regulatory oversight.”

CommBank first revealed a plan to issue a bond over a blockchain system as far back as 2017, saying it was working with an unnamed “major world issuer.”

Other financial institutions across the globe have been recently testing blockchain-based systems for bond issuance, including Santander, Societe Generale and Abu Dhabi-headquartered Al Hilal Bank.

World Bank image via Shutterstock

original article https://www.coindesk.com/world-bank-commbank-team-up-for-world-first-blockchain-bond-transaction

?

Getty Images

A blockchain industry alliance has released a guide and list of use cases for deploying the technology to enable, among other things, the purchase of fractions of real estate property as digital securities on an open marketplace.

The Enterprise Ethereum Alliance (EEA) used its 30-page Real Estate Use Case document to promote blockchain as a more open, transparent and traceable method of transacting in the multi-trillion dollar realty industry. The document was created by the EEA's Real Estate Special Interest Group(SIG), which was created a year ago and has already garnered more than 50 member companies.

[ Further reading: Blockchain: The complete guide ]

Among the member companies are blockchain software developers such as Applicature, Blockapps and ConsenSys, as well as Deloitte LLC, John Hancock Life Insurance, Ott Capital Ventures, and online blockchain-powered real estate platforms Propy and Blockimmo.

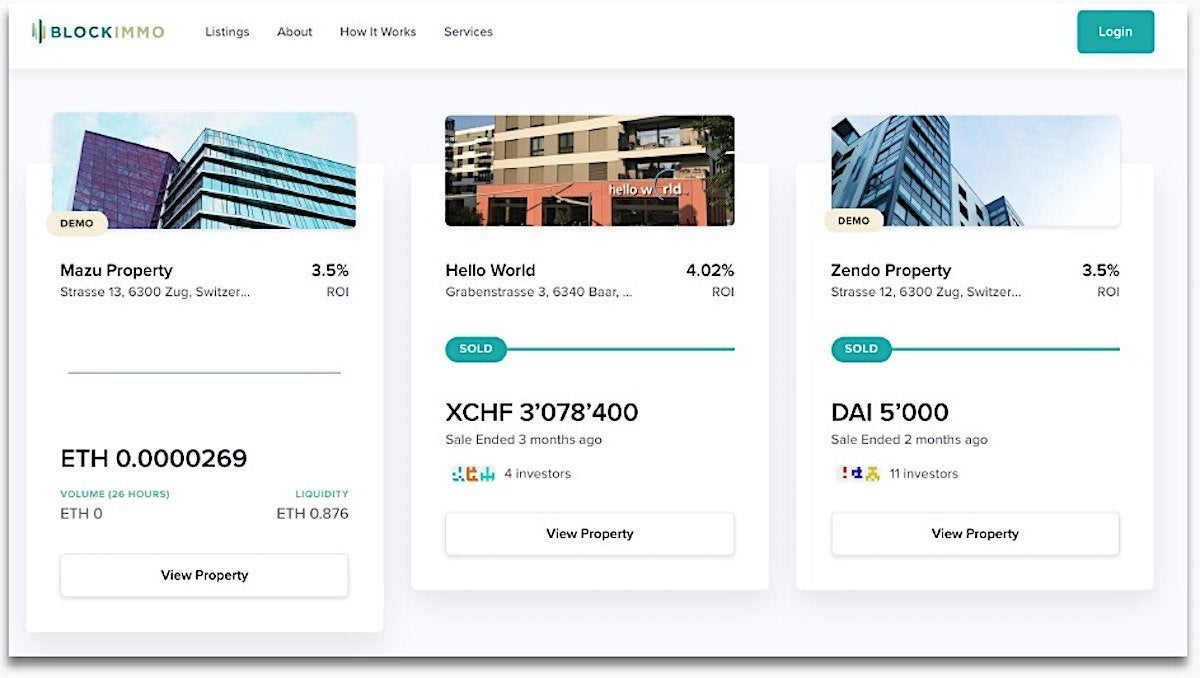

Bastiaan Don, chair of the EEA's Real Estate SIG, began developing his Swiss-based Blockimmo marketplace a little over a year ago. Like a stock market with corporations, Blockimmo users can purchase, sell or trade portions of real estate properties that have been turned into digital tokens on a global marketplace that runs 24/7.

