Image Source: Unsplash

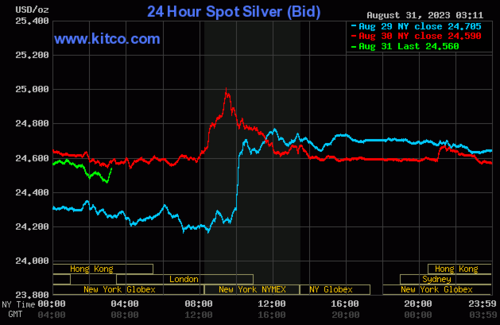

Silver Price News: Silver Price To Approach The $25 Mark?

Silver jumped above $24.5, hitting a new 4-week high and confirming the recent bullish trend.

The decline of the US dollar, following weaker than expected macroeconomic data, lifted silver prices.

From a technical perspective, the outlook has already significantly improved with the rebound from $22.7 to $24.3 posted last week. This week can be seen as the natural continuation of this movement and the next key area appears to be $25.0-25.2, the top reached last month.

The JOLTS data release significantly impacted silver and gold. But there is plenty of macroeconomic data still to come this week. Indeed, later today, will be the turn of the ADP nonfarm employment, but the main market driver of the week remains the all-important Non-Farm payrolls data, due to be released on Friday. Read More

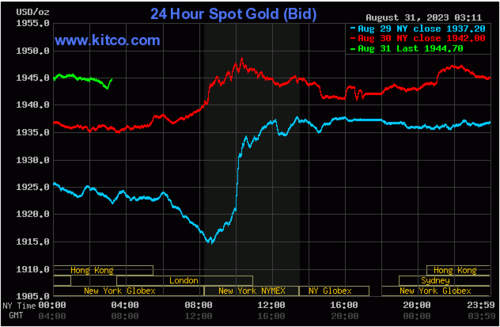

Gold Price News: Gold Extends Recovery After Weak US Data

Gold has been relatively steady in the first part of this week, with the spot price holding above $1,900, and little volatility.

The outlook changed, however. It has further improved yesterday after the release of the first significant macroeconomic figures of the week. Both the Job Openings and Labor Turnover (JOLTS) and consumer confidence have been softer than forecast. The precious metal jumped to $1,935 as a consequence while the US yields and the dollar declined, as the weaker data makes new interest rate hikes less likely.

As we mentioned in a recent comment published by Reuters, gold holding its ground above $1,900 was a signal of strength for the precious metal, especially in the challenging context of a more hawkish Federal Reserve last week at the Jackson Hole Summit.

The situation has now improved from a technical point of view too, as the price has surpassed the resistance placed at $1,930 and is looking towards the next potential target in the region of $1,950. Read More

Gold prices holding steady as private sector employment growth disappoints, rising 177K in August

The U.S. labor market shows signs of cooling as the U.S. economy sees disappointing gains in private-sector jobs in August, according to private payrolls processor ADP.

Wednesday, ADP said that 177,000 jobs were created this past month. The data missed expectations as economists were looking for job gains of around 194,000.

"This month's numbers are consistent with the pace of job creation before the pandemic. After two years of exceptional gains tied to the recovery, we're moving toward more sustainable growth in pay and employment as the economic effects of the pandemic recede," said Nela Richardson, chief economist at ADP, in the report.

However, the weaker-than-expected employment report appears to have little impact on gold prices. December gold futures are holding near session highs but are seeing little new momentum, last trading at $1,969 an ounce, up 0.19% on the day. Read More

Gold is a proven difference-maker as real returns on equities, bonds, and cash converge - WGC's De Pessemier

Falling returns for equities and rising yields on cash and bonds are forcing market participants to rethink their allocation strategies and reassess the role of gold in their portfolios, according to Jeremy De Pessemier, Asset Allocation Strategist at the World Gold Council.

“A lot has been made of the convergence of yields for cash, bonds and equities (on an earnings yield basis), with the higher yield on offer in the cash space leading many investors to reassess their portfolio exposures,” De Pessemier said

“In fact, with cash yields offering compelling reward with little risk and with the balance of economic forces still appearing to be tilted against global capital markets, investors have been rushing into cash over recent months,” he wrote, adding that after years of “unattractive yields,” the ability to earn significant interest on defensive positions is nice. “That, however, is different to saying that holding cash today – on a long-term basis – is a no-brainer,” he said. “Why? Cash yields still aren’t positive in real terms.”

De Pessemier noted that from the late 1980s until the Global Financial Crisis of 2008, high cash rates were associated with growing spending power. “Today it’s not the case,” he said. Read More

Bitcoin has no real backing, gold is the future of digital currency - World Gold Council Chair

While the cryptocurrency market struggles to gain broader adoption in global financial markets, gold could be uniquely positioned to succeed as an accepted digital asset, according to one executive in the precious metal sector.

