Image Source: Unsplash

Silver Slides Near $23 on Prospect of Fresh Inflation Rise

Silver is sliding back down towards $23 an ounce in another slump that will frustrate long-term holders of the precious metal.

Even though silver’s medium to long-term fundamental credentials remain solid, the metal has regularly been punished over the last year or so by shorter-term macroeconomic concerns. The latest one is that the price spikes in oil following the extension of supply cuts by OPEC+ will cause inflation to climb once again.

Certainly, efforts by central banks to return inflation back towards their 2% targets will need to continue for a while longer, but this looks more likely to be achieved by higher for longer interest rates rather than more hikes.

Investors and traders remain unconvinced about the bull case for equities and are continuing to adopt a cautious trading stance, and this is seeping into the outlook for silver. Read More

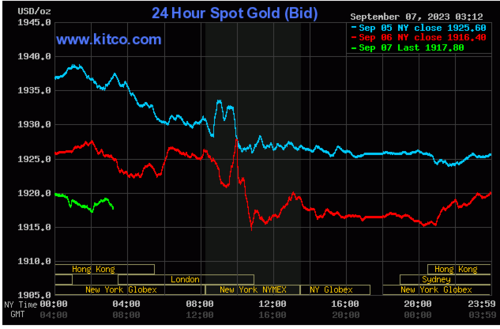

Gold Falls Below $1,930 on Renewed Inflation Concerns

Gold has fallen back below $1,930 an ounce in the face of a strong US dollar and renewed fears over inflation after oil prices climbed following OPEC+ extended their supply cuts.

The medium-term direction of gold looks unclear while investors and traders remain unconvinced of the true health of the global economy. While employment data has generally held up well in the face of high inflation and rising interest rates, central banks’ battle to fully curb inflation looks far from over with Bundesbank President Joachim Nagel warning that any pause in interest rate hikes is unlikely to be quickly followed by rate cuts.

So while further hikes, particularly in the US, are looking less likely, gold looks set to have to endure a period of high-interest rates, reducing the appeal of the asset against other interest-bearing classes, such as bonds. Read More

Gold weighed down by higher oil prices following OPEC cuts that are fueling fears the Fed will maintain its hawkish bias longer than expected

The gold market is seeing renewed selling as rising inflation pressure from higher oil prices continues to support the Federal Reserve's hawkish monetary policy bias, boosting the U.S. dollar and pushing bond yields higher.

Oil prices surged higher Monday after OPEC+ members Saudi Arabia and Russia announced that they would maintain their oil production cuts for another three months, through to the end of the year. Saudi Arabia will continue to hold back production by one million barrels per day, while Russia will continue to reduce its output by 300,000 barrels per day.

Saudi Arabia said that the voluntary supply cuts are aimed at supporting stability and balance in oil markets. The ongoing production cuts have pushed oil prices to a 10-month-high. West Texas Intermediate (WTI) crude oil prices continue to hold on to most of their early morning gains, last trading at $86.67 per barrel, up 1.27% on the day. At the same time, Brent Crude, which reflects more international oil demand, was trading at $89.20 per barrel, up 1.5% on the day. Read More

Spot gold against Canadian dollar remains under pressure after BoC leaves interest rates at 5%

The Bank of Canada’s decision to leave interest rates unchanged is providing little direction for gold priced against the Canadian dollar as the broader market, sees solid selling pressure Wednesday.

As expected, the BoC left its overnight rate unchanged at 5%. Slowing economic activity in the Great White North, has pushed the central bank to the side lines, even as inflation remains stubbornly high.

“With recent evidence that excess demand in the economy is easing, and given the lagged effects of monetary policy, Governing Council decided to hold the policy interest rate at 5% and continue to normalize the Bank’s balance sheet. However, Governing Council remains concerned about the persistence of underlying inflationary pressures, and is prepared to increase the policy interest rate further if needed,” the central bank said in its monetary policy statement. Read More

Rising bond yields drive outflows from gold ETFs, but long-term support remains

Rising bond yields continue to take their toll on the precious metals markets as investors flee from gold-backed exchange-traded funds (ETFs), according to the latest data from the World Gold Council.