On March 1, Blockimmo listed its first tokenized property – an apartment building with a restaurant – with a value of 15 million Swiss francs ($14.8 million). Twenty percent of the property's value was converted to "Swiss Crypto Tokens," with transactions enabled through the use of the "CryptoFranc," a stablecoin linked directly to the Swiss franc. The tokens sold to four investors.

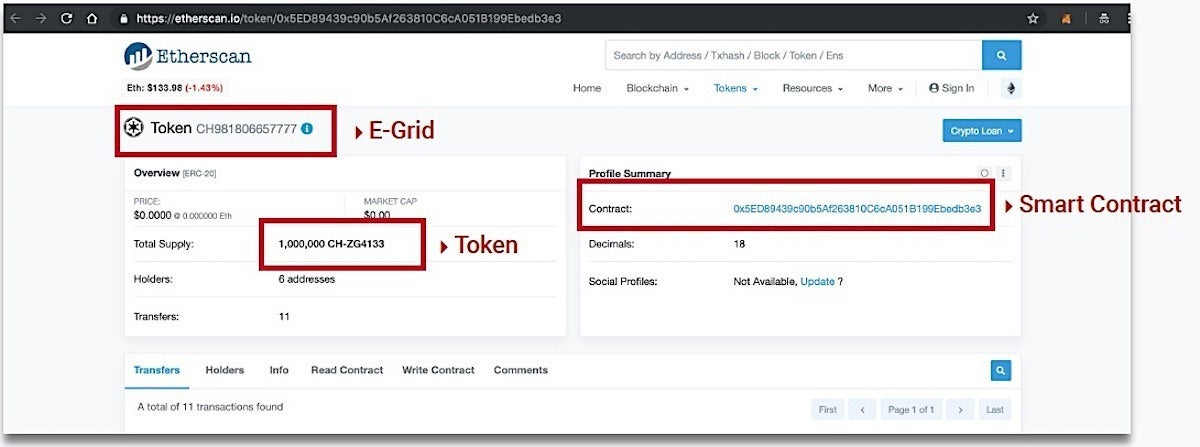

Property data hashed on the an Ethereum blockchain using an Interplanetary File System (IFPS)

Stablecoins are cryptocurrencies that, unlike bitcoin, are linked to fiat currency, such as the U.S. dollar or Swiss franc. They're expected to become increasingly popular as a vehicle to tokenize (digitize) assets, such as property that can then be bought or traded on blockchain exchanges. For example, J.P. Morgan recently created a stablecoin to transfer funds over a blockchain network internally and internationally between institutional clients.

The EEA's Real Estate playbook lists eight different uses for blockchain, including property identification (including listings and data); token-enabled marketplaces; token securitization; public registries detailing ownership of properties; and sales process optimization.

Along with creating a real estate exchange, blockchain has been used as a platform for conventional real estate sales. For example, New York-based ShelterZoom plans to go live this year with a platform that enables sellers and buyers to make offers over an Ethereum blockchain.

Another start-up, Jointer.io is focused exclusively on real estate tokenization. Unlike other services, it doesn't offer one property as shares that can be purchased. It offers a number of buildings in an index, and participants can buy tokens from that index. The result is less risk and more profit, according to Jude Regev, founder and CEO of Jointer.

The real estate market is highly liquid, meaning property can be bought or sold relatively quickly with little to no loss in value. But the ability to play in that marketplace has mostly been reserved for a small number of wealthy investors, Don argued. And, it's a complex system because of the need for a middleman (a bank) and others to enable transaction clearance and settlement.

Blockimmo

Blockimmo

Tokenized properties for sale on Blockimmo's real estate marketplace.

"It's almost impossible for a semi-professional investor to get access to it. So on one hand, by applying blockchain technology, you can enable anyone to invest because the costs to do it are so much lower, and it enables fractionalized ownership," Don said, referring to the absence of banking fees. "That's exactly what tokenization does; it allows someone to indirectly acquire a piece of real estate."

"Democratization," a term that has frequently been applied to blockchain's ability to enable an open and transparent marketplace, is also being used by the EEA's Real Estate SIG to describe the benefits of real estate tokenization.

