Image Source: Unsplash

Gold Price News: Gold Hits All-Time High on Dollar Weakness

Gold prices set another all-time high on Tuesday, gaining a boost from a weaker US dollar and a flare-up in geopolitical tensions.

Prices rallied as high as $2,277 an ounce on Tuesday afternoon, compared with around $2,253 an ounce in late deals on Monday.

The US dollar fell against other major currencies on Tuesday, giving up the previous day’s gains, and putting upward pressure on dollar-denominated assets like gold.

Geopolitics also came to the fore this week after what appeared to be an Israeli strike against an Iranian consulate in Syria on Monday, which killed several people, including two generals. The latest attacks may be seen as increasing the risks of a wider confrontation beyond the immediate war between Hamas and Israel in Gaza, driving investment flows toward perceived safe havens. Read More

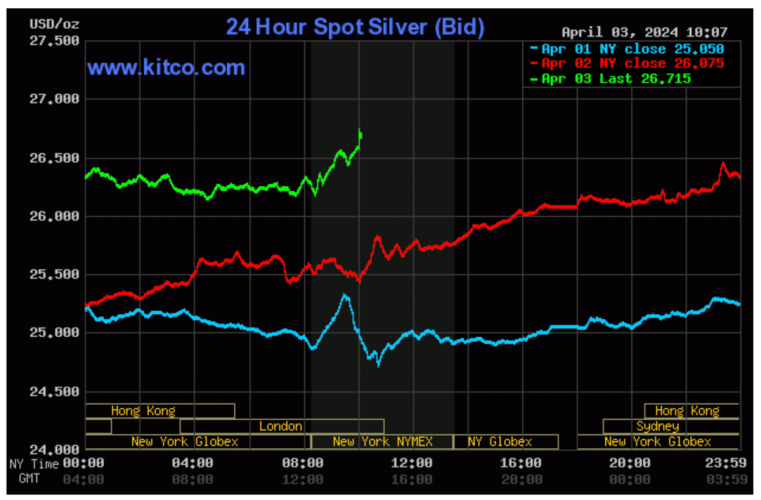

Silver Price News: Silver Tops $26.00 As Gold Hits New High

Silver prices powered up to a two-week high on Tuesday, moving in tandem with gold prices, which rallied to a new all-time high.

Silver prices rose as high as $26.14 an ounce on Tuesday afternoon, up from around $25.20 an ounce in late deals on Monday.

Silver followed in the wake of gold, which once again stole the limelight on Tuesday as prices hit a new all-time high of $2,277 an ounce.

The precious metals complex in general took support from a fall in the value of the US dollar, which saw initial strength go into reverse on Tuesday. A weaker dollar makes gold and silver cheaper for buyers in other currencies, driving increased interest.

Both metals also took support from heightened geopolitical tensions after a military strike against an Iranian consulate in Damascus on Monday, which killed several people. In a separate incident, Ukraine claimed responsibility for a drone attack deep inside Russia’s Tatarstan region on Tuesday, which targeted a drone factory and the country’s third-largest refinery. Increased hostilities tend to drive investments into lower-risk assets like precious metals. Read More

Silver prices are well-positioned to outperform gold once again – WisdomTree’s Tahir

Silver appears to be gearing up for its cyclical outperformance of gold, according to Mobeen Tahir, Director of Research at WisdomTree.

Tahir wrote in a recent analysis that given the strong correlation between the two metals, gold’s strong and ongoing rally augurs well for silver.

“Silver often finds itself in a race with gold. It’s a contest that tends to attract bets from investors,” he said. “In recent weeks, the competition appears to be creating just the dynamic that brings people to the edge of their seats.”

Tahir noted that silver gained around 8% in March, actually outpacing gold’s 7% gain. “Notably, silver has picked up pace relatively recently as it still trails gold in terms of year-to-date performance (gold up 6.1% while silver is up 2.9%).” Read More

#silversqueeze is coming, stocks could be depleted in two years - TD Securities

There is a lot of focus on gold right now as prices push to within striking distance of $2,300 an ounce; however, one bank is telling investors that silver is the metal to watch.

