Image Source: Unsplash

Gold Price News: Gold Could Be Ready To Regain Its Safe Haven Role

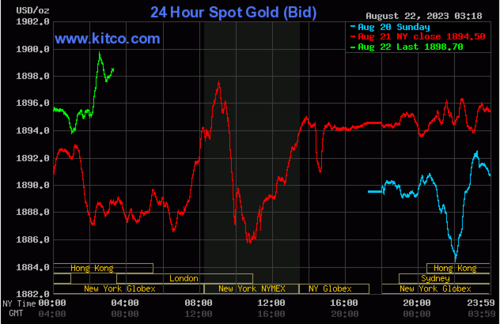

The gold spot price closed last week just below $1,890 per ounce. The early trading this morning has started without big movements, with gold holding above $60 per gram.

Overall the price has declined around 5% from its recent peak of $1,990 in mid-July. So far, the bullion price has not been able to rebound, remaining traded at its lowest level since March, as investors are still digesting the hawkish rhetoric used by the Federal Reserve at its last meeting.

Notably, several board members continue to view inflation as having upside risks. This interpretation implies an increased probability of one (or, less likely, two) additional rate hikes by the Fed.

While the economy continues to demonstrate resilience, inflation remains a primary concern. As such, the short-term outlook for gold is moderately bearish, with expectations of high rates for an extended period and the US dollar’s recovery on the currency market. These factors generally exert downward pressure on gold, although these impacts are likely already incorporated into the current price levels. Read More

Silver Price News: Silver Is Trying To Recover The $23 Mark

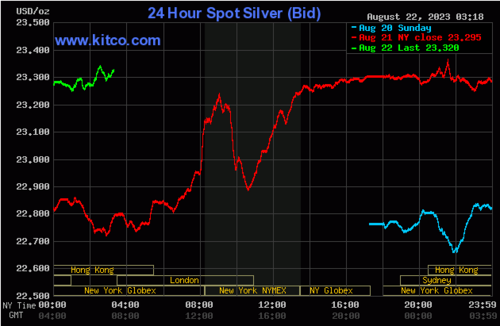

Silver closed last week showing interesting rebounding signals. Despite a challenging macroeconomic scenario – as investors are still fearing further Fed rate hikes – the silver found a solid support zone between $22 and $22.5 per ounce.

The price of the grey metal has declined almost 10% in the last four weeks, outpacing gold, which only lost around 3% in the same period. But we should note that in the last few days, selling pressure has been curbed by the resilience of buyers, with silver finally overperforming gold.

From a technical point of view, the price has yet to offer a clear bullish signal, even if the scenario is improving. A clear surpass of the peak reached last week in the region of $23.00 would open space for a continuation of the recent rebound.

Anticipating potential targets in such a scenario is a challenge. Silver, like gold, remains closely intertwined with the decisions made by the Federal Reserve. Continued rate hikes could impede silver’s recovery efforts, while any dovish indications from the Federal Open Market Committee (FOMC) could act as a bullish catalyst for the precious metals sector. Read More

Gold was confiscated in the 1930s, could your bank deposits face the same fate now? Hugh Hendry breaks down the probability it could really happen

With more cracks emerging in the banking sector, should U.S. citizens fear their bank deposits could be frozen? Could banks implement lock-in periods similar to hedge funds preventing withdrawals for a set amount of time? Here's the latest probability breakdown from Hugh Hendry, Founder of Eclectica Macro.

The rapid succession of rate hikes from the Federal Reserve might be over, but the household sector is yet to feel the damaging consequences, Hendry told Michelle Makori, Lead Anchor and Editor-in-Chief at Kitco News.

"The household sector … hasn't felt the shock," Hendry said. "The financial sector in America has trillions of dollars of debt that it lent to the household sector and to other economic agents at the wrong price. Those loans now trade at a great discount. That represents a loss in the financial sector. And it also represents a source of great anxiety. The economy needs credit like the human body needs oxygen." Read More

A dovish Powell could provide some relief next week for gold prices stuck at five-month lows

Growing worries that the Federal Reserve, in its bid to fight inflation, will keep interest rates aggressively elevated longer than expected is taking a significant toll on gold as prices end the week near a five-month low.

While there is still a lot of optimism that gold can regain its lustre by the end of the year, analysts are warning investors that a lot of near-term technical damage has been done, and the precious metal has room to move lower next week.

Analysts note that although economic uncertainty is fairly elevated as China's economy shows signs of stress, the precious metal is not seeing much investor interest as a safe-haven asset. Rising bond yields, which hit a 15-year high Thursday, have become significant competition for gold.