"It enables anyone to own and acquire a piece of real estate. You can do that today through an investment company, but blockchain allows anyone to sell anytime. You can sell your share on a secondary market," Don said. "And, in our case, it's not just marketing talk. We've already launched a decentralized exchange for real estate tokens."

The ability to purchase a fraction of a piece of property is not new. A Real Estate Investment Trust (REIT) is a fund or security that allows investors to purchase shares of income-generating real estate properties. REITs are owned and operated by shareholders who invest in commercial properties such as office and apartment buildings, shopping centers and hotels.

"Our solutions let the investors decide which property at which exact location they want to invest their money," Don said. "Each property will have its own smart-contract and thus own token. They can choose to invest in a specific property at a specific address in New York, Amsterdam and Zurich and build up their own customized, flexible and diversified real estate portfolio of which they are in control."

While Don describes his company's Ethereum-based marketplace as a public or open blockchain, in reality it fits the definition of a private blockchain in that it's governed or administered by a central authority of users who whitelist those who can participate by first authenticating their identities. Once cleared, their personally identifiable information is encrypted and stored in a cryptowallet, a piece of software that keeps track of the secret keys used to digitally sign blockchain transactions.

During the blockchain onboarding process, potential users are automatically asked questions and required to submit proof of identity (such as a copy of a passport) through a business automation application known as a "smart contract" that is intended to satisfy know-your-customer and anti-money laundering regulations, Don said. Those who complete the onboarding process have their cryptowallets whitelisted for blockchain transactions.

Blockimmo

Blockimmo

A tokenized property showing where it exists on a blockchain, its token identifier and the smart contract controlling its distribution.

"If I'm whitelisted, I'm able to participate in crowdfunding opportunities – for instance an interesting real estate building being offered on the blockchain platform. But more importantly, I'm also allowed to trade these tokens on a secondary market," Don said. "The technology has to adapt to the infrastructure and regulations of the markets. And Ethereum is perfectly able to do that today. You can program smart contracts so you stick to these laws and regulations."

A real estate property can be divided into individual investment units each identified and embodied via a security token (via the ERC 20 or ERC 721 specifications or another variant). The tokens, which include the property's lot number, will identify ownership, provide a mechanism for transactional processing, and serve as the property identifier to allow for trading on regulated secondary markets.

"We only offer tokenization of properties as a service, but the asset owner is in control of the tokens," Don said. "If our company goes bankrupt, and we've tokenized 100,000 buildings, nothing happens to those buildings."

"It's early days," Don continued, "but it's heading in the right direction. Larger institutional investors are seeing the potential of using public blockchains like Ethereum. At least in Switzerland, even financial regulators see that it's possible to use a public blockchain and be able to stick to laws and regulations."

original article https://www.computerworld.com/article/3396627/for-real-estate-blockchain-could-unshackle-investment.html

You too can be a blockchain developer

Ever wanted to become a blockchain pioneer? It might sound intimidating, but you don’t need to be a developer or a programming expert to build the foundations of a cryptocurrency ecosystem. In fact, with the latest tool from the ARK Ecosystem, even Craig Wright can do it.

The new tool is the ARK Deployer, launched today by the creators of the 89th largest cryptocurrency. According to developers, the Deployer fits in with ARK’s goals of creating an ecosystem of interoperable blockchains.

The new tool will also make it easier for projects to realize the benefits of blockchain technology, creating customized versions of ARK’s delegated proof-of-stake blockchain. Using the Deployer, creators can easily set the key parameters for their blockchains such as block times, rewards, and number of delegates.

“The ARK Deployer revolutionizes a previously lengthy and complex process, and significantly reduces the barriers to entry of blockchain technology,” creators announced today. “The intuitive user interface means that anyone, regardless of their technical experience or background, can build, customize and deploy their own blockchain by utilizing an easy-to-follow tool.”

This is not the first such tool to be released by the ARK project, but earlier versions were built for more sophisticated users, with command-line experience. Using the latest Deployer, users can launch a customized version of ARK’s DPOS blockchain in only three steps.

“Developers are crying out for tools to significantly reduce the time and effort needed to utilize blockchain technology,” explained Ark’s Chief Strategy Officer Matthew Cox. “With the ARK Deployer, users will quickly be able to create their own scalable, efficient and decentralized blockchain network based on ARK’s code but customized to their specific requirements. “

“This means users can focus on building their own ideas,” he added, “safe in the knowledge that they will have a solid and secure blockchain foundation as part of the ARK Ecosystem.”

