Image Source: Unsplash

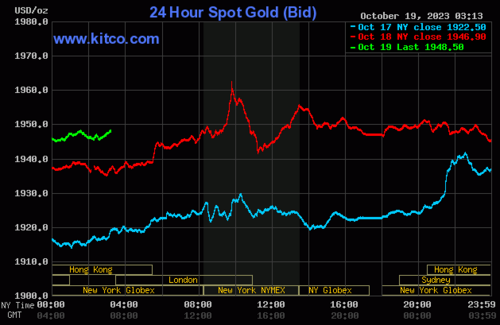

Gold Price News – Gold weathers rate surge on safe asset bid

Gold continued to extend gains after Monday’s profit-taking, pushing through $1,924 per ounce, despite renewed headwinds from the US interest rate outlook.

Tuesday saw a raft of US economic data, with retail sales, manufacturing and industrial production, and capacity utilisation for September, all coming in higher than expected. With further evidence of US economic resilience, interest rates have continued to track higher, creating headwinds for non-yielding assets, such as gold.

While the market awaits further clarity on the rate outlook from a speech by Federal Reserve Chair Powell on Thursday, gains for the US Dollar – and the dampening impact on gold prices – have been marginal as this is already considered a very ‘crowded trade’ within FX markets.

Recent gold investment flows appear somewhat mixed. Read More

Silver Price News – Silver gains supported by ‘soft landing’ bet

Silver continued to make headway, with a move to $23 per ounce taking the price to levels last seen at the end of September.

Like gold, silver is a non-yielding asset, so recent US data suggesting that US interest rates might remain higher for longer could be considered a headwind to price appreciation as higher rates increase the opportunity cost of holding zero yield assets.

However, Tuesday’s US data also signalled stronger retail sales, industrial production and manufacturing, all of which are broadly supportive of silver demand, c. 45-50% of which is derived from industrial applications.

Moreover, recent global economic data has also become more consistent with a ‘soft landing’ scenario, with a firming trend in Asia. The Eurozone remains a laggard, though economic data is now disappointing by a smaller margin. It also seems highly likely that the next move in Eurozone rates will be down. Read More

Gold prices should be well-supported through 2023, while PGMs could miss their Q4 rally - Heraeus

A pullback in bond yields and strong demand from India could boost gold prices in the fourth quarter, but platinum-group metals are unlikely to rebound before the new year, according to the latest precious metals report from Heraeus.

The analysts note that Fed speakers have been giving dovish signals, which has impacted rate expectations and has been supportive for gold. “The probability of a hike in November has fallen from 41% a month ago to 7.7% as of last week,” they noted. “US yields and the dollar softened immediately following these statements, suggesting that there may be no need for further increases to interest rates in light of the recent rally in yields across the curve, despite a higher-than-expected inflation reading for September. Two-year yields remain above 5% and the ten-year is holding above 4.5%. Once yields begin to fall, gold is expected to move higher.“

They also noted the decline in the rupee-denominated gold price, which the analysts believe could be a catalyst for higher demand in India during the upcoming festive season.

“The fourth quarter of the year tends to be the best for consumer gold demand in India,” they wrote. “Over the last decade, Q4 gold demand has averaged 243 tonnes, versus an average quarterly demand of 163 tonnes throughout the rest of the year (source: World Gold Council). Festivals and auspicious gold buying events such as Diwali (12 November 2023) tend to stimulate demand.” Read More

The monetary system today: 'Council of elders deciding the price of money' - Lyn Alden

With all eyes on the Federal Reserve and whether it will be forced to hike one more time this year due to high inflation numbers, Lyn Alden, Founder of Lyn Alden Investment Strategy, points to the opaque process of setting monetary policy and the 12 unelected individuals calling all the shots.

The Fed has a tremendous impact domestically and globally, but its policy is far from transparent or accountable, Alden told Michelle Makori, Lead Anchor and Editor-in-Chief at Kitco News, on the sidelines of the Pacific Bitcoin Festival.

"Interest rates and balance sheet size affect the price of money," Alden said. "And if you look in most markets, price controls are not historically effective. But in this current era, we have price controls for the price of money, or specifically the price of credit."

Instead of letting the market determine an appropriate price of credit, the central bank is in charge, Alden pointed out.

"Various parts of the interest rate pricing mechanism are heavily set by the centralized group. And it's literally 12 people that decide. It's seven members of the board of governors, and then it's a revolving set of other central bank heads," she said.

And none of them are elected, Alden added. "It's almost like a council of elders deciding this is the price of money today. And then, they divine the tea leaves, and every six weeks, everybody tunes in to see what color smoke's going to come out of the group of 12 people sitting around the table to decide." Read More

Off the record: silver looks better than gold in 2024 according to LBMA survey

Although the Federal Reserve is expected to maintain interest rates at restrictive levels through most of 2024, geopolitical uncertainty will continue to support gold prices in the next 12 months, according to sentiment during the London Bullion Market Association 2023 Global Precious Metals Conference.