Some analysts noted that it has become more compelling to hold three-month U.S. Treasury bills with a 5% interest than gold.

"The U.S. economy is not going to collapse overnight, so you would be foolish not to invest in short-duration bonds," said Adrian Day, president of Adrian Day Asset Management. "But short-term Treasuries is just a parking spot. It is not a long-term investment." Read More

Gold slightly up as marketplace looks forward to Jackson Hole

Gold prices are slightly up and silver prices are solidly up in midday U.S. trading Monday, with gold poking to another five-month low in overnight trading. Short covering, corrective rebounds are featured in the two precious metals. However, rising U.S. Treasury yields to start the trading week and still-bearish charts are limiting the upside for gold and silver. Trading may be more subdued this week, ahead of the late-week annual Federal Reserve symposium held in Jackson Hole, Wyoming. This meeting usually produces some market-sensitive news from world central bankers’ comments, including Fed Chair Jerome Powell. Powell is scheduled to speak at the confab on Friday. December gold was last up $1.80 at $1,918.40 and September silver was up $0.442 at $23.175.

Technically, December gold futures were up $1.70 at $1,918.20 in midday trading and nearer the session low. Prices hit another five-month low today. Bears have the firm overall near-term technical advantage. Prices are in a four-week-old downtrend on the daily bar chart. Bulls’ next upside price objective is to produce a close above solid resistance at $1,980.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,900.00. First resistance is seen at today’s high of $1,927.90 and then at $1,938.20. First support is seen at today’s low of $1,913.60 and then at $1,900.00. Wyckoff's Market Rating: 3.0.

Image Source: Kitco News

September silver futures were up $0.437 at $23.17 at midday and nearer the session high. The silver bears have the overall near-term technical advantage. However, a four-week-old downtrend on the daily bar chart is now in jeopardy. Silver Bulls' next upside price objective is closing prices above solid technical resistance at $24.00. The next downside price objective for the bears is closing prices below solid support at $22.00. First resistance is seen at today’s high of $23.36 and then at $23.75. Next support is seen at today’s low of $22.71 and then at $22.50. Wyckoff's Market Rating: 4.0. Read More

Image Source: Kitco News

Gold bulls will need to stay patient for a little while longer - Acheron Insights

Fundamentals, positioning, sentiment, and technical analysis all point to a further delay in gold’s big move upward, according to Chris Yates of Acheron Insights.

“For the short to medium-term fundamentals that influence the gold price - primarily the likes of real yields and the dollar - the outlook is still somewhat mixed for gold, after what has been a terrific year for the sector,” Yates wrote. “While it seems increasingly likely real yields are nearing their peak for this cycle, and although they are not likely to return to negative territory in the immediate future (that is more likely a story for 2024), the headwind from real yields that has kept a lid on the gold price for the last two-plus years is reaching its crescendo.”

Yates said the fact that gold held up well despite “the biggest spike in real yields in decades” reaffirms his bullish long-term case. He said a rate cut before 2024 was “highly unlikely”, but pointed to gold’s historical positive performance once rate cuts begin. Read More

Gold price at $6k? This asset is more likely to triple - Hugh Hendry

It is essential to have exposure to real assets in this uncertain macro environment, according to Hugh Hendry, Founder of Eclectica Macro. But Hendry still prefers to hold four times more Bitcoin than gold, and here's why.

From real assets Hendry's top pick is gold. "I would have 5% of my portfolio [in gold]," Hendry told Michelle Makori, Lead Anchor and Editor-in-Chief at Kitco News. "Why gold? Because for the last 12 years, gold has kept hitting this $2,000. It feels like there's a price barrier, and a lot of people want to own gold, but there's not enough economic stimulus or data to sponsor a consistently higher gold price."

In the months and years ahead, gold will move above this $2,000 an ounce resistance, which is when Hendry will start increasing his 5% position.

"When it gets to $2,000, it fades, and it falls away. But one of these days, maybe, it is going to go $2,100, $2,200, $2,300," he said. "When it breaks the barrier to the upside, I'm buying it." Read More

Live From The Vault - Episode: 136

“This is going to be worse than the Great Depression” Feat. Rob Kientz

In this week’s episode of Live from the Vault, Andrew Maguire is joined by Rob Kientz of GoldSilverPros.com to evaluate the immediacy of another major US banking crisis and the ricochet effect this could have on people’s bank deposits.

The two precious metals experts examine whether spiralling debts - now in the trillions - are designed to break the system and usher in a ‘build back better’ financial period even darker than the great depression.

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.