Image Source: Unsplash

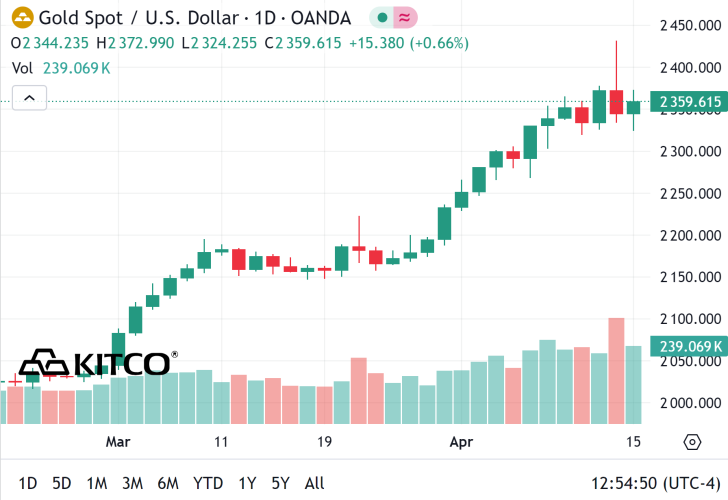

Gold Price News: Gold Tops $2,400 An Ounce Mark

Gold prices had another go at the upside on Friday, setting a new all-time high of $2,431 an ounce before falling back sharply later in the session.

Gold garnered all the attention last week, seemingly ignoring the latest round of bearish macroeconomic pointers, with the bulls apparently firmly in control.

Prices fell back later in the day Friday to around $2,360 an ounce in late deals, compared with $2,375 an ounce on Thursday.

Various theories were in circulation in the latter half of the week regarding gold’s sudden surge higher, from technical factors, to Chinese demand, to wider structural themes around central bank buying and concerns over persistent inflation reducing the purchasing power of fiat currencies.

Recent data have pointed to outflows in gold-backed ETFs, suggesting that the current bout of increased buying is coming from the physical markets. Read More

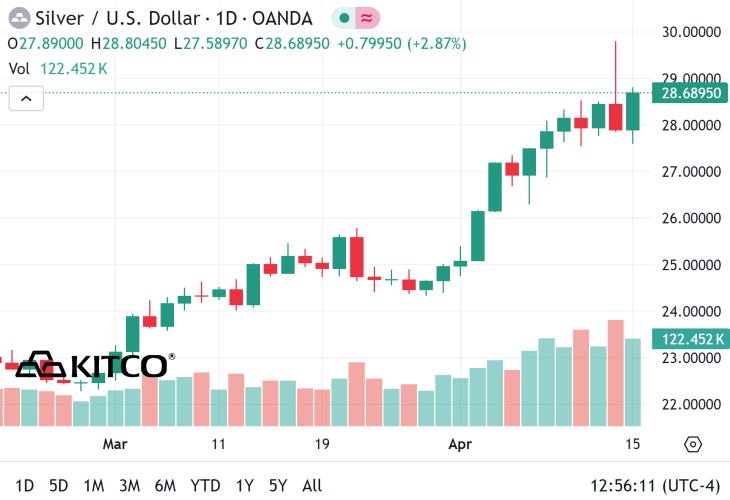

Silver Price News: Silver Hits 11-Year High As Gold Soars

Silver prices jumped to over $29.80 an ounce on Friday, their highest price for 11 years.

Prices rallied to a high of $29.84 an ounce – the highest price for silver since February 2013 – although prices fell back later to trade at just above $28.00 an ounce.

The latest gains for silver came as gold prices continued their recent rally to hit an all-time high of $2,431 an ounce on Friday.

The precious metals complex has been pushed higher by investment flows into safe-haven assets amid heightened geopolitical tensions around the world, and this has overshadowed the bearish influence of what now seem to be fading chances of interest rate cuts by major central banks this summer.

On the demand side, attention last week switched to India – the world’s largest consumer of silver. India’s silver imports surged to a record 2,295 metric tons in February, compared with 637 mt in January, the Economic Times of India reported last week.

This was reportedly due to lower duties, which encouraged large purchases from the United Arab Emirates. Market sources were quoted as saying this was due to Indian industrials re-building stocks of silver, having depleted them in 2023. Read More

Any U.S. attempt to restrain gold price would backfire – Jeffries’ Christopher Wood

The U.S. government may be tempted to restrain gold prices, but this would only serve to drive bullion higher, according to the latest GREED & fear report from Christopher Wood, Global Head of Equity Strategy at Jeffries.

Wood wrote that there is an “obvious temptation on the part of a major central bank to seek to try to manage the gold price,” and shared an anomalous move in Comex gold futures as an example of how this kind of management might appear.

