Image Source: Unsplash

Silver Price News: Silver Needs a ‘Soft Landing’ Economy

Silver starts the week a touch below $23.4 per ounce, with some profit-taking after hours on a big Friday uptick. Still, silver gained more than 3.7% on the week to a one-month-high.

The most recent (17 October) CFTC Commitment of Traders report published late on Friday revealed that both retail and professional speculators have added a little to net long silver futures positions. However, positioning overall remains quite light, with large speculators thus far failing to engage to the same degree as recently as late August/early September. Silver funds have continued to show net outflows since July.

Like gold, the markets’ ongoing assessment of the risk environment will be the driver of silver pricing going forward. The economic data releases highlighted in today’s gold commentary are also pertinent, particularly inasmuch as both are zero-yielding assets facing interest rate headwinds.

However, silver is significantly exposed to industrial applications and economic growth prospects, so the following releases should also be on the silver traders’ radar: Read More

Gold Price News: Further Gold Gains are Data-Dependent

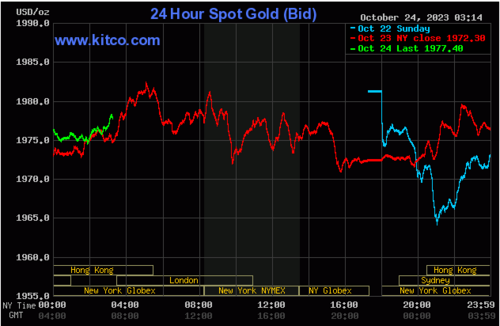

Gold heads into Monday having risen over 3% last week to a five-month high of almost $1,981 per ounce. Arguably, more supportive data is needed to push much closer to $2,000.

The most recent (17 October) CFTC Commitment of Traders report published late on Friday revealed that speculative money managers have flipped from a net short to a net long futures position, while other speculators have trimmed net longs.

Overall, net longs have recovered somewhat, but are barely over half the level seen in mid-July when gold prices were at similar levels, suggesting caution over further momentum. Gold funds continue to see net outflows since July.

Technical positioning aside, the markets’ ongoing assessment of the risk environment will be a key determinant of gold pricing going forward. Given difficulties in pricing (rising) geopolitical risk with any precision, this manifests itself as a ‘risk premium’ to safe-haven assets, such as gold. Read More

Gold price to see wild $100+ daily gains, Bitcoin rally to follow, if Middle East tensions escalate and spillover into 'unmitigated disaster' - Larry Lepard

Turmoil in the Middle East is keeping investors on edge, and gold is one of the first assets to react — rising above the critical psychological level of $2,000 an ounce and trading near 2.5-month highs on Friday.

It won’t be surprising to see gold witness daily gains of $100+ as the Israel-Hamas war escalates, Larry Lepard, Managing Partner and Founder of Equity Management Associates, told Michelle Makori, Lead Anchor and Editor-in-Chief at Kitco News.

"Gold has gone up a lot in a very short period of time," Lepard said Thursday. "And that’s a combination of the war and also sniffing out the underlying problem in the bond market. When geopolitical trouble arises, gold tends to smell it first." Read More

Gold, silver weaker as bulls take a pause

Gold and silver prices are a modestly down near midday Monday, on some routine corrective, consolidative pressure following recent gains. Some profit taking by the shorter-term futures traders is also featured. Gold hit a 3.5-month high and silver a four-week high last Friday. Bulls in both markets are still confident and are likely to step in to buy the dips at some point soon. December gold was last down $5.20 at $1,989.00. December silver was last down $0.249 at $23.265.

The focus of traders and investors remains on rhetoric coming from central bankers, especially the Federal Reserve. A Wall Street Journal headline today reads: “The (U.S.) economy was supposed to slow by new. Instead, it's revving up.” A Barrons headline today says: “Markets are confident Fed done on rates. Why that's dangerous.” The Barrons story suggests inflation is still not under control and geopolitical risk remains high--underscoring there are still major risks to the global economy.

Technically, December gold futures prices hit a 10-week-high Friday. The bulls have the overall near-term technical advantage. Prices are in an uptrend on the daily bar chart. Bulls' next upside price objective is to produce a close above solid resistance at $2,050.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,900.00. First resistance is seen at $2,000 and then at last week's high of $2,009.20. First support is seen at today's low of $1,971.00 and then at $1,957.00. Wyckoff's Market Rating: 6.0.

Image Source: Kitco News

December silver futures bulls have the overall near-term technical advantage. Prices are in an uptrend on the daily bar chart. Silver bulls' next upside price objective is closing prices above solid technical resistance at $25.00. The next downside price objective for the bears is closing prices below solid support at $21.60. First resistance is seen at today's high of $23.505 and then at last week's high of $23.88. Next support is seen at $23.00 and then at $22.785. Wyckoff's Market Rating: 6.0. Read More

Image Source: Kitco News

Gold is ignoring rate hikes, more responsive to G20 money supply - ByteTree's Charlie Morris

Gold prices are becoming more closely aligned with the global money supply while ignoring rate hikes and surging bond yields, according to Charlie Morris, Chief Investment Officer at ByteTree.

