Image Source: Unsplash

Gold Price News: Gold Enjoys Buoyant July on Prospect of Peak Interest Rates

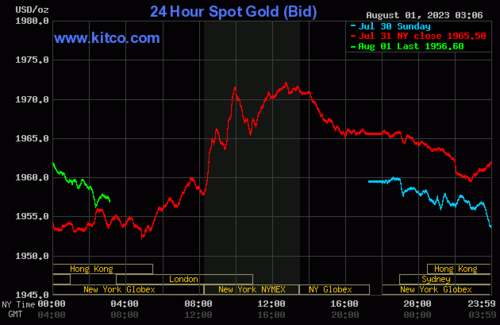

Gold enters the last day of July still holding above $1,950 an ounce and on course for a sizeable monthly gain.

Gold’s buoyancy is based on the expectation that central banks around the world are coming to the end of their cycle of interest rate hikes. After the Federal Reserve and the European Central Bank both delivered their expected increases last week, this week brings the latest decisions by the Reserve Bank of Australia and the Bank of England with further hikes widely anticipated.

Yet despite this flurry of hikes, traders and investors are looking past the current moves and instead focusing on whether these are the last increases and how close we are to the peak of interest rates globally. This forward-looking stance has enabled gold to shrug off any hits to its price it would otherwise have received in reaction to these rate hikes as during times of rising rates gold’s appeal can dwindle due to its lack of yield with other interest-bearing assets favoured instead. Read More

Silver Price News: Stronger Dollar Pushes Silver Back Down To $24

In contrast to its golden peer, silver ends July looking downwards rather than upwards with the price barely holding above $24 an ounce having surged above $25 an ounce earlier in the month.

Silver’s climb up to $25 an ounce looked to be the start of a long-awaited sustained rally for the precious metal with strong long-term demand for silver’s conductive qualities driving a fundamental outlook that projects a multi-year supply deficit.

However, yet again macroeconomic factors have pulled the price back with a stronger US dollar on the back of the Federal Reserve’s latest interest rate hike last week reducing silver’s appeal. And with further hikes expected from the Reserve Bank of Australia and the Bank of England this week, that could limit silver’s potential for short-term gains. Read More

Gold investors will be watching U.S. data like a hawk next week, anticipating a weakening trend

Gold market will be hungry for information that will help provide some clarity to the Federal Reserve's open-ended monetary policy stance with disappointing economic data supporting higher prices.

While analysts are not expecting a major breakout in gold in the near term, some have said that the bias is to the upside as the Federal Reserve's monetary policy stance is expected to weaken the economy. Heading into the weekend, the gold market has pushed back above $1,950 an ounce, even as it sees a modest loss. August gold futures last traded at $1,958.80 an ounce, down 0.3% from last Friday.

In comparison, silver has seen a bigger struggle this past week as prices have managed to hold support above $24.25 an ounce. September Silver futures last traded at $24.45 an ounce, down 1.6% from last week.

Kevin Grady, president of Phoenix Futures and Options, said he expects gold prices to test the top end of its current range in reaction to softer data. He added that while a definitive softening trend could propel gold higher, even the slightest sign of weakness will be price supportive. Read More

‘I have more in gold' & ‘there will be casualties' as Fed keeps rates higher for longer - Danielle DiMartino Booth

The damage to the U.S. economy from the Fed’s interest rate hikes is only just beginning, according to Danielle DiMartino Booth, CEO and Chief Strategist at QI Research.

DiMartino Booth joined Kitco News’ Lead Anchor and Editor-in-Chief Michelle Makori to discuss the latest signals that Federal Reserve chair Jerome Powell sent at the July meeting, and the fallout still to come from the central bank’s policies.

She said Powell has clearly communicated the Fed’s plans to continue reducing the size of their balance sheet, and that the end of the tightening cycle is on the horizon.

“I certainly wouldn't think that in 2024, we would see a continuation of rate increases,” she said. “But I think when he mentions inflation not coming to target for a very long period of time, what he's saying is this is how ‘higher for longer’ is going to manifest. We're going to keep rates at a very high level for longer than markets anticipate, or certainly are used to, in order to get that inflation down to target, all the while shrinking the balance sheet, continuing to deplete liquidity from the system.”

She expects this course of action by the Fed will create new casualties as the effects of higher rates work their way through the system. Read More

Gold, silver gain on chart-based buying

Gold and silver prices are higher in midday U.S. trading Monday. Amid a lack of fresh fundamental news to drive market prices, the precious metals traders are focusing on the improved near-term chart postures in gold and silver and doing some technically based buying. December gold was last up $10.00 at $2,009.80 and September silver was up $0.46 at $24.96.