“At 3pm New York time last Thursday there was a US$1.6bn sale of gold futures in about three minutes which temporarily knocked the bullion spot price,” he pointed out, and while he has no idea who was behind it, he noted that “a soaring gold price is not in the interest of the relevant authorities any more than a surging oil price is.” Read More

Gold bulls back on some notions Israel-Iran conflict de-escalates

Gold prices are a bit weaker in midday U.S. trading Monday, while silver prices are higher. While the general marketplace remains uneasy amid still-heightened geopolitics, especially in the Middle East, there are some ideas the Israel-Iran confrontation will not escalate. Such has squelched some of the safe-haven buying interest in gold. Rising U.S. Treasury yields to start the trading week are also negative for gold and silver. June gold was last down $9.10 at $2,365.00. May silver was last up $0.33 at $28.65.

It was a tense weekend after Iran and its allies coordinated a massive air strike on Israel. However, judging by what the markets are doing Monday, some of the marketplace reckons the weekend outcome could have been much worse and that the Iran-Israel confrontation could de-escalate now. That may be wishful thinking, however.

Technically, June gold futures prices Friday hit a contract and record high. The bulls have the strong overall near-term technical advantage. A two-month-old uptrend is in place on the daily bar chart. Bulls’ next upside price objective is to produce a close above solid resistance at $2,500.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $2,300.00. First resistance is seen at the today’s high of $2,389.60 and then at $2,400.00. First support is seen at today’s low of $2,340.20 and then at last week’s low of $2,321.70. Wyckoff's Market Rating: 8.5.

Image Source: Kitco News

May silver futures prices Friday hit a nearly three-year high. The silver bulls have the strong overall near-term technical advantage. A two-month-old price uptrend is in place on the daily bar chart. Silver bulls' next upside price objective is closing prices above solid technical resistance at $30.00. The next downside price objective for the bears is closing prices below solid support at $26.00. First resistance is seen at $27.00 and then at $27.50. Next support is seen at $28.00 and then at $27.50. Wyckoff's Market Rating: 8.5. Read More

Image Source: Kitco News

The silver market is undersupplied, which will drive prices above $30 - ANZ

Volatility has picked up in the precious metals market, but one new trend is emerging as the silver market wakes up and starts to outperform gold.

In a report published Monday, commodity analysts at ANZ said that silver still has significant potential, even after hitting solid resistance at $29.90 on Friday.

The gold market is starting the week with some consolidation after it was unable to hold gains above $2,400 an ounce. June gold futures last traded at $2,375 an ounce, roughly flat on the day. However, silver continues to be the metal to watch as it currently trades at $28.70 an ounce, up more than 1.% on the day.

The gold/silver ratio also continued to fall sharply, dropping to 82 points, its lowest level since early December.

“We expect gold to trade near USD2,500/oz and silver to move above USD31/oz by the end of 2024. We expect the gold-silver ratio to normalize to 80x by year-end 2024 after hitting a high of 91x in February 2024,” Senior Commodity Strategist Daniel Hynes and his team at the Australian bank wrote Monday. “We lift our gold and silver price forecasts’ trajectory through 2024 and 2025 as key market drivers – easing rate cuts and a weaker dollar– are yet to materialize.” Read More

Gold prices may have peaked for 2024 - Capital Economics

Gold’s volatile push above $2,400 last week could represent the precious metal’s high water mark for the year as markets adjust to expectations that the Federal Reserve will maintain its aggressive monetary policy longer than expected, according to one research firm.

Caroline Bain, Chief Commodity Economist at Capital Economics, said in a report published Friday that although she is bullish on gold for this year, the price has run well beyond expectations, and she expects prices to fall back to earth by the end of the year.

“The 16.5% surge in the gold price since the start of the year appears increasingly out of kilter with the interest rate outlook,” Bain said in her latest research note. “Indeed, the strong US employment report last Friday and Wednesday’s March CPI print, which arguably suggested rates could be higher for longer, coincided with rises in the gold price, while Treasury yields and the US dollar also rose.”

Bain said she is maintaining her year-end gold price target of $2,100 an ounce. At the same time, she sees silver prices ending the year at around $26 an ounce. Read More

Live From The Vault - Episode: 168

BRICS driving gold & silver breakout? Feat. Dave Kranzler

In this week’s episode of Live from the Vault, Andrew Maguire is joined once more by Dave Kranzler, publisher of the popular Mining Stock Journal, to analyse the drivers behind the current physically-driven gold and silver bull run.

The precious metals experts take listeners through the current drivers of short-term market movements, including the possibility of unforeseen black swan events and the now beta-tested BRICS currency.

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.