After underperforming gold in the last month, as the yellow metal hit record high after record high, silver has now started to move. The gold-silver ratio has dropped sharply to 87.6 points on Tuesday but still has a long way to go before hitting last month’s lows at 85 points, much less the historical average in the low 50s.

May silver futures are currently trading at $25.93 an ounce, up more than 3% on the day. Analysts note that critical resistance at $26 could trigger a bigger move for the precious metal.

While technicals are turning bullish for silver, Daniel Ghali, senior commodity analyst at TD Securities, said he expects fundamental factors will create a long-term uptrend for the white metal. Read More

Gold price testing $2,300 as ISM Services PMI drops to 51.4%

The health of the U.S. economy is becoming increasingly muddled as the service sector continues to lose momentum, according to the latest data from the Institute for Supply Management.

Wednesday, the ISM said its Services Purchasing Managers Index dropped to 51.4%, down from February’s reading of 52.6%. The data was weaker than expected, as economists were looking for a relatively unchanged reading of 52.8%.

Readings above 50% in such diffusion indexes signify economic growth and vice-versa. The farther an indicator is above or below 50%, the greater or smaller the rate of change. Read More

Gold, silver extending strong bulls market runs

Gold prices are firmly higher and hit another record high of $2,308.80 basis June Comex futures today. Silver prices are sharply up and hit a two-year high of $27.00 basis May Comex futures. Safe-haven demand is featured this week as geopolitical tensions in the Middle East have ratcheted up. Bullish charts are also pushing the technical traders to the long side of the two precious metals markets. June gold was last up $21.90 at $2,304.00. May silver was last up $1.032 at $26.955.

The economic data pace picks up the rest of this week, including Fed speak. Several Federal Reserve officials are also scheduled to speak today, including Fed Chairman Jerome Powell. On Friday comes the U.S. employment situation report.

Technically, the gold futures bulls have the strong overall near-term technical advantage. A six-week-old uptrend is in place on the daily bar chart. Bulls’ next upside price objective is to produce a close in June futures above solid resistance at $2,400.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $2,200.00. First resistance is seen at the overnight contract high of $2,308.80 and then at $2,320.00. First support is seen at Tuesday’s of $2,267.10 and then at $2,250.00. Wyckoff's Market Rating: 9.0.

Image Source: Kitco News

The silver bulls have the solid overall near-term technical advantage. Bulls have revived a six-week-old uptrend on the daily bar chart. Silver bulls' next upside price objective is closing May futures prices above solid technical resistance at $27.50. The next downside price objective for the bears is closing prices below solid support at $25.00. First resistance is seen at the overnight high of $26.68 and then at $27.00. Next support is seen at the overnight low of $26.235 and then at $26.00. Wyckoff's Market Rating: 7.5.

Image Source: Kitco News

Technically, June gold futures bulls have the strong overall near-term technical advantage. A six-week-old uptrend is in place on the daily bar chart. Bulls’ next upside price objective is to produce a close above solid resistance at $2,400.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $2,200.00. First resistance is seen at today’s contract high of $2,308.80 and then at $2,320.00. First support is seen at today’s low of $2,285.70 and then at Tuesday’s low of $2,267.10. Wyckoff's Market Rating: 9.5

May silver futures bulls have the solid overall near-term technical advantage and have restarted a six-week-old price uptrend on the daily bar chart. Silver bulls' next upside price objective is closing prices above solid technical resistance at $28.00. The next downside price objective for the bears is closing prices below solid support at $25.00. First resistance is seen at $27.25 and then at $27.50. Next support is seen at $26.50 and then at today’s low of $26.235. Wyckoff's Market Rating: 8.0. Read More

Nothing's stopping gold, prices push above $2,300 as Powell strikes neutral tone but still signals rate cuts this year

The gold market is trading near session highs, solidly above $2,300 an ounce, as Federal Reserve Jerome Powell continues making the case for rate cuts this year.

