Image Source: Unsplash

Gold Under Pressure from Rising Interest Rates & Stronger Dollar

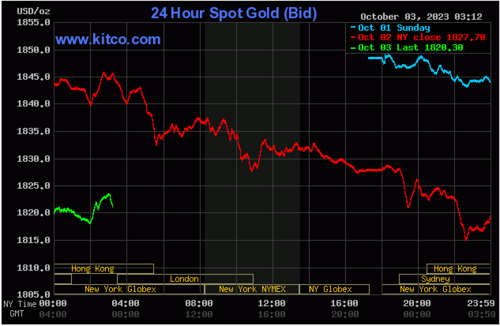

Gold has seen a sharp decline in the last few days, breaking the support zone of $1,890 and sliding further down to break the next key support level at $1,850.

It is currently trading near a 6-month low.

After the resilience shown in the first 20 days of September, with the price trading within the tiny range between $1,890 and $1,950, the expectations for more hawkish central bank policies for longer have weighed on the price of gold.

So what is the outlook for gold now?

Bullion is likely to remain under pressure until the markets have more clarity on when central banks’ interest rates will reach a peak – this is expected very soon.

But at the same time, markets are worried by the idea of having “high interest rates for longer”, as widely repeated by policymakers in the last few weeks. Read More

Silver Price News: Sell-off Continues on Fears of ‘Higher for Longer’ Interest Rates

The price of silver has broken a series of key support levels, reaching the new 6-month low at $21.7, while the scenario remains bearish.

In recent months, every time silver has reached the support zone of $22.5, it has managed to rebound. This probably kept happening thanks to the activity of long-term buyers, who were trying to buy on dips, with the clear target of increasing their portfolio exposure to silver.

This time, however, the bearish pressure has been stronger, and the spot price has broken both the key levels of $22.5 and $22.2, falling below the $22 mark.

From a technical point of view, the sharp breakdown of $22.2-22.5 per ounce, has opened space for a further decline. The price falling to a low of $21.7, shows that the grey metal is suffering strongly from the pressure coming from the combination of rising rates, high yields, and the strength of the U.S. Dollar. Read More

Analysts expect gold to kick off Q4 with gains, while retail investors are evenly split

Gold prices underwent a dramatic sell-off this week, continuing and accelerating the downtrend that began after the Federal Reserve left interest rates unchanged on the 20th and reiterated that rates would remain higher for longer than previously anticipated.

The latest Kitco News Weekly Gold Survey sees most market analysts optimistic that gold will see a bounce in the near term, while retail investors are more evenly divided after experiencing seven straight sessions of losses.

Everett Millman, Chief Market Analyst at Gainesville Coins, attributed gold's recent slide largely to seasonal factors and options contracts expiring, and sees the precious metal rebounding to start the fourth quarter.

"My initial reaction to the downturn this week was that it had a lot to do with the options expiry on Comex, which does usually lead to a lot of downside volatility as people are closing out or rolling over contracts," he said. "But given that this price action continued throughout the rest of the week, I'm also going to attribute that a bit to seasonality. The gold market usually goes into a slumber in the late summer, early autumn months. We saw that exact same pattern last year. Unless markets are interpreting the FOMC to be extremely hawkish, which I don't think is what's going on, I think you have to chalk it up to seasonality and just the regular trading dynamics that come at this time of year." Read More

Gold prices fall to session lows after ISM Manufacturing PMI improves to 49% in September

Gold prices are setting new session lows after the latest data on the U.S. manufacturing sector showed it improved beyond expectations, but still contracted for the eleventh consecutive month.

The Institute for Supply Management (ISM) manufacturing index came in at 49% for September, after posting a 47.6% print in August. Market consensus calls were expecting a reading of 47.9%.

Readings above 50% in such diffusion indexes signify economic growth and vice-versa. The farther an indicator is above or below 50%, the greater or smaller the rate of change.

Following the release, gold prices declined to fresh lows on the session. Spot gold last traded at $1,830.25, down exactly 1.00% on the session. Read More

Gold, silver decline as markets opt for risk-on assets following government shutdown deal

Gold prices continued their recent declines after the U.S. Congress struck a 45-day deal over the weekend which narrowly averted the Federal government shutdown that was set to begin on Monday.

Major stock indices were up in premarket trading and kicked off the first trading session of October with positive momentum, but have since pulled back, with the S&P 500 and Dow Jones now virtually flat on the session.

Traders appear to have regained their risk appetite, however, as the NASDAQ is up over 100 points at 13,322 and Bitcoin hit $28,950, its highest level since mid-August. Meanwhile, the yield on the benchmark 10-year treasury jumped to 4.672%, its highest level since July 2007.

