Image Source: Unsplash

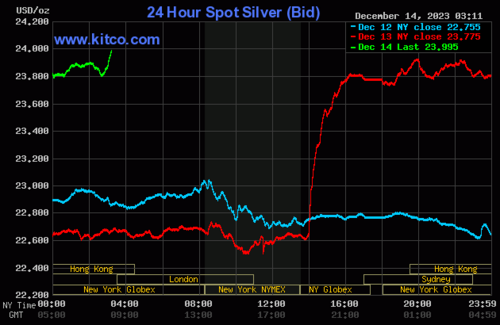

Silver Price News: Silver Falls To One-Month Low Ahead of Interest Rate Decisions

Silver prices edged further down on Tuesday, as the markets continued to mull the implications of economic data from the US for signals on central bank monetary policy.

Prices dipped to as low as $22.70 an ounce on Tuesday, compared with a high of $23.09 an ounce on Monday. That was the lowest silver price since November 14th.

US inflation figures for November came in broadly in line with market expectations on Tuesday, showing that US consumer prices edged 0.1% higher against October levels. The inflation figures are closely watched because of their implications for interest rate decisions.

The US Fed is widely expected to maintain interest rates at 5.5% in a decision set for Wednesday, while on Thursday the ECB and Bank of England are expected to hold rates unchanged at 4.5% and 5.25% respectively. Potentially of more significance will be any signals on possible rate cuts in 2024, which could create a supportive element for gold and silver prices. Read More

Gold Price News: Gold Nudges Higher as Markets Watch Central Banks

Gold prices firmed slightly on Tuesday, showing signs of stability after a decidedly bearish start to the week.

Prices moved in a range of $1,983 to $1,997 an ounce through the day, after falling as low as $1,976 an ounce on Monday.

Looking ahead this week, the US Fed is widely expected to maintain interest rates at the current 22-year high of 5.5% in a decision scheduled for Wednesday, with the markets looking for further clues on the outlook ahead of the Fed’s next meetings in December, January and March.

Data from interest rate traders currently indicates a 54% probability that the central bank will hold rates unchanged at its March meeting, and a 44% chance of a 25-basis point cut. It should be cautioned that these implied probabilities fluctuate on a day-to-day basis as the trading environment evolves. Interest rates matter for gold prices because they affect the opportunity cost of holding non-interest-bearing assets. Read More

Gold prices holding around $2,000 an ounce as U.S. PPI remains unchanged in November

The gold market is trying to hold support above $2,000 an ounce as producer inflation pressures cools slightly more than expected in November.

Wednesday, the U.S. Labor Department said its Producer Price Index (PPI) was unchanged last month following October’s revised increase of 0.4%. According to consensus forecasts, the data was significantly in line with expectations.

In the last 12 months producer inflation rose 0.9%.

However. Core PPI, which strips out volatile food and energy costs, was also unchanged in November. The data was weaker than expected as economists forecasted a 0.2% increase. Read More

Gold to outperform silver and platinum as weak growth forces the Fed to cut rates in 2024 - Heraeus

Gold is expected to be the best-performing asset in the precious metals sector in 2024 as the world faces a potential recession, forcing investors to look for safe-haven assets, according to a European precious metals firm.

Commodity analysts at Heraeus Precious Metals released their 2024 outlook, and they see gold trading in a range between $1,880 and $2,250 an ounce in the new year as a slowing economy forces the Federal Reserve to cut interest rates.

The analysts noted that gold has held up relatively well as the Federal Reserve has aggressively raised interest rates, providing solid support for the U.S. dollar and pushing bond yields to multi-year highs.

"The fact that non-yielding bullion has performed this well despite what have historically been strong headwinds could provide a set-up for new all-time highs in 2024 as the case for the loosening of monetary policy builds," the analysts said in the report. Read More

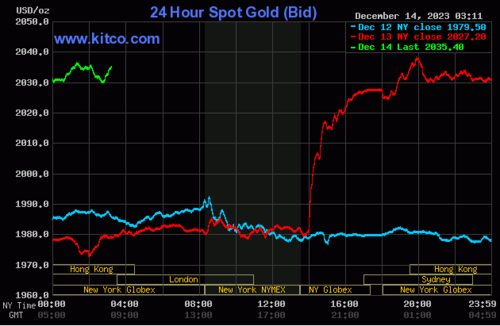

FOMC statement leans dovish, gold price rallies

Gold and silver prices are solidly higher and hit new daily highs in the aftermath of the Fed's FOMC meeting conclusion. The FOMC statement was surprisingly dovish on U.S. monetary policy, which pushed the precious metals markets sharply up. February gold was last up $26.60 at $2,020.10. March silver was last up $0.434 at $23.425.

On the front burner of the marketplace is the just-concluded two-day Federal Open Market Committee (FOMC) monetary policy meeting of the Federal Reserve. The FOMC statement said U.S. economic growth has moderated, but inflation remains elevated. Most FOMC officials now see rate cuts coming in 2024. 2025 and 2026. The marketplace is reading the FOMC statement as being surprisingly dovish on U.S. monetary policy. Now the marketplace awaits the press conference from Fed Chairman Jerome Powell. It's still expected Powell may lean at least a bit hawkish by saying the inflation fight is not yet finished.

