Image Source: Unsplash

Gold Price News: Gold Defies Bearish Threats to Trade Near $1,930

Gold continues to defy the bearish threats of high interest rates and a strong US dollar and remains close to $1,930 an ounce.

The strength of gold despite the macroeconomic environment presenting a challenging time for the precious metal illustrates the level of central bank support for the haven asset, particularly from those countries, such as China, looking to diversify away from the hegemony of the US dollar.

One factor helping gold continue to trade comfortably above $1,900 an ounce is the prospect of central bank interest rates nearing their peak, particularly in the light of last week’s surprising pause by the Bank of England. That said, while interest rates are unlikely to climb much higher, they are set to hold at current levels for the foreseeable future, reducing the appeal of physical gold due to its lack of yield. Read More

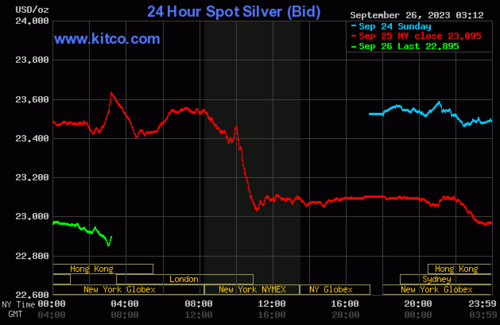

Silver Price News: Silver Nudges Up With Hope of Rally to Come

Silver is starting a new trading week but nudging up above $23.50 an ounce as the prospect of central banks around the world, including the Federal Reserve, the European Central Bank and the Bank of England, nearing the end of their cycle of interest rate hikes presents a more accommodative environment for the precious metal.

Silver has been subdued for much of the last year as a result of the Fed implementing a series of interest rate hikes, making the non-yield-bearing silver less attractive as a result. This has forced silver to trade well off the high touched in March last year before the Fed announced its shift in policy, even though the fundamental outlook for the metal has remained very strong throughout. Read More

US government shutdown brings debt problems into focus, which is positive for gold - Invesco's Kristina Hooper

U.S. 10-year bond yields at fresh 16-year highs as the U.S. dollar near a one-year high continues to keep a lid on the gold market; however, according to one market strategist, the precious metal's downside remains limited as economic uncertainty and rising U.S. debt provide solid support.

In an interview with Kitco News, Kristina Hooper, chief global market strategist at Invesco, said that while she doesn't expect the U.S. economy to slip into a recession, she said that the Federal Reserve's outlook for a soft landing is a little too optimistic. She added that she sees a rough landing for the U.S. economy and a growing deflationary environment that will force the U.S. central bank to cut interest rates sooner than they expect.

"Yes, the economy has been resilient, and the labor market has been tight, but cracks are starting to appear," she said. "I think the idea we will see a soft landing might be wishful thinking."

Along with growing economic uncertainty, Hooper said that growing deficit problems in the U.S. are also creating some support for gold, as it will limit the Federal Reserve's monetary policy decisions after it raised interest rates at an unprecedented pace. Read More

Higher USDX, bond yields, lower crude sink gold, silver

Gold and silver prices are down in midday U.S. trading Monday, with silver prices sharply lower. U.S. Treasury yields are on the rise and at multi-year highs, the U.S. dollar index hit a fresh 6.5-month high today and crude oil prices are lower. These are all bearish daily outside market influences on the precious metals markets. December gold was last down $9.30 at $1,936.50 and December silver was down $0.504 at $23.34.

The metals market bulls also have a still-hawkish Federal Reserve working against them.

The gold and silver market bulls are frustrated their metals have not seen any notable safe-haven demand, despite several elements that are very worrisome to the marketplace. However, don't rule out some keener safe-haven buying in gold and silver if any of the worrisome elements, mentioned above, move from a simmer to a boil.

