Image Source: Unsplash

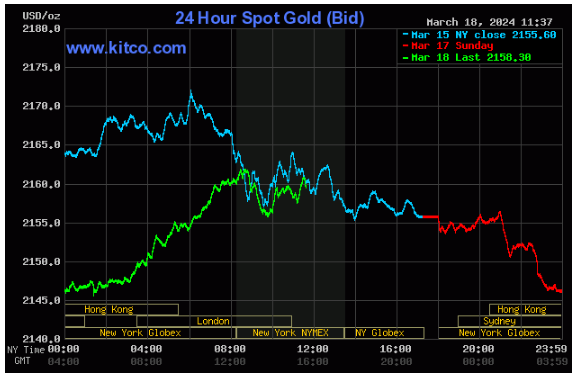

Gold Price News: Gold Edges Lower in Subdued Trading

Gold prices nudged a few cents lower on Friday in rather subdued conditions, with little to provide renewed momentum in either direction.

Prices ticked lower to $2,156 an ounce in late trades on Friday, compared with around $2,162 an ounce on Thursday.

The relative stability through the week followed a volatile period in the first half of March, which saw gold prices notch up all-time highs of around $2,195 an ounce.

The market appeared to be taking a breather, and despite the slight pullback through the week, gold managed to hold most of the gains made in the first two weeks of the month.

Prices showed little reaction to Friday’s Michigan consumer sentiment preliminary figures for March, which edged down to a three-month low of 76.5, compared with expectations of 76.9. Read More

Silver Price News: Silver Ends Week in Bullish Mood

Silver prices put in another strong performance on Friday to cap a bullish week for the precious metal.

Prices moved as high as $25.46 an ounce during the day, before pulling back to around $25.20 an ounce later in the day. That compared with $24.84 an ounce in late deals on Thursday.

Friday’s gains capped a strong week for silver overall, and the price of nearly $25.50 compares with $24.34 in the week ending March 8 and as low as $22.58 on March 1.

Silver’s recent strength has mostly come from gold, which stole the limelight in the first half of March, with prices culminating in all-time highs of around $2,195 an ounce. Both metals have benefited from a weakening of the US dollar against other major currencies over the same period.

Looking at the one-year price chart, silver has spiked several times at a similar trajectory to the most recent gains, only to fall back on profit-taking. Any downside movements, though, have attracted solid support at around the $22.00 an ounce mark since November last year, suggesting plenty of willing buyers at those levels. Read More

The gold market has gotten ahead of anticipated Fed easing cycle - Barclays

The gold market has gotten ahead of itself and is due for a further correction after a relatively quiet week following its breakout to record highs, according to one major British Bank.

While off of last week's high above $2,200 an ounce, gold prices have rallied more than 5% this month. In recent comments, Stefano Pascale, Equity Derivatives Strategist at Barclays, said that gold’s surging bullish momentum is being driven in part by expectations that the Federal Reserve will begin its new easing cycle in June.

He added that gold’s nine-day rally this month is one of the longest bullish streaks for precious metals on record. However, he said that there could be limited upside for gold in the near term. Read More

Gold a bit firmer; quiet ahead of FOMC meeting Tues.-Wed.

Gold prices are slightly higher and silver slightly lower in midday U.S. trading Monday. The marketplace is quieter to start the trading week, just ahead of major central bank activity this week. April gold was last up $2.50 at $2,164.00. May silver was last down $0.066 at $25.32.

The U.S. data point of the week will be the Federal Open Market Committee (FOMC) monetary policy meeting that begins Tuesday morning and ends Wednesday afternoon with a statement and press conference from Fed Chairman Jerome Powell. No change in policy is expected, but as always, the marketplace will parse the statement and Powell’s presser for clues on the future path and timing of monetary policy.

Technically, April gold futures bulls still have the solid overall near-term technical advantage. A four-week-old uptrend is in place on the daily bar chart. A bullish pennant pattern has formed on the daily bar chart. Bulls’ next upside price objective is to produce a close above solid resistance at the contract high of $2,203.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $2,100.00. First resistance is seen at today’s high of $2,167.20 and then at Friday’s high of $2,176.90. First support is seen at today’s low of $2,149.20 and then at $2.140.00. Wyckoff's Market Rating: 8.0.

Image Source: Kitco News

May silver futures prices hit a three-month-high Friday. The silver bulls have the firm overall near-term technical advantage. Silver bulls' next upside price objective is closing prices above solid technical resistance at the December high of $26.575. The next downside price objective for the bears is closing prices below solid support at $24.00. First resistance is seen at last week’s high of $25.66 and then at $26.00. Next support is seen at $25.00 and then at $24.50. Wyckoff's Market Rating: 7.0. Read More

Image Source: Kitco News

Gold still has room to rally as hedge funds’ bullish bets hit a two-year high

According to many analysts, there is still plenty of value left in the gold market, even as the latest trade data shows speculative bullish positioning reached a two-year high after hedge funds went on an unprecedented buying spree.

The Commodity Futures Trading Commission’s disaggregated Commitments of Traders report showed money managers increased their speculative gross long positions in Comex gold futures by 28,888 contracts to 1,73,994 for the week ending March 12. At the same time, short positions fell by 2,432 contracts to 32,911.

The gold market is currently net long 141,083 contracts, its highest level since early March 2022. During the survey period, gold prices surged to an all-time high just above $2,200 an ounce. Read More

Gold demand should dip as summer approaches, while silver prices could play catch-up - Heraeus

Demand for gold is likely to ease with the approach of summer, while silver prices may be poised to play catch-up, according to the latest precious metals report from strategists at Heraeus.

“Following the typically strong gold-buying season in the first two months of the year in China due to Lunar New Year demand,” the month of March and Q2 tends to see lower consumer demand, the analysts wrote in the report.

“Over the last 10 years, Chinese consumer gold demand in Q2 has declined by an average of 21% quarter-on-quarter,” they said. “Implied demand was particularly strong to start the year, indicated by 10-year highs in Chinese gold imports from Hong Kong. This may suggest that with no notable events likely to boost demand in Q2 ’24, a quarter-on-quarter drop could be larger – particularly if new record gold prices begin to crimp appetite for bullion.” Read More

Gold price forecast looks bearish, dragged by fundamental risks, technical indicators - FX Leaders’ Butt

Gold prices look set to continue their recent retracement as the technical and fundamental picture worsens, according to Arslan Butt, Lead Commodities and Indices Analyst at FX Leaders.

Butt said the near-term price forecast for spot gold looks weak as the precious metal is seeing its third consecutive down day, hitting a one-week low of $2,050 per ounce during Monday’s Asian trading session.

“This decline is attributed to the robust inflation figures emanating from the United States last week, which have fueled expectations that the Federal Reserve will maintain a stance of prolonged high-interest rates,” he wrote. “Consequently, this scenario has bolstered US Treasury bond yields, providing a boost to the US Dollar (USD) and placing pressure on non-yielding gold.”

Despite this, Butt said the market is still anticipating rate cuts from the Federal Reserve as early as June. Read More

Live From The Vault - Episode: 164

Gold & Silver supply shortage imminent? Feat. Rob Kientz

In this week’s episode of Live from the Vault, Andrew Maguire is joined once more by Rob Kientz of GoldSilverPros, who reveals the trade secrets he just picked up at a major industry event in Canada.

The precious metals experts discuss how a gold and silver supply shortage may coincide with an economic downturn, and how investors can prepare for coming challenges by switching to sound money.

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.