This week's U.S. inflation data in the form of the consumer price and producer price indexes for November came in close to market expectations and suggest U.S. inflation continues to cool. The data somewhat assuaged the marketplace, at least for the moment, as the U.S. stock indexes this week hit new for-the-move highs amid a seasonal Santa Claus rally.

Technically, February gold futures prices hit a three-week early on low today. The bulls have the overall near-term technical advantage but regained some momentum today. Prices are in a two-month-old uptrend on the daily bar chart. Bulls' next upside price objective is to produce a close above solid resistance at $2,050.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at the November low of $1,955.40. First resistance is seen at this week's high of $2,023.70 and then at the October high of $2,039.70. First support is seen at $2,000.00 and then at today's low of $1,987.90. Wyckoff's Market Rating: 6.0.

Image Source: Kitco News

March silver futures prices hit a three-week low early on today. The silver bears have the slight overall near-term technical advantage. Prices are now trending down on the daily bar chart. Silver bulls' next upside price objective is closing prices above solid technical resistance at $24.50. The next downside price objective for the bears is closing prices below solid support at the October low of $21.17. First resistance is seen at $23.75 and then at $24.00. Next support is seen at $23.00 and then at today's low of $22.785. Wyckoff's Market Rating: 4.5. Read More

Image Source: Kitco News

Gold has one big advantage over Bitcoin - Sandstorm Gold's Nolan Watson

Central bank buying will favor gold over Bitcoin, said Nolan Watson, president and CEO of Sandstorm Gold.

On Thursday, Watson spoke to Kitco.

Looking at the gold market, Watson said the metal is benefiting, but the miners are not.

"Central banks and governments around the world are buying gold, but they're not buying gold equities," noted Watson, which is resulting in higher metal prices but not necessarily higher stock prices for the miners.

To track what's happening in the gold space, pay attention to gold ETFs, said Watson. He said that there's been net liquidation out of gold ETFs over the last 18 months due to institutional investors selling because of the high interest rate environment.

"That is about to reverse. If you actually look at the trend of net liquidation of gold ETFs it's getting smaller and smaller every month," said Watson, who expects the trend to change in the next month or two.

Gold prices hit an all-time high in early December, but cryptocurrencies have had their own run, with Bitcoin doubling off lows at the start of the year. Watson said that gold has nothing to fear from Bitcoin. Read More

Gold prices up more than 1% on the day above $2,000 as the Fed signals rate cuts are coming in 2024

The gold market is pushing back above $2,000 as the Federal Reserve looks to loosen monetary policy in 2024 as the economy and inflation ease.

As expected, the Federal Reserve kept interest rates within a range between 5.25% and 5.50%. However, the central bank highlighted slowing growth and easing inflation, a slight shift in its previous narrative.

"Recent indicators suggest that growth of economic activity has slowed from its strong pace in the third quarter. Job gains have moderated since earlier in the year but remain strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated," the central bank said in its monetary policy statement.

Along with its more neutral outlook, the Federal Reserve also signaled that it expects to cut interest rates more than it anticipated in the summer.

The latest economic projections, also known as the "dot plot," indicate that the central bank sees the Federal Funds rate at 4.6% by the end of 2024, down from September's forecast of 5.1%. Read More

Fed pivot toward interest rate cuts in 2024 and gold’s bullish response

The Federal Reserve concluded its last FOMC meeting of the year, and as expected, they kept their benchmark interest rate unchanged. They also released an updated economic forecast in its Summary of Economic Projections (SEP). The most current projections indicate that central bank officials almost unanimously are anticipating interest rate cuts to begin next year, with the expectations of a ¾% cut taking Fed funds rates to approximately 4.6%.

Seventeen voting members are all predicting interest rate cuts next year, with five officials projecting a decrease of ¾%, five officials anticipating a larger rate cut than ¾%, and the remaining two voting members anticipating no rate cuts next year. According to their economic projections, the Fed believes core inflation will peak at 2.4% next year, which is lower than its projections in September of 2.6%.

The Federal Reserve is also projecting inflation will cool to 2.2% in 2025 and 2.0% in 2026. Their projections anticipate unemployment rising to 4.1% in 2024 and remaining at that level through 2026. The Fed also anticipates an economic deceleration forecasting growth at 1.4% next year, and rising to 1.8% in 2025 and 1.9% in 2026

Gold futures basis the most active February 2024 contract is up 2.36%, a net gain of $46.90 taking current futures pricing to $2041.80. Read More

Live From The Vault - Episode: 152

2024 pivotal for precious metals Feat. Craig Hemke

In this week’s episode of Live from the Vault, Andrew Maguire is joined by Craig Hemke the editor and publisher of the TFMetals report. The precious metals experts and educators reflect on their time in the industry before looking forward.

The old friends and whistleblowers agree that there’s a lack of confidence and education in the system, and speculate that gold would climb even higher if every investor chose to take delivery of just one ounce.

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.