Image Source: Unsplash

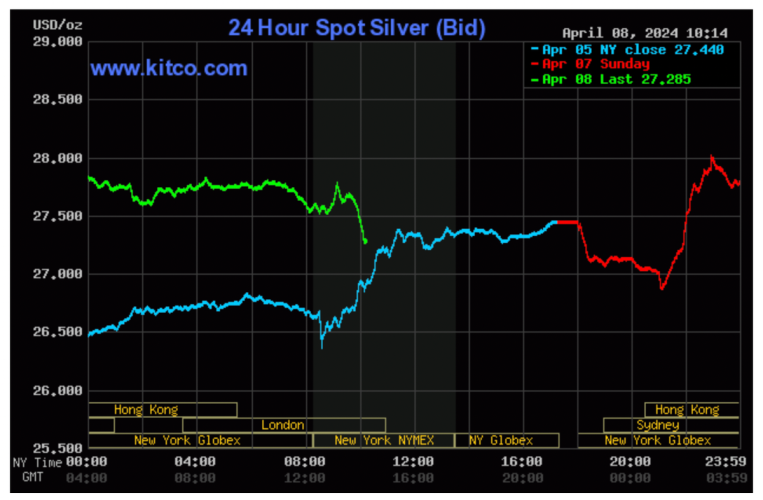

Silver Price News: Silver Nudges Higher, Close to 3-Year High

Silver prices pushed higher on Friday to cap a bullish week for the white metal, rising in line with gold prices, which hit new record highs.

Silver prices briefly climbed as high as $28.24 an ounce, although most of the volume going through was centred around the $27.30 to $27.50 area in late deals. That compared with around $26.95 an ounce on Thursday. Silver’s moderate gains on Friday took the metal to its highest price since June 2021 — almost a three-year-high.

Silver’s gains came on a day in which gold prices hit a new all-time high of $2,330 an ounce.

The gold-silver ratio hit a high of around 91 in February, indicating gold’s relative price strength against silver, and this may have been taken as a sign that silver’s relative underperformance had increased the chances of a bullish run-up in prices.

The markets will be looking ahead to Wednesday’s US inflation numbers to get a handle on the likely timing of any interest rate cuts in the short-term. Read More

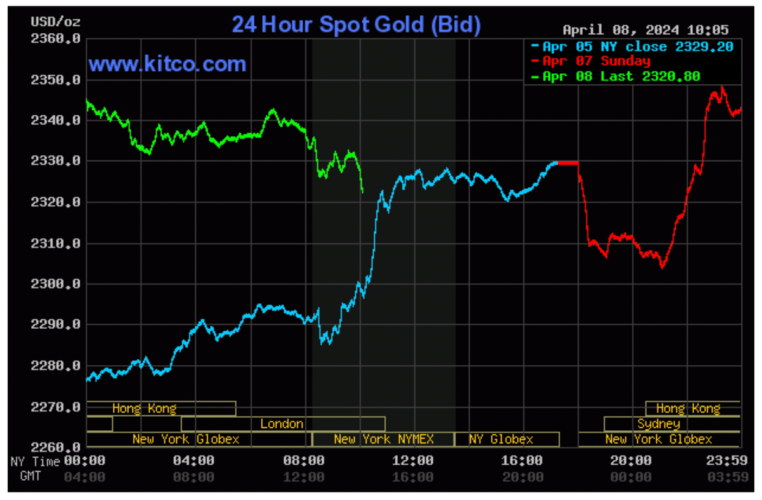

Gold Price News: Gold Hits All-Time High As Bullish Momentum Continues

Gold prices powered up to another all-time high on Friday, with the market supported by geopolitical tensions and bets on upcoming interest rate cuts.

Prices hit a new all-time high of $2,330 an ounce on Friday, compared with around $2,290 an ounce in late deals on Thursday. Gold’s price direction showed a dramatic within-day turnaround, with a dip to as low as $2,268 an ounce in Asian hours before rebounding sharply to hit the fresh highs by early evening European time.

Geopolitical factors appeared to be the main driver, with ongoing hostilities in the Middle East and Ukraine injecting a risk premium into the gold price. Ukraine carried out a drone attack against the Morozovsk air base in Russia on Friday, which destroyed six Russian planes and badly damaged a further eight, according to news reports.