Wednesday, the WGC said that global physically-backed gold ETFs saw their third consecutive month of outflows, declining by 46 tonnes, valued at $209 billion. So far this year, global ETFs have seen net outflows of 130 tonnes.

"During the month, the gold price declined by 1%, the weakest performance since February. And its weakness, especially during the first three weeks, was likely the main driver of the outflows in August," the analysts said in the report.

While Europe has been the biggest source of outflows in the gold market, last month was led by North American-listed funds. The WGC said that 44 tonnes of gold, valued at $2.7 billion, flows out of North American markets. Read More

Gold, silver down on technical selling, strong greenback

Gold and silver prices are lower in midday U.S. trading Wednesday, as technical selling is featured amid a lack of fresh fundamental news to drive prices. Gold and silver see their near-term technical postures bearish. A strong U.S. dollar and elevated U.S. Treasury yields are bearish outside market elements working against the precious metals market bulls recently. December gold was last down $9.70 at $1,943.10 and December silver was down $0.408 at $23.465.

A feature in the marketplace at mid-week is rising crude oil prices after Saudi Arabia and Russia decided to extend their oil-production cuts. Nymex crude oil futures prices are firmer and trading around $87.50 a barrel, after hitting a 10-month high on Tuesday. Brent crude oil futures this week pushed above $90 a barrel.

Technically, the gold futures bears have the overall near-term technical advantage. Bulls’ next upside price objective is to produce a close in December futures above solid resistance at $2,000.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at the August low of $1,913.60. First resistance is seen at $1,965.00 and then at Tuesday’s high of $1,972.60. First support is seen at today’s low of $1,940.00 and then at $1,931.00. Wyckoff's Market Rating: 3.5.

Image Source: Kitco News

The silver bears have gained the overall near-term technical advantage and have momentum. Silver bulls' next upside price objective is closing December futures prices above solid technical resistance at the July high of $25.82. The next downside price objective for the bears is closing prices below solid support at the August low of $22.585. First resistance is seen at $24.00 and then at $24.25. Next support is seen at today’s low of $23.315 and then at $23.00. Wyckoff's Market Rating: 4.0. Read More

Image Source: Kitco News

Silver price outlook sours, hamstrung by soaring U.S. dollar, Treasury yields - FX Empire's James Hyerczyk

The recent strength of the U.S. Dollar and the dramatic run-up in Treasury yields have put considerable pressure on silver and gold, discouraging precious metals buying from investors holding other currencies, according to FX Empire’s James Hyerczyk.

Hyerczyk noted that spot silver prices hit two-week lows on Wednesday, bouncing off $23 an ounce around 11 am EDT. “This drop coincides with the U.S. dollar approaching a six-month high and a surge in U.S. Treasury yields,” he said. “The prevailing sentiment suggests an ongoing demand for high-interest rates, largely fueled by concerns surrounding China’s economic status and worldwide growth. Consequently, silver, similar to gold, becomes less accessible for those holding foreign currencies.”

After the Labor Day long weekend, Hyerczyk said market participants’ focus has been on rising U.S. Treasury yields, which hit a 14-year high late last week, along with rising oil prices. “The backdrop to this market tension is last Friday’s nonfarm payrolls report, which indicated a peak in unemployment rates since early 2022 and declining hourly earnings, causing a shift in investors’ views on inflation and Federal Reserve policies,” he said. Read More

The yield curve is signaling a 'black swan' event in 2024, this is what it could be - George Gammon

The inversion of the yield curve has "incredible" predictive powers, and it is now telling investors that a global financial crisis 2.0 could hit the world economy in 2024, said George Gammon, an investor, macroeconomics expert, and host of the Rebel Capitalist Show.

A yield curve inversion happens when long-term bonds have a lower yield than short-term bonds. It is viewed as a reliable indicator that an economy could be heading for recession. Read More

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.