None of this was good for precious metals prices. Gold and silver have both fallen to their lowest levels since early March, with spot gold last trading at $1,833.20, down 0.85% on the session, and COMEX silver futures down 4.4% at $21.445 per ounce at the time of writing. Read More

Strong greenback, rising bond yields continue to punish gold, silver

Gold and silver prices are sharply lower at midday Monday, with December gold futures hitting a 10-month low and December silver futures a 6.5-month low. A strong U.S. dollar that hit a 10-month high today and rising U.S. Treasury yields that are at a 16-year high are firmly bearish outside market elements hammering the precious metals markets lower. December gold was last down $17.50 at $1,848.70 and December silver was down $0.94 at $21.505.

While the gold and silver bears are presently in command, both markets are technically well oversold and due for decent upside price corrections very soon.

Risk attitudes are more upbeat to start the trading week, and that’s also a negative for the safe-haven gold and silver markets. In a last-minute effort to prevent a U.S. government shutdown, President Biden over the weekend signed into a law a stopgap measure to fund the federal government for 47 more days, through Nov. 17. Most of the marketplace figured the government would shut down over the weekend. However, the Senate, following a strong push from House Democrats, approved the measure in a lopsided vote. This 11th-hour decision ensures the continuation of various government services and the payment of federal employees, at least temporarily. However, lawmakers still need to finalize a permanent budget appropriation plan to address the nation's financial needs.

Technically, December gold futures prices hit a 10-month low today. Bears have the solid overall near-term technical advantage. A five-month-old downtrend is in place on the daily bar chart. However, the market is now short-term oversold and due for a decent corrective bounce soon. Bulls’ next upside price objective is to produce a close above solid resistance at $1,900.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,800.00. First resistance is seen at today’s high of $1,864.70 and then at $1,875.00. First support is seen at today’s low of $1,942.70 and then at $1,835.00. Wyckoff's Market Rating: 1.0.

Image Source: Kitco News

December silver futures prices hit a 6.5-month low today. The silver bears have the firm overall near-term technical advantage. Prices broke solidly below what were solid technical support levels below the market. A nine-week-old downtrend is now in place on the daily bar chart. Silver bulls' next upside price objective is closing prices above solid technical resistance at $23.00. The next downside price objective for the bears is closing prices below solid support at the March low of $20.615. First resistance is seen at $22.00 and then at today’s high of $22.41. Next support is seen at today’s low of $21.405 and then at $21.00. Wyckoff's Market Rating: 2.5. Read More

Image Source: Kitco News

Gold bulls can look forward to a bright future despite headwinds - Heraeus

Even as markets watch gold prices fall into the low 1830s as the fourth quarter gets underway, interest rate history favors gold bugs in the medium and long term, according to the latest precious metals report from Heraeus.

“The gold price tends to rise following the first cut of US interest rate cycles,” the analysts write. “On average since 1984, one calendar year after the Federal Reserve first cuts its rate after a hiking cycle, gold is 10% higher than the day of the decision to reduce interest rates, and after two years is 18% higher. The dollar tends to weaken, yields on U.S. Treasuries fall, and the economy tends to have deteriorated. All of these elements can act as a tailwind for the gold price.”

The analysts say that after the yield on the 10-year treasury note peaks, it’s only a matter of time before Fed Chair Jerome Powell begins to cut. “The last rate hike of the cycle also tends to coincide with the peak in the yield on 10-year U.S. Treasuries,” they write. “Since 1984, interest rate cuts have never lagged the peak in 10-year U.S. Treasury notes by more than one year and seven months – this being the outlier in 1989. Excluding 1989, cuts have followed the peak by an average of ~10 months.”

They note, however, that this does not constitute a guarantee. “Two years after the first interest rate reduction in 1995, gold was 16% lower at $325.50/oz,” they say. “On the other hand, gold’s relative performance to the upside following interest rate cuts has grown since the 2001 cycle.” Read More

Live From The Vault - Episode: 142

Looming credit collapse sparks rampant Eastern gold stockpiling. Feat Alasdair Macleod

In this week’s episode of Live from the Vault, Andrew Maguire is joined by Alasdair Macleod to examine the East’s blossoming relationship with gold as they’re beating the markets by securing local currencies and commodities against its value.

The London whistleblower broaches gold’s vital role in a looming credit collapse, which the East seem to have foreseen with greater clarity than the West, before tackling the esoteric nuances behind CBDCs and decentralised currencies.

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.