Image Source: Unsplash

Silver Price News: Silver Playing With Key Support Zone Of $22.2

Silver closed last week with a bearish note, declining to $22.2 an ounce. In today’s early trading, this mood has been confirmed, with the spot price continuing to slide in the region of the $22 mark. The (modest) recovery of the greenback and the gains posted by the U.S treasury are pressuring the non-yielding assets, such as silver.

From a technical point of view, in the last 6 months, the price of silver has been posting declining tops and lows, an indicator of bearish trend. This mood has been confirmed in the last few days, when the price has been unable to surpass the resistance zone of $23.5, sliding to the current levels of $22.2.

We should note that the price is currently trading close to a key support zone of $22.2, and it is crucial for silver holding above these levels. Indeed, a hypothetical rebound from this support zone, would increase chances of seeing again the precious metal testing the resistance zone of $23.5-23.7. Read More

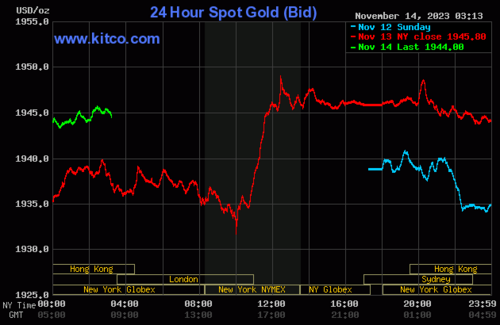

Gold Price News: Gold Remains Under Pressure After Losing Support Level Of $1,950

After the recovery seen in the final part of October, the gold price is continuing to ease slightly. This decline could be explained by a mix of factors. In particular, last week US Fed chair Powell’s remarks have been seen as relatively hawkish. Markets are still facing a strong U.S. Dollar, combined with the rebound of Treasury yields. In other words, rate cuts are still far away.

Moreover, as we pointed out in some recent comments, the recovery seen in the final part of October (from $1,820 to $2,000 an ounce) has been extremely quick and gold is retracing due to some apparent profit-taking.

From a technical perspective, the breakdown of the support zone of $1,950 represented a weakness signal, confirming the bearish pressure of the last few days. The next key levels are placed at $1,920 and $1,900. Read More

Retail investors maintain bullish outlook on gold, but Wall Street analysts expect continued downtrend

Gold trended steadily downward this week after riding the Israel-Hamas geopolitical risk bid higher since early October. The precious metal has held above $1,930 per ounce, but hasn't come close to testing the psychological resistance level of $2,000 since last Friday as the Middle East conflict has remained contained amid ongoing ground operations.

The latest Kitco News Weekly Gold Survey sees retail investors maintaining a bullish bias for the coming week, while market analysts have turned firmly bearish in their assessment of the yellow metal's near-term prospects.

John Weyer, Director of the Commercial Hedge Division at Walsh Trading, said gold's safe haven bid is waning.

"There was definitely a safe haven play going on with Gaza and Israel, and things seem to be stabilized there," he said. "Not necessarily good, but they're stable, not escalating. So we've probably given away some of that premium from the start of [the conflict]."

Weyer said Federal Reserve Chair Jerome Powell's remarks on Thursday that the central bank remains ready to raise rates also had an impact. "Those comments from the Fed Chair definitely played into it, that they may continue to raise rates, which went against some of the more recent data that we've received," he said. "I tend to think unless we get another headline to change that, we're going to have another slow drift down next week." Read More

Moody's turns negative on US credit rating, draws Washington ire

Moody's on Friday lowered its outlook on the U.S. credit rating to "negative" from "stable" citing large fiscal deficits and a decline in debt affordability, a move that drew immediate criticism from President Joe Biden's administration.

The move follows a rating downgrade of the sovereign by another ratings agency, Fitch, this year, which came after months of political brinkmanship around the U.S. debt ceiling.

Federal spending and political polarization have been a rising concern for investors, contributing to a sell-off that took U.S. government bond prices to their lowest levels in 16 years.