In the latest Atlas Pulse Gold Report, Morris said that gold likes low rates, high inflation, a booming money supply and strong global demand, but it appears willing to shrug off higher rates. “[I]nterest rates are surging, and the gold price couldn’t care less,” he wrote. “Gold is sending a message.”

Morris said he believes that gold is undervalued given the money supply. “Currently, the chart implies gold is around 5% undervalued against the global money supply. It’s a different way to think about it,” he wrote.

He said that the point about global money supply is that gold is a global asset, so it can tell you things that U.S. data won’t. “Traditionally, we have used US data for many things, mainly because the US is the largest economy, but more importantly, it has the best available data,” he said. “It’s not as good a fit as the global M2, but at least it has history.” Read More

Gold market sees second-biggest short covering rally on record as hedge funds caught wrong-footed

Analysts were warning that the gold market was ripe for a short squeeze rally as prices fell to a seven-month low earlier in the month, and they were proven right as the latest trade data from the Commodity Futures Trading Commission (CFTC) showed significant short-covering in gold and silver.

The CFTC's disaggregated Commitments of Traders report for the week ending Oct. 17 showed money managers increased their speculative gross long positions in Comex gold futures by 10,774 contracts to 104,708. At the same time, short positions fell by 31,096 contracts to 89,605.

After two weeks of being net short, speculative positioning has turned sharply bullish and is net long by 15,103 contracts. During the survey period, the short covering propelled gold prices through initial resistance at $1,900 an ounce.

Commodity analysts at Société Générale noted that this was the second-largest short-covering move in the gold market on record, going back to 2006. Read More

Gold shows surprising strength despite sky-high Treasury yields, silver continues to be undervalued - Heraeus

Gold prices continued to shrug off rising rate hike expectations and skyrocketing Treasury yields as they remain near $2000 per ounce, and while silver’s low prices supported coin sales, the precious metal remains oversold, according to analysts at Heraeus.

“Higher than expected US inflation in the previous week and retail sales above expectation last week boosted the odds of the Fed further tightening monetary policy in November,” the analysts wrote in their latest report. “Despite this, gold held its momentum from the week before, rising as high as $1,997/oz. Some of the rally was likely down to short covering, helped further by the escalation of the conflict in the Middle East motivating haven demand.”

They noted that even with prices appreciating, 7.97 million ounces of gold have flowed out of ETFs since the last peak in May. “It appears that, despite the recent rally in the gold price, investors are more focussed on short-term pain caused by rapidly rising yields rather than opting to bet on potential longer-term gains once this trend reverses,” they said. “Gold has made a base above the previous upward trend line, which may act as a support for the next few weeks.” Read More

US consumers selling their gold to make ends meet; Fed unlikely to get inflation under control - House of Kahn Estate Jewelers

The gold market continues to prove its worth as an essential store of value, as consumers are taking advantage of higher prices by cashing in on their broken jewelry.

In a recent interview with Kitco News, Tobina Kahn, president of House of Kahn Estate Jewelers based in Chicago, said that gold's bounce from its recent seven-month lows has once again spurred consumers to sell their old, broken jewelry.

She said that traffic in her shop is similar to what she saw at the start of the year as gold rallied above $2,000 an ounce. However, Kahn added that there is a significant difference in the sentiment among her customers now compared to the start of the year.

"In March, we saw many customers sell their old jewelry to raise money to invest it in the stock market. People were optimistic," she said. "Now consumers are selling their gold to make their mortgage payments. They are selling their broken jewelry because they need the money. Instead of getting a second job, they're going through their jewelry box and finding extra income that they thought they never had." Read More

Major dollar weakness limits the decline of gold pricing today

Gold prices, both physical and futures, are down about $8.00 to $9.00 today. However, one of the largest contributors working to lessen the price decline is dollar weakness. The dollar has lost 0.62% or 65 points, taking the dollar index to 105.335, a low not seen since Thursday, October 12. Dollar neutrality or strength today would have magnified the downside pressure considerably.

Spot gold according to the KGX (Kitco Gold Index) is currently fixed at $1972.40 after factoring in a decline today of $8.80. The components tell a different story, with dollar weakness strengthening the price of gold by $9.70 and selling pressure by traders resulting in a price decline of $18.50 per ounce.

It seems that today's net change in gold prices is largely technical, in that the underlying fundamentals that have moved gold higher (rising geopolitical tensions in the Middle East) have not diminished over the weekend. Read More

Live From The Vault - Episode: 145

Why a real physical gold price will rise from the Cartels ashes in 2024

In this week’s episode of Live from the Vault, Andrew Maguire kicks off with a discussion about the synthetic disconnect between the speculators and the COMEX, before delving into the behind-the-scenes moves affecting gold prices.

The precious metals expert takes listeners through the current bullish market behaviour and what’s driving it as we approach the end of 2023, harkening back to his start of the year predictions about the impact of Basel III NSFR compliance.

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.