Image Source: Unsplash

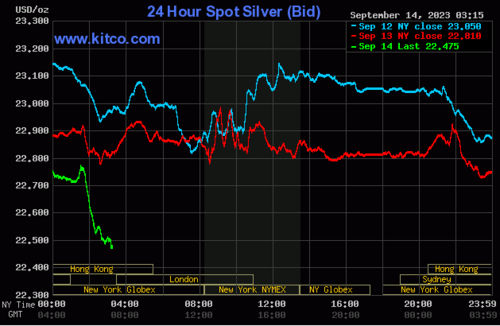

Silver Below $23 as High Interest Rates Lessen Short-Term Appeal

Silver has fallen below $23 an ounce as the precious metal finds itself out of favour in the current trading cycle.

The main headwind for silver is the prospect of global interest rates staying higher for longer, which would make physical silver, with its lack of yield, less attractive than interest-bearing asset classes.

Yet one of the main reasons that central banks look set to keep interest rates around 5% for the foreseeable future is the increasing confidence that economies are able to sustain these higher levels without tipping into recession. Given silver’s industrial exposure in sectors such as solar energy and electrical applications more broadly, a healthy global economy is important for the metal’s physical demand. Read More

Higher for Longer Interest Rates Pushes Gold Towards $1,900

Gold has slipped closer to $1,900 an ounce as a busy period of central bank interest rate decisions looms. Tomorrow brings the latest move by the European Central Bank with investors increasing bets on the likelihood of another hike. The ECB’s announcement will be followed by the Federal Reserve and the Bank of England among others next week and while lots more hikes are unlikely, central banks look set to adopt a “higher for longer” stance towards interest rates.

The prospect first of further interest rate hikes by potentially both the ECB and the Bank of England as well as rates staying above 5% for the foreseeable future on both sides of the Atlantic creates a challenging macroeconomic environment for gold, and it now looks a matter of time before the price falls below the $1,900 an ounce threshold that the precious metal has traded above for the majority of the last six months. Read More

Gold should do well as weak growth forces central banks to give up on 2% inflation targets - Capitalight's Chantele Schieven

Gold prices remain under pressure, but its ability to hold critical support levels reveals that investors could be worried that hawkish monetary policies worldwide have run their course, even as inflation remains stubbornly high.

Although the U.S. Federal Reserve has maintained its hawkish bias, there are signs that the European Central Bank could be ready to shift to a more neutral stance on monetary policy and potentially adjust its inflation target rate, according to Chantelle Schieven, head of research at Capitalight Research.

Schieven's comments come ahead of the ECB's monetary policy decision Thursday. The central bank is expected to leave interest rates at 4.75%. Many economists have said it could be difficult for the ECB to continue raising interest rates as the regional economy continues to slow.

Last month, during the Federal Reserve's central bank symposium at Jackson Hole, Wyoming, ECB President Christine Lagarde said that the world could be seeing the start of a new economic era. Read More

Gold price to hit $5,000 in 3 years, watch the default wave kick off a U.S. recession in Q4 - Michael Lee

Even though the gold market lacks direction ahead of the Federal Reserve's September monetary policy meeting, prices will make a move and hit $5,000 an ounce within three years, according to Michael Lee, Founder of Michael Lee Strategy.

The stagnation in the price action is partly because of the strength of the U.S. dollar and the market's interest rate expectations. But the macro data the market is basing its estimates on looks manipulated or flawed by design, according to Lee.

"For a lot of the United States, they're already in recession," he told Michelle Makori, Lead Anchor and Editor-in-Chief at Kitco News. "You've already seen some massive deterioration in the labor market, although it's not certainly not being reported that way."

Lee broke down the U.S. jobs data releases from this year, pointing to a 12 standard deviation event, which is known as an extreme statistical outlier.

"Every single time a report came out [this year], it was later revised lower. That has happened every month this year. That is a 12 sigma deviation event — meaning, you're more likely to get struck by lightning five times on the way to work than this happening," he said. "You have to ask yourself, is this government bureaucracy, is this a flawed model, or is the Bureau of Labor Statistics cooking the books to favor the Biden administration?" Read More

Gold prices remain near session lows as U.S. CPI rises 3.7% in the last 12 months

Gold prices are trading near session lows but are not seeing significant selling pressure even as the Federal Reserve continues to fight an uphill battle against inflation after consumer prices rose more than expected last month.

Wednesday, the U.S. Labor Department said its much-anticipated Consumer Price Index rose 0.6% last month, following a 0.2% rise in June. The data was in line with expectations.

However, the report said that inflation in the last 12 months rose 3.7%, up from July's increase of 3.2%. According to consensus forecasts, economists expected inflation to rise 3.6% for the year.

At the same time, the report said that higher consumer prices continue to be embedded in the broader economy as core CPI, which strips out volatile food and energy prices, rose 0.3% last month. Economists were expecting to see a 0.2% increase.

The gold market is struggling in the face of the latest inflation numbers as the market trades near session lows; however, there has not been any significant sell-off in initial reaction to the data. December gold futures last traded at $1,932.80 an ounce, down 0.12% on the day. Read More

Gold shopping spree continues for Poland, Czechia and India, Uzbekistan also buys in August

Central bank gold demand continues to dominate the precious metal markets and, according to many analysts, it is one of the biggest factors supporting prices in the complex environment of rising bond yields and robust strength in the U.S. dollar.