Technically, December gold futures bears have the firm overall near-term technical advantage. A four-month-old downtrend is in place on the daily bar chart. Bulls' next upside price objective is to produce a close above solid resistance at last week's high of $1,968.90. Bears' next near-term downside price objective is pushing futures prices below solid technical support at the August low of $1,913.60. First resistance is seen at today's high of $1,946.80 and then at $1,950.00. First support is seen at last week's low of $1,933.10 and then at the September low of $1,921.70. Wyckoff's Market Rating: 2.5.

Image Source: Kitco News

December silver futures bears have the overall near-term technical advantage. However, there are solid technical support levels just below the market that begin to suggest a market bottom is in place. Silver bulls' next upside price objective is closing prices above solid technical resistance at $25.00. The next downside price objective for the bears is closing prices below solid support at the September low of $22.555. First resistance is seen at $23.75 and then at last week's high of $24.05. Next support is seen at last week's low of $23.06 and then at $23.00. Wyckoff's Market Rating: 4.0. Read More

Image Source: Kitco News

Hedge funds still neutral on gold, silver as economic uncertainty supports prices

The gold market continues to go nowhere in a hurry as hedge funds maintain relatively neutral positioning in the precious metal ahead of last week’s U.S. monetary policy decision, according to the latest data from the Commodity Futures Trading Commission.

The CFTC's disaggregated Commitments of Traders report for the week ending Sept. 19 showed money managers increased their speculative gross long positions in Comex gold futures by 3,435 contracts to 121,172. At the same time, short positions fell by 9,384 contracts to 73,782.

The gold market is now net long by 47,390 contracts, relatively unchanged from the previous week’s two-week low. During the survey period, gold prices trading either side of $1,950 an ounce.

"The bulk of the buying was driven by short covering as funds cut bearish bets ahead of FOMC and despite an ongoing rise in bond yields and the dollar trading near a six-month-high," said Ole Hansen, head of commodity strategy at Saxo Bank.

Analysts note that gold has been trapped in a neutral trading range since May, caught in a tug-of-war between growing economic uncertainty and the Federal Reserve’s hawkish stance on U.S. monetary policy. Read More

Gold to hit $2k by end of 2023, reach $2,200 an ounce in 2024 as dollar weakens - SocGen

While French Bank Société Générale has slightly reduced its exposure to the precious metal, it still remains positive on the precious metal as inflation remains stubbornly elevated amid plans by the Federal Reserve to end its tightening cycle.

Despite gold's lacklustre performance through the summer, SocGen is optimistic that prices have a path back to $2,000 an ounce.

"Headline inflation continues to cool, but core inflation remains stubbornly high, and the Fed is near its cyclical peak. As the timing of a potential US recession recedes, these developments give the Fed the opportunity (and the obligation) to keep rates higher for longer to fight inflation. This should keep real rates elevated, and – combined with the strong dollar – creates headwinds that should cap gold prices at or below $2,000/oz to the end of this year, in our view," the bank's commodity analysts said in their latest outlook report.

Looking to the new year, the analysts said that they see gold prices pushing to $2,200 an ounce by the end of 2024 as investors realize how difficult it will be for central banks to bring core inflation down to their 2% targets.

"With the low-hanging fruit in the inflation fight already picked, we think the gold market will have to price in higher forward CPI projections. As a result, we see gold appreciating to $2,200/oz in lumpy moves by end-2024, as the market adjusts its forward inflation expectations with the macro newsflow. Further, in our anticipated scenario of moderating US rates, we see the USD weakening – an additional bullish driver that should buoy gold, together with other USD-denominated assets," the analysts said. Read More

Live From The Vault - Episode: 141

Deconstructing the Gold Analyst Stockholm Syndrome

In this week’s episode of Live from the Vault, Andrew Maguire digs deeper into the markers signalling the demise of the market manipulators, who have become entangled in a web of overleveraged positions and suspected gold price-rigging.

The whistleblower then diagnoses the “Stockholm syndrome” that’s hindering analysts from identifying how much gold is being withdrawn from exchanges, before giving his thoughts on the arbitrage trading hampering Eastern & Asian gold markets.

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.