On the economic side, US Non-Farm Payrolls figures released Friday showed that the US economy added 303,000 jobs in March, the most in ten months and well above expectations of 200,000. Ordinarily these figures would be expected to be bearish for gold prices as they imply a stronger than expected economy, strengthening the case for a higher-for-longer stance on interest rates by the US Fed. Read More

Gold’s 2024 price ceiling is now the floor, silver is approaching ‘sweet spot’ for investors – MKS Pamp

The first quarter of 2024 was all about gold, according to an updated outlook from MKS Pamp. “We were not bullish enough Gold in Q1’24 and were too bullish Silver and Platinum,” the analysts said, “but the relative outperformance between Gold and the white metals (Silver & PGMs) should compress in Q2’24 & Q3’24.”

In their recently published Precious Metals Outlook 2024 – Revised Forecasts, the Swiss precious metals giant broke down the sector’s performance in detail, and laid out their adjusted predictions for the remainder of the year.

The analysts wrote that gold has shown sensitivity to central banks’ tolerance of higher rates to address sticky inflation.

“Original Forecast $2050/oz (mildly bullish vs the street) is now upgraded to $2200/oz (outright bullish) as Gold sniffs out a collective turn in major CB policy willing to accept higher for long inflation, amidst solid physical demand,” they wrote. “Our original 2024 forecast published in January was $2050/oz (high-low range of $1900-$2200/oz), hinging on the Fed cutting rates as the global economy slowed. We also expected new all-time highs. So far Gold has already taken out our high price forecast of $2200/oz with the timing as expected as Gold pre-empts a Fed rate cutting cycle, while Central Bank and physical demand remains relentless.” Read More

Gold price sees another 5% rally this week as geopolitical uncertainty drives the market to touch $2350

The gold market continues its unstoppable run to record highs as it touches an all-time high of $2,350 an ounce ahead of the weekend.

Gold’s latest rally comes after the U.S. economy created 303,000 jobs in March, significantly beating expectations. At the same time, unemployment dropped to 3.8%. Despite the robust job growth, wages were relatively muted, rising 0.3%, in line with expectations.

Economists described the latest nonfarm payrolls data as a “blockbuster report,” which supports higher bond yields and relative strength of the U.S. dollar. Bond yields have risen as the market continues to shift heir expectations regarding the start of the Federal Reserve’s easing cycle.

This past week, members of the Federal Open Market Committee have been fairly evasive on the topic of interest rate cuts. According to the CME FedWatch Tool, markets see a 54% chance of a rate cut in June. Last week, markets were pricing in a more than 60% chance of easing. Read More

Gold prices due for a correction, silver gets support from both investors and industry – Heraeus

Gold appears overbought and due for an imminent correction, while silver is seeing support from both the investment community and industrial demand, according to precious metals analysts at Heraeus.

In the company’s latest report, the analysts noted that gold prices are continuing to rise despite the fact that rate cut expectations have been moderating.

“The gold price has risen by 12.6% year-to-date, and this is without the aid of a Fed monetary policy pivot, a markedly weaker dollar, or a meaningful resurgence in institutional investment demand via ETFs,” they wrote. “This may leave the door open to a move even higher later in the year when the Fed finally decides to drop interest rates, which in all likelihood will weaken the US dollar.” Read More

Gold and silver are still not overvalued as hedge funds add to their bullish bets

The latest trade data shows hedge funds continue to pile into gold and silver, and while prices have pushed significantly higher, some analysts have said that the precious metals still have room to move higher.

Commodity Futures Trading Commission disaggregated Commitments of Traders report for the week ending April 2 showed money managers increased their speculative gross long positions in Comex gold futures by 10,067 contracts to 173,073. At the same time, short positions fell, dropping by 1,218 contracts to 25,993.

The gold market is currently net long by 147,080. Bullish speculative positioning has reached its highest level since early March 2022; however, positioning has remained largely flat for the last three weeks and is still well under its highs reported in 2019.

In a note Monday, Mike McGlone, Senior Market Strategist at Bloomberg Intelligence, said that gold’s positioning is not yet overextended. Read More

Choppy, consolidative action in gold after record high hit early on

Gold prices are near steady and have traded both sides of unchanged near midday Monday. June Comex gold reached a record high of $2,372.50 overnight. Silver prices hit a two-year-high overnight, with May Comex futures hitting $28.195. Some routine profit taking by the shorter-term futures traders is featured to start the trading week. June gold was last up $0.80 at $2,346.20. May silver was last up $0.197 at $27.705.