Preliminary data from the World Gold Council indicates robust central bank demand through the third quarter as Poland, India, Uzbekistan and the Czech Republic all increased their gold reserves last month.

Krishan Gopaul, senior market analyst for the WGC, said in comments published on social media that preliminary data from the National Bank of Poland shows the country bought around 18 tonnes of gold in August.

"This lifts YTD net buying to ~88 tonnes, and total gold reserves to ~317 tonnes. We'll confirm the exact figure once reported via the IMF," he said in the post. Read More

Gold, silver weaker after U.S. CPI suggests still-hawkish Fed

Gold and silver prices are modestly down in midday U.S. trading Wednesday. Although prices showed little reaction to a major U.S. inflation report that contained no big surprises, the data did fall into the camp of the U.S. monetary policy hawks. That's a negative for the metals markets. December gold was last down $3.60 at $1,931.50 and December silver was down $0.277 at $23.125.

Today's U.S. data point of the week saw the consumer price index report for August come in at up 3.7%, year-on-year, with the core CPI up 4.3% in the same period. The CPI was expected to be up 3.6%, year-on-year, versus a 3.2% rise in the July report. The core reading in July was up 4.7%. The metals and the general marketplace showed little reaction to the numbers.

Said Nigel Green of the deVere Group right after the CPI report: “The Federal Reserve will hold interest rates steady in September, before hiking them again next time. Inflation heated up again last month in the world's largest economy, driven mainly by rising oil costs. This latest U.S. CPI data is unlikely to move the needle on the Fed's highly anticipated move to hold rates steady at their meeting next week, which has already been priced-in by financial markets." He added, “But the uptick in inflation gives the U.S. central bank extra reason to be hawkish moving forward. As such, we also expect the Fed will start to prepare the market for a rate increase at its November meeting."

Technically, the gold futures bears have the overall near-term technical advantage. Bulls' next upside price objective is to produce a close in December futures above solid resistance at the September high of $1,980.20. Bears' next near-term downside price objective is pushing futures prices below solid technical support at the August low of $1,913.60. First resistance is seen at Tuesday's high of $1,947.50 and then at this week's high of $1,954.60. First support is seen at $1,925.00 and then at $1,913.60. Wyckoff's Market Rating: 3.0.

Image Source: Kitco News

The silver bears have the overall near-term technical advantage. A bearish pennant pattern has formed on the daily bar chart. Silver bulls' next upside price objective is closing December futures prices above solid technical resistance at last week's high of $24.655. The next downside price objective for the bears is closing prices below solid support at the August low of $22.585. First resistance is seen at this week's high of $23.515 and then at $24.00. Next support is seen at $23.00 and then at $22.585. Wyckoff's Market Rating: 3.5. Read More

Image Source: Kitco News

CPI report reveals a 0.6% rise in inflation taking yields and the dollar higher

The CPI (Consumer Price Index) was released this morning, and predictions that headline inflation had risen by 0.6% last month forecasted by economists polled at the Wall Street Journal were spot on. Last month inflation had its largest month-over-month gain this year. However, economists polled by the WSJ slightly underestimated the rise in the core CPI which was predicted to increase by 0.2% and came in hotter with a rise of 0.3%.

According to the BLS (Bureau of Labor Statistics), “The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.6 percent in August on a seasonally adjusted basis, after increasing 0.2 percent in July, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all-items index increased 3.7 percent before seasonal adjustment”.

Inflation rose annually from 3.2% in July to 3.7% in August. This means that the Federal Reserve’s 2% target will unlikely be reached this year. But, according to the CME’s Fedwatch tool, traders’ expectations that the Fed will maintain its current terminal rate intact at the FOMC meeting next week increased from 92% yesterday to 97% today, and the probability of a continuation of the pause at the November FOMC meeting strengthening from 55.8% yesterday to a 58.4% probability today. Read More

New gold metric shows investors' holdings at their highest level since 2012 - JP Morgan

The record streak of central bank gold purchases that began in 2022 has also driven investors to allocate the largest percentage of their portfolios to the precious metal since 2012, according to a newly-developed metric unveiled in a recent report from analysts at JPMorgan.

“We had argued previously in our publication that, at the global level, investors’ allocation to commodities ex gold has shifted to significantly below neutral (i.e. below historical averages) over the past year,” the analysts said, and this prompted questions about what the equivalent allocation metric would be for gold allocations.

“To answer this question we introduce a new metric to proxy investors’ allocation to gold at a global level,” they said. “In particular, we focus on the portion of gold that is held for investment purposes by either central banks or private investors holding gold via coins, bars or physical gold ETFs (or similar products).” Read More

Gold, copper miners could pay 8% Federal royalties under new Biden mining proposal

The Biden administration is proposing a dramatic overhaul of a 151-year-old law that governs mining for gold, copper and other minerals on U.S.-owned lands, which would force companies to pay royalties to the Federal government on what they extract.

The final proposal, which was drafted by an interagency working group led by the Department of the Interior, also calls for the creation of a mine leasing system and the coordination of permitting among the various federal agencies.

Under the terms of the existing 1872 law, the U.S. government does not collect royalties on minerals extracted from federal lands. The new White House plan would impose a variable 4% to 8% net royalty on hardrock minerals extracted from federal lands.

The proposal comes amidst a push by the Biden administration to boost domestic production of minerals needed for electric vehicles, solar panels and other clean energy technologies. Read More

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.