Image Source: Unsplash

Silver Price News: Silver Extends Recovery as Investors bet on Precious Metals after Sell-off

There is light at the end of the tunnel.

The silver price closed last week, posting a significant rebound to $21.6 an ounce. This positive impulse has been confirmed in the early trading today, with the precious metal extending its recovery to $21.85.

At the moment, silver is trading over one dollar per ounce above the low reached twice last week, with the price trying to come back to the former support zones of 22.2 and 22.5 (which have now become resistance levels).

The current rebound can be seen as the result of different factors. The slowdown of the greenback seen on Friday on the Forex Market reduced the bearish pressure on silver, while growing tensions are forcing investors to focus their attention on precious metals (as safe-haven assets). Moreover, the recent decline seemed too quick, with silver losing 15% in just 5 weeks, generating – from a graphical point of view – an oversold situation. Read More

Gold Price News: Bullion Rebounds as Geopolitical Tensions Boost Haven Demand

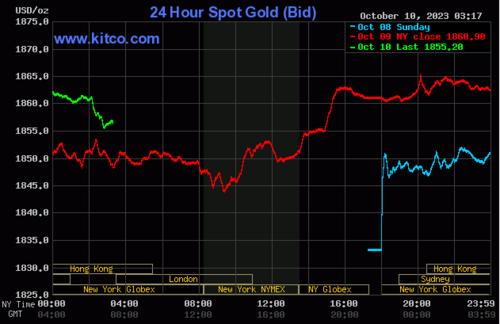

The gold price is showing interesting recovery signals. After a difficult week, on Friday bullion tried to reverse the recent bearish trend, jumping above $1,830 an ounce in the final trading hours.

Despite the solid U.S. macroeconomic data, with the nonfarm payrolls of September showing values well above expectations, the greenback lost ground and both gold and silver rebounded.

In early trading, this morning, we have seen gold extending the rebound, reaching and surpassing the key level of $1,850 an ounce. From a technical point of view, the scenario has improved, as the selling pressure temporarily slowed down.

The weekend was sadly marked by the growing tensions in the Middle East, with the attack on Israel. This scenario could push investors to increase the presence of gold in their portfolio as safe haven asset, in case of further escalation of geopolitical turmoil. Read More

Israel's war with Hamas puts new safe-haven focus on gold

Safe-haven demand is providing new bullish momentum for gold as investors react to Hamas' brutal attack on Israel on Saturday.

Although safe-haven demand has not provided consistent, long-term support for gold, some analysts note that an escalation of tensions in the Middle East is just the latest geopolitical factor that will continue to support the precious metal into 2024.

Sunday, the Israeli government formally declared war and gave the green light for "significant military steps" to retaliate against Hamas after Saturday's surprise attack that killed hundreds of Israelis.

Analysts note that the global economy and financial markets will remain sensitive to an escalation of the war. Political analysts note that growing tensions could pull Iran and the U.S. into the conflict, which could impact energy markets and inflation.

"It is difficult to predict the extent of the price action on geopolitical shocks. The fact that the U.S. and Iran are pulled into the turmoil hints that tensions may further escalate. From a price perspective, the $90pb level is expected to shelter decent offers in U.S. crude, as escalation and prolongation of Mid-East tensions could be the final straw that could bring the world very close to the brink of recession, and temper appetite for oil. It's too early to call," said Ipek Ozkardeskaya, senior analyst at Swissquote Bank, in a note Monday. Read More

Gold, silver lifted by safe-haven buying as Middle East a powder keg

Gold and silver prices are higher in midday U.S. trading Monday, on safe-haven demand following the surprise Hamas attack on Israel over the weekend. This already dire situation is likely to get worse before it gets better, which likely means even stronger safe-haven flows into gold and silver for at least the near term. December gold was last up $21.20 at $1,866.20 and December silver was up $0.242 at $21.96.

The marketplace is unnerved following the weekend Hamas raid on Israel that killed hundreds of civilians and hostages taken. Israel retaliated harshly and declared war on Hamas. This is the largest act of violence seen in Israel in 50 years. Risk aversion is high to start the trading week, as the ramifications of the weekend attack by Hamas are huge, both politically and economically. The U.S. is building up its military presence in the Middle East region.

The major Middle East conflict will likely in the coming months impact major economies, including affecting central bank policies. There is also speculation the Israel war with Hamas may even impact the U.S. Congress and the process of selecting a new Speaker of the House of Representatives.

Technically, December gold futures prices gapped higher on the daily bar chart today, after posting a bullish “outside day” up last Friday. These are early clues that a market bottom is in place. However, the bears have the firm overall near-term technical advantage. A five-month-old price downtrend is in place on the daily bar chart. Bulls’ next upside price objective is to produce a close above solid resistance at $1,900.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,800.00. First resistance is seen at $1,875.00 and then at $1,900.00. First support is seen at today’s low of $1,857.50 and then at $1,849.00. Wyckoff's Market Rating: 2.5.

Image Source: Kitco News

December silver futures bears have the firm overall near-term technical advantage. A 2.5-month-old downtrend is still in place on the daily bar chart. Silver bulls' next upside price objective is closing prices above solid technical resistance at $23.00. The next downside price objective for the bears is closing prices below solid support at the March low of $20.615. First resistance is seen at today’s high of $22.18 and then at $22.50. Next support is seen at today’s low of $21.705 and then at $21.50. Wyckoff's Market Rating: 2.5. Read More

Image Source: Kitco News

Live From The Vault - Episode: 143

1.4 billion people about to create global gold shortage

In this week’s episode of Live from the Vault, Andrew Maguire delves into the major drivers of gold in the world today: Russian oil trading and the Chinese push for all 1.4 billion citizens to regularly purchase gold through the People’s Bank of China.

The precious metals expert uncovers the impending supply demand imbalance, explaining how soon one third of global gold resources could quickly be consumed by even a small percentage of Chinese citizens purchasing a gram each month.

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.