Broker SP Angel today in an email dispatch said the present gold market rally has “dumbfounded” most analysts, given the break from its correlation with U.S. Treasuries, which have sold off over the past month. Also, the U.S. dollar has been stronger, and that’s usually bearish for gold and silver. “Central bank buying has been a sustained source of support for gold, with Bloomberg reporting China’s PBOC has added gold for the 17th month in a row,” said the broker, adding this has fuelled speculation over a potential devaluation of the Chinese yuan, as well as geopolitical concerns over heightened aggression against Taiwan.

Technically, June gold futures bulls have the strong overall near-term technical advantage. A seven-week-old uptrend is in place on the daily bar chart. Bulls’ next upside price objective is to produce a close above solid resistance at $2,400.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $2,250.00. First resistance is seen at today’s contract high of $2,372.50 and then at $2,385.00. First support is seen at today’s low of $2,321.70 and then at $2,300.00. Wyckoff's Market Rating: 9.0.

Image Source: Kitco News

May silver futures bulls have the solid overall near-term technical advantage. An accelerating seven-week-old price uptrend is in place on the daily bar chart. Silver bulls' next upside price objective is closing prices above solid technical resistance at $30.00. The next downside price objective for the bears is closing prices below solid support at $26.00. First resistance is seen at today’s high of $28.195 and then at $28.50. Next support is seen at $27.00 and then at $26.40. Wyckoff's Market Rating: 8.5. Read More

Image Source: Kitco News

The gold price is up nearly 19% in this rally, but you haven’t seen anything yet - abrdn’s Robert Minter

Although Western investors continue to ignore gold even as prices continue to hit record highs, they are no longer actively getting in the way of higher prices, which means the current rally has legs to run higher, according to one market analyst.

In an interview with Kitco News, Robert Minter, Director Of Investment Strategy at abrdn, said that gold’s rally to record highs above $2,350 an ounce is just getting started, and it's only a matter of time before retail investors jump into gold-backed exchange-traded funds to kick off the next major leg higher.

Minter’s comments come as abrdn celebrates a significant milestone with its gold-backed ETF. Last week, assets under management in abrdn Physical Gold Shares ETF (NYSE: SGOL) surpassed $3 billion for the first time.

Although investment demand remains somewhat lukewarm, Minter said gold investors should be content that at least the selling has stopped. Read More

PBoC’s March gold purchases lowest since November 2022, but China still controls price

China’s central bank added gold to its reserves for the 17th straight month in March, but the increase was the smallest since the streak began in November 2022, according to official data released Sunday.

The People’s Bank of China announced that they increased their gold holdings by 0.2% to 72.74 million troy ounces last month, with record-high prices likely discouraging them from heftier purchases. Spot gold went on quite a run during the month, climbing from $2,040 per ounce on March 1 to a new all-time high above $2,265 by March 31.

Central bank buying has been a significant driver of gold’s price gains since the Russian invasion of Ukraine in 2022, and China has led the sovereign buying during that period. High prices have dampened demand in recent months, however, with sovereign gold purchases declining 58% month-over-month in February. Read More

No bank is safe, implosion coming: 'Every single bank is insolvent' — Lynette Zang

The banking sector’s troubles might be out of mainstream headlines, but the crisis is far from over, with the risk of an implosion and consolidation of banks still extremely high, warned Lynette Zang, Founder & CEO of Zang Enterprises & LynetteZang.com.

A little more than a year since the March 2023 banking crisis, when the U.S. saw three of the four largest bank failures in its history, the banking sector is arguably even more vulnerable.

“I believe we will definitely see even more banks collapse,” Zang told Michelle Makori, Lead Anchor and Editor-in-Chief at Kitco News. “What they're trying to do is engineer a soft landing, but the problem is that we are transitioning into a new system. There's no such thing as a soft landing. They need a crisis. So we will see even more banks collapse this year.”

Zang pointed out that every single bank is insolvent because of what the Federal Reserve has been doing. Read More

Live From The Vault - Episode: 167

Alert 🚨 BRICS secret gold revaluation

In this week’s episode of Live from the Vault, Andrew Maguire takes listeners through the recent gold price action and short-term predictions, revealing the behind-the-scenes failings of the Fed’s price-capping.

The London whistleblower uncovers the panic behind physically-driven precious metal rallies and provides a major update on the BRICS commodity-backed currency that hastens dedollarisation.

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.