Gold and silver bulls this week may also be focusing on recent upbeat U.S. and European Union economic data that may suggest better consumer and commercial demand for metals in the coming months. However, downbeat economic data coming out of China recently will keep precious metals traders from getting too bulled up.

Technically, December gold futures bulls have the slight overall near-term technical advantage. Bulls’ next upside price objective is to produce a close above solid resistance at $2,050.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at the June low of $1,939.20. First resistance is seen at last week’s high of $2,022.10 and then at the July high of $2,028.60. First support is seen at $2,000.00 and then at today’s low of $1,986.70. Wyckoff's Market Rating: 5.5.

Image Source: Kitco News

September silver futures bulls have the overall near-term technical advantage. Silver Bulls' next upside price objective is closing prices above solid technical resistance at $26.00. The next downside price objective for the bears is closing prices below solid support at $23.00. First resistance is seen at last week’s high of $25.325 and then at the July high of $25.475. Next support is seen at $24.50 and then at last week’s low of $24.18. Wyckoff's Market Rating: 6.0. Read More

Image Source: Kitco News

Silver price outperforms gold as market bets on Fed rate hike pause

The silver market continues to be sensitive to gold’s price action; however, the volatility in the marketplace shows what kind of potential the grey metal has when gold prices start to rally.

The gold market, as the contract rolls over to a new month, is seeing a new pushback above $2,000 an ounce; however, silver is outperforming the precious metal as it makes a move back to $25 an ounce.

September silver last traded at $24.975 an ounce, up nearly 2% on the day. At the same time, December gold futures last traded at $2,009 an ounce, up 0.50% on the day.

According to some analysts, both gold and silver are benefitting from growing perceptions that the Federal Reserve has ended its tightening cycle. After raising interest rates by 25 basis points last week, Fed Chair Jerome Powell said that the central bank is keeping its options open and will be heavily data-dependent ahead of September’s decision. Read More

A rise in U.S. money supply will drive gold, silver prices to new highs - Wells Fargo's John LaForge

Despite recent volatility, the gold market continues to hold firm support at around $1,950 an ounce. However, despite the precious metal's resilient strength, one analyst says something more is needed to drive the precious metal to record high.

In an interview with Kitco News, John LaForge, head of real asset strategy for Wells Fargo Investment Institute, said that gold and silver have been underperforming general commodities in a broad neutral trading range for the last three years. He added that the precious metal market is stuck as investors continue to focus on tightening U.S. monetary policies and the sharp drop in U.S. money supply.

However, LaForge added that with the Federal Reserve nearing the end of its tightening cycle, both gold and silver could be on the cusp of a long-term bull market as part of the larger commodity super-cycle. He said that it's only a matter of time before the U.S. central bank starts pumping money back into financial markets to keep the economy from slipping into a recession. Read More

BRICS currency could roil gold, Treasury markets even if it doesn't displace the U.S. dollar - CrossBorder Capital

Despite denials from the host country, some market analysts believe that a gold-backed BRICS currency announcement may still be forthcoming at the August summit in Johannesburg, South Africa.

According to a recent research report from London-based CrossBorder Capital, “The BRICS economies (and some 40 ‘friendly’ nations) look set to endorse a new gold exchange standard by using their swelling gold reserves to back (or strictly, partially back) a new international currency unit, so far unnamed.” They characterize this as the “most important development in international finance since the 1971 Nixon Shock” when the United States abandoned the gold standard.

The analysts write that a gold-backed BRICS currency would be “a potential disruptor,” and would highlight “the growing importance of collateral backing in global credit markets,” which they believe is an attempt to “move the World monetary system back from (largely US) fiscal collateral to its origins in gold bullion collateral.”

CrossBorder Capital sees the BRICS currency as a potential power play by China, which has made clear its goal of rivalling U.S. dominance in international finance. “Hiding the Chinese Yuan within a new BRICS unit may be a clever way of reaching her goal a tad faster?” they write. “Wolf economic diplomacy in sheep’s clothing, perhaps?” Read More

Gold sees record average prices in Q2, supported by physical bullion demand

Persistent economic uncertainty created robust physical demand for gold supporting prices at record levels during the second quarter, according to the latest research from the World Gold Council.

In its second quarter of Gold Demand Trends, the WGC noted that gold prices saw a record average price of $1,976 an ounce, up 6% from the second quarter of 2022 and up 4% from the previous record high reported in the third quarter of 2020.

In an interview with Kitco News, Juan Carlos Artigas, head of research at the World Gold Council, said that the banking crisis in May, as several regional banks in the U.S. collapsed, created a significant risk event driving physical demand for bar and coins in North America. He added that general global uncertainty is supporting robust jewelry sales in key markets like China.

"The fact that gold has remained pretty robust throughout the second quarter is a sign that there are more strategic investors in all categories of the marketplace that continue to find it useful to have this asset in their portfolios," he said. Read More

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.