At least one organization is already leveraging the Deployer to build in the Ark Ecosystem. “Creating our own ecosystem utilizing ARK’s technology as a starting point means that our organization is able to progress quickly and efficiently,” said Ki Foundation’s CEO Réda Berrehili. “We’re able to focus on developing our business-specific applications while ARK’s open source technology is providing us with a free, efficient and scalable blockchain foundation.”

original article https://cryptobriefing.com/ark-deployer-launch-blockchain/

by Anna Baydakova , Ian Allison ,

Retail giant Target has quietly entered the blockchain space.

Since mid-2018 the Minnesota-based retailer has been working on a blockchain-powered solution for supply chain management, dubbed ConsenSource. More recently it pledged to support the Hyperledger Grid project, a supply chain framework that earlier saw participation from food giant Cargill, one of Target’s suppliers, together with tech giant Intel and blockchain startup Bitwise.io.

To boost its distributed ledger technology-related work, Target is now looking for a blockchain engineer and systems developer, according to the company’s career page.

The new engineer will be contributing to the recently open-sourced ConsenSource and to Hyperledger Grid, developing “distributed ledger systems, protocols, smart contracts, CLI’s, and RESTful APIs in an open source environment,” the job posting says.

“I’m proud that Target will support the Hyperledger Grid project, and that we’re committing dedicated engineering resources to build out components in the Grid architecture,” Joel Crabb, Target’s vice president of architecture, wrote in a little-noticed post on its corporate blog.

The ConsenSource project, which Target recently open-sourced, was primarily focused on the certification of suppliers for the company’s own paper manufacturing. Target has been “working directly with the forest managers and certification boards” studying the technology and trying to figure out what data can be shared on a distributed ledger, Crabb wrote.

The exploration led to Target to recognize the benefits of open-source projects – and supporting some.

The blog reads:

“Many companies – including Target – see the most potential for enterprise blockchain initiatives as open source. Open-source projects require all participating parties to define the governance model collectively from the outset, so companies then can focus their time working on blockchain-based solutions that will lead to greater speed, transparency and cost savings.”

Target did not respond to CoinDesk’s requests for comment by press time.

Until now, Target has largely flown under the radar with its blockchain initiatives. The company hired Aarthi Srinivasan – who has previously worked at JPMorgan and IBM – as its director of product management for personalization, machine learning and blockchain, in 2016.

In December 2018, CoinDesk learned from a source within Hyperledger that Target – the eighth-largest retailer in the U.S. – had been working on a supply chain product under the umbrella of the open-source Hyperledger consortium.

The source, who did not want to be identified, said Target would join the Sawtooth Supply Chain project, which is developing a distributed application to track the provenance of food and other assets using the Sawtooth implementation of Hyperledger.

Emily Fisher, a spokesperson for the Linux Foundation, which oversees Hyperledger, said Monday: “Target has made code contributions but is not a member of Hyperledger.”

While it is still in the development phase and far from reaching production, the Sawtooth project has been a hotbed of coding activity, with more than 5,000 commits from 46 contributors on GitHub. According to the ConsenSource GitHub repository, that project uses the Sawtooth code.

Among Target’s notable moves has been incorporating identity verification technology from another Hyperledger project called Indy. Cargill, the food production giant, is also known to be involved in the supply chain project.

The Sawtooth codebase, which was contributed to Hyperledger by Intel, is the main alternative to Fabric, the best-known Hyperledger implementation, developed by IBM. Fabric is already being used in food tracking on a network called Food Trust – a project spearheaded by IBM and Target’s big-box rival, Walmart.

In its last annual report to shareholders, Target said it is investing in supply chain improvements.

The company is “in the process of a broad migration of many mainframe-based systems and middleware products to a modern platform, including systems supporting inventory and supply chain-related transactions,” the company said, without mentioning blockchain or DLT.

Update (June 10, 16:05 UTC): This article was updated with a comment from Hyperledger clarifying Target’s relationship to the consortium.

Target image via Shutterstock

original article https://www.coindesk.com/retail-giant-target-is-working-on-a-blockchain-for-supply-chains