According to the LBMA’s annual end-of-conference survey, conference participants said they expect gold to outperform within the precious metals market. However, anecdotal observation and comments during the conference show solid support for silver, with some analysts saying it is cheap compared to its fundamentals.

"Silver is a metal we need to keep an eye on," said Suki Cooper, precious metals analyst at Standard Chartered.

The LMBA conference survey shows that participants see silver prices trading around $26.80 an ounce by next year’s conference in Miami, Florida. The bullish outlook comes as silver is currently trading around $23 an ounce. Read More

The war in the Middle East intensifies because of a possible incursion by Hezbollah

Multiple haven assets react by gaining value in light of the current conflict

As of 5:00 PM EDT, the most active December 2023 contract of gold futures has gained $25.60 or 1.25% and is fixed at $1961.20. Gold’s gains occurred by overcoming dollar strength and still having a double-digit gain. Currently, the dollar is up 0.29%, which is a gain of 31 points, taking the dollar index to 106.355.

Spot gold is currently higher by $26.30 after factoring in dollar strength, which required subtracting $6.70. Without dollar strength, gold would have risen $33.00. Yields on U.S. Treasuries also had substantial gains in the 10, 20, and 30-year government bonds.

Current technical studies for gold indicate two important levels of resistance that gold must trade above on a closing basis if prices will at some point challenge and overtake $2000 per ounce. On Friday, September 1 gold traded to a high of $1980 the first level of resistance. Major resistance occurs at $2008 basis, the most active December futures contract. This major resistance level is based upon a top that occurred on Monday, July 31. Read More

Time to increase allocation to gold - JPMorgan's Kolanovic

Equity markets in the U.S. and around the world remain overvalued and geopolitical risks continue to intensify, making it a good time for investors to increase their allocation to gold, according to JPMorgan Chief Market Strategist Marko Kolanovic.

In the investment bank’s latest Global Markets Strategy report, Kolanovic noted that while markets are off their early October lows, the medium-term outlook remains negative with headwinds getting stronger and tailwinds weaker.

“Still-rich equity valuations face increasing risk from high real rates and cost of capital, while earnings expectations for next year appear overly optimistic,” he wrote. “Weakening PMI momentum suggests that Q3 earnings growth is likely to be negative, while softening corporate pricing could lead to a squeeze on margins.”

Kolanovic said he believes that most of the negative effects from high rates are still to come. “Delinquencies in consumer loans and corporate bankruptcies are starting to move higher, and this trend is likely to continue absent a cut in rates,” he wrote. “The flare up of geopolitical risks adds another headwind and increases tail risks for markets and economic activity. Our outlook is likely to remain cautious as long as interest rates remain deeply restrictive, valuations expensive, and the overhang of geopolitical risks persists.” Read More

Sharp gains for gold on better safe-haven bidding

Gold prices are solidly higher and hit a six-week high in midday U.S. trading Wednesday. Silver prices are slightly up and scored a three-week-high. Keener risk aversion in the marketplace as the Middle East violence is flaring up has traders and investors seeking out safe-haven assets like gold and silver. December gold was last up $26.70 at $1,962.40 and December silver was up $0.016 at $23.04.

Risk aversion has up-ticked at mid-week after a bombing at a hospital in Gaza has reportedly killed over 500 people. Hamas blamed an Israel air strike, while Israel blamed an errant Hamas missile. Reports said U.S. military intelligence says the explosion was caused by a Palestinian military group. Reads a Barrons headline today: “Rate fears, bond yields, war; market concern grows.”

Technically, December gold futures prices hit a six-week-high today. Recent price action suggests that a market bottom is in place. The bulls have gained the slight overall near-term technical advantage. A five-month-old price downtrend on the daily bar chart has been negated, and prices are now trending higher. Bulls' next upside price objective is to produce a close above solid resistance at $2,000.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,875.00. First resistance is seen at today's high of $1,975.80 and then at the August high of $1,980.20. First support is seen at $1,950.00 and then at today's low of $1,935.90. Wyckoff's Market Rating: 5.5.

Image Source: Kitco News

December silver futures prices hit a three-week high early on today. The silver bulls have the slight overall near-term technical advantage. A three-month-old downtrend is in place on the daily bar chart has been negated and prices are now trending up. Recent price action suggests a market bottom is in place. Silver bulls' next upside price objective is closing prices above solid technical resistance at $24.00. The next downside price objective for the bears is closing prices below solid support at $21.60. First resistance is seen at today's high of $23.49 and then at $23.80. Next support is seen at today's low of $22.84 and then at this week's low of $22.535. Wyckoff's Market Rating: 5.5. Read More

Image Source: Kitco News

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.