Speaking at Stanford’s Business, Government, and Society Forum, Powell said that although the central bank is not looking to cut interest rates immediately, it still sees lower rates this year. He added that the central bank has time to gauge the strength of the economy and the path of inflation.

“We do not expect that it will be appropriate to lower our policy rate until we have greater confidence that inflation is moving sustainably down toward 2 percent,” he said in his opening remarks. “If the economy evolves broadly as we expect, most FOMC participants see it as likely to be appropriate to begin lowering the policy rate at some point this year.” Read More

Central banks buy 19 tonnes of gold in February, purchases slow but remain healthy – World Gold Council

Central Bank gold demand continues to dominate the marketplace, even as the pace of purchase slows.

According to the latest data from the World Gold Council, global central banks' gold reserves increased by 19 tonnes last month. However, purchases were down 58% compared to January as some central banks also increased their gold sales.

However, looking beyond the headline figures, Krishan Gopaul, senior market analyst at the WGC, said that central bank gold demand remains healthy in the early months of 2024.

“On a y-t-d basis, central banks report the addition of 64t over January and February, 43% lower than the same period in 2023 but a fourfold increase on 2022,” he said in the report. “Despite slower demand from central banks in February, the year has got off to a healthy start and the broad trend of gold buying remains intact.” Read More

Gold’s on track to hit $2,400 this year, less dependent on Fed rate cuts – Bank of America

Bank of America was one of the bullish banks on gold heading into 2024, and everything they have seen this year has only added to their conviction.

In a note published Tuesday, commodity analysts, led by Michael Widmer, reiterated their call for gold prices to push to $2,400 an ounce this year. In December, Widmer said that he was expecting a gold rally when the Federal Reserve actually started cutting interest rates. That stance has only changed slightly.

“We had previously proposed a $2,400/oz price estimate if the Fed cut rates in 1Q24; we commit to that estimate for this year, even if rate cuts come later,” Widmer said in the report.

Bank of America’s bullish outlook comes as the precious metal has made significant gains in the last month, establishing record highs on top of record highs. June gold futures last traded at $2,315.10 an ounce, up nearly 1.5% on the day. Read More

Gold Futures Breach and Close Above $2300 for the First Time

Image Source: Kitco News

In a historic move, gold futures surged past the $2300 mark for the first time in history. As of 4:30 PM EDT, gold futures basis the most active June contract is currently at a record high of $2318.90. The June contract opened at $2301.70 and traded to an intraday high of $2319.70. The precious metal's rally showed no signs of slowing down, with the June 2024 contract currently fixed at $2319.10 after factoring in today’s gain of $37.30, or 1.63%, marking the seventh consecutive trading day of gains.

This remarkable surge has been fueled by a combination of factors, chief among them being the growing expectations that central banks, including the Federal Reserve, are preparing to lower interest rates as inflation cools down. Chairman Jerome Powell, in his address to the Stanford Business, Government, and Society Forum, hinted at the possibility of rate cuts, stating that a lower interest rate would likely be appropriate "at some point this year" if the economy develops as expected. This statement heightened expectations for a Fed rate cut in June. Read More

Gold price hits new record highs as the West loses price-setting powers: Frank Giustra & Pierre Lassonde on new geopolitical reality & resource nationalism

As gold set another record high, Canadian mining legends Frank Giustra, CEO of Fiore Group, and Pierre Lassonde, Chairman Emeritus at Franco-Nevada, say the West has lost its power to set the price of gold. Giustra and Lassonde also warn that in the new geopolitical reality of resource nationalism, Canada is failing its economy and citizens.

With gold futures hitting another record high of above $2,264 an ounce at the start of the second quarter, Giustra and Lassonde pointed to a major shift in the gold market.

"The world hasn't woken up yet. The marginal buyer of gold is no longer the U.S. It's no longer Europe. It's China. Between the country's central bank and the Chinese public, China takes up over two-thirds of all the annual production. They are the new marginal buyer. That's where the gold price is set," Lassonde told Michelle Makori, Lead Anchor and Editor-in-Chief at Kitco News, during Kitco Insights Interactive Mining Titans' Power Panel. Read More

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.