"It is hard to disagree with the rationale, with no reasonable expectation for fiscal consolidation any time soon," said Christopher Hodge, chief economist for the U.S. at Natixis. "Deficits will remain large ... and as interest costs take up a larger share of the budget, the debt burden will continue to grow."

The ratings agency said in a statement that "continued political polarization" in Congress raises the risk that lawmakers will not be able to reach consensus on a fiscal plan to slow the decline in debt affordability." Read More

Gold unlikely to gain from looming U.S. government shutdown, rally likely to come only afterward

As the United States faces the threat of a federal government shutdown for the second time in two months beginning Nov. 17, investors may be tempted to flee to gold as a safe haven asset. But the yellow metal’s track record in the run-up to other potential shutdowns, and its performance even when shutdowns actually occur, should give them pause.

First, the ostensible case in favor of gold: There’s no question that a partial shutdown of government services and spending is negative for the overall economy. If federal government employees are furloughed or laid off, it will certainly hurt consumer spending just as the country enters holiday shopping season, with Black Friday on Nov. 24 and Cyber Monday on Nov. 27. This worsening of the employment situation and weakening of the spending outlook ought to be supportive of gold prices. Read More

Analysts optimistic for solid gold demand during record Diwali celebrations

Record crowds during India’s most important celebration on Sunday could potentially be positive news for the gold market.

Sunday, millions of people in India and around the world celebrated Diwali, the Hindu festival of light. The five-day festival is an important event for the global gold market as India is one of the world’s top gold-consuming nations and the precious metal is often given as a gift during the holidays.

Even before the record turnouts throughout India, analysts were expecting this year’s celebration to have a solid impact on gold demand.

Harshal Barot, senior research consultant at Metals Focus, said that demand has been volatile through most of the year; however, lower prices at the start of the month created some optimism. “

“It has indeed been busy ahead of Diwali, with our contacts suggesting good sales momentum in early October when the price corrected. That said, the increased volatility since then has negatively impacted sentiment. Given the festive season is still underway and the wedding season follows, it is early to comment on y/y growth. The recent cooling off in the gold price just ahead of Dhanteras (November 10) may bode well for demand,” said Barot. Read More

Gold gains on short covering, bargain hunting

Gold prices are moderately higher near midday Monday, on some short covering by the shorter-term futures traders and some perceived bargain hunting after recent selling pressure. Gold and silver prices overnight hit four-week lows. December gold was last up $7.00 at $1,944.70. December silver was last down $0.061 at $22.215.

U.S. stock indexes are slightly lower so far today. Risk appetite has been slowly creeping back into the general marketplace recently, as there has been no major military escalation in the Israel-Hamas war, at least from the markets’ point of view. That’s been a bearish weight on the safe-haven gold and silver markets for the past couple weeks.

Technically, December gold futures prices hit a four-week low early on today. The bulls and bears are on a level overall near-term technical playing field, but prices are starting to trend down. Bulls’ next upside price objective is to produce a close above solid resistance at $2,000.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,900.00. First resistance is seen at $1,950.00 and then at $1,965.00. First support is seen at today’s low of $1,935.60 and then at $1,925.00. Wyckoff's Market Rating: 5.0.

Image Source: Kitco News

December silver futures prices hit a four-week low today. The silver bears have the overall near-term technical advantage. Prices are trending lower on the daily bar chart. Silver bulls' next upside price objective is closing prices above solid technical resistance at the October high of $23.88. The next downside price objective for the bears is closing prices below solid support at the October low of $20.85. First resistance is seen at $22.50 and then at $22.80. Next support is seen at today’s low of $21.925 and then at $21.50. Wyckoff's Market Rating: 3.5. Read More

Image Source: Kitco News

Live From The Vault: Episode 148

Dollar doesn't work, but gold has everlasting value. Feat. Dr Stephen Leeb

In this week’s episode of Live from the Vault, Andrew Maguire is joined by Dr Stephen Leeb, money manager and writer of the Intel for Investors newsletter, to discuss the acronym he coined: ICAG, and the expansion of BRICS.

The precious metals experts discuss gold’s role on a spiritual level as well as its place in current and future global monetary systems, before taking a closer look at the US dollar-based financial model, explaining why it no longer works.

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.