In a recent interview with Kitco News, Randy Smallwood, CEO of Wheaton Precious Metals and the Chair of the World Gold Council, said that gold continues to establish itself as a global store of value, attracting a new generation of investors who have lived through unprecedented uncertainty and volatility.

Smallwood said that what gives gold its value is its rarity; he pointed out that despite a handful of leading digital coins, the sector has become inundated with products. He noted that there are tens of thousands of digital coins in the marketplace, and just as many have failed in the last few years.

Smallwood added that Bitcoin's lacklustre performance through 2023 could allow gold to shine in the digital marketplace. He noted that through 2023, the World Gold Council has seen significant interest from banks worldwide that are interested in digitizing physical gold. Read More

Key technicals now favor gold bulls, and macro events could push prices higher - FX Leaders' Butt

Gold prices have received bullish confirmation from key technical indicators, and could also get a further push from U.S.-China tensions and weaker economic data in the coming days, according to Arslan Butt, Lead Commodities and Indices Analyst at FX Leaders.

“Gold’s price (XAU/USD) is exhibiting limited upward momentum despite hovering at its highest level in three weeks, currently trading around the $1,937-38 range,” he said. “Traders are seeking further indicators to solidify the doveish stance on the US Federal Reserve (Fed), which gained traction following disappointing US data the previous day.”

Butt said that U.S.-China relations and “sluggish performance in U.S. Treasury bond yields” are providing headwinds for gold bulls as they look to this week’s major data releases for confirmation of economic weakness to support further gains for the precious metal. Read More

Gold, silver gain on more downbeat U.S. economic data

Gold prices are higher in midday U.S. trading Wednesday and notched a three-week-high, in the aftermath of another batch of U.S. economic data than came in a bit weaker than market expectations. Silver is trading near unchanged but hit a four-week high early on today. December gold was last up $9.30 at $1,974.50 and December silver was up $0.046 at $25.18.

This morning’s ADP National Employment Report for August showed a rise of 177,000 jobs, compared to expectations for a gain of 200,000 and compares with a revised rise of 371,000 in the July report. Meantime, the second estimate of second-quarter U.S. GDP showed a gain of 2.1%, year-on-year, versus the first estimate of up 2.4% and was below market expectations. The closely watched PCE price index for the second quarter was up 2.5% versus the first estimate of up 2.6%. All of these numbers fall into the camp of the U.S. monetary policy doves, who want the Federal Reserve to hold off on raising interest rates further.

The busy U.S. data week is highlighted by Friday’s employment situation report for August from the Labor Department. The key non-farm payrolls number is expected to come in at up 170,000, compared to a rise of 187,000 in the July report.

Technically, December gold futures prices hit a three-week-high today. More short covering and bargain hunting were featured. Bears still have the overall near-term technical advantage, but bulls have gained some momentum. Prices are starting to trend up. Bulls’ next upside price objective is to produce a close above solid resistance at $2,000.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at the August low of $1,913.60. First resistance is seen at $1,985.00 and then at $2,000.00. First support is seen at today’s low of $1,962.80 and then at $1,950.00. Wyckoff's Market Rating: 4.0.

Image Source: Kitco News

December silver futures hit another four-week high today. The silver bulls have the overall near-term technical advantage. Prices are trending higher on the daily bar chart. Silver bulls' next upside price objective is closing prices above solid technical resistance at the July high of $25.82. The next downside price objective for the bears is closing prices below solid support at $23.50. First resistance is seen at today’s high of $25.425 and then at $25.82. Next support is seen at today’s low of $24.92 and then at $24.555. Wyckoff's Market Rating: 6.5. Read More

Image Source: Kitco News

BRICS will break the dollar and usher a return to gold - Mises Institute

The U.S.-led West will soon witness the end of the dollar’s pre-eminent position in international trade, and all of fiat will follow, writes Patrick Barron on behalf of The Mises Institute, which endorses the Austrian school of economics in the tradition of Ludwig von Mises.

Barron says the recent BRICS summit in Johannesburg, South Africa, included “an agreement on a first step toward establishing an alternative international trade settlement system based on commodities, which would certainly include gold.”

“Although the coming change may be characterized as one between the Western democracies and the BRICS nations, the real battle is one of ideas—between Keynesian economic theory and gold,” he writes. “The winner will be gold.”

Barron argues that even with the end of Bretton Woods in 1971, gold has never actually been proven inferior to fiat. “The gold standard was not replaced by a better monetary system,” he says. “It was suppressed in stages to satisfy the state’s insatiable need for money—first to make war and then to corrupt the people via welfare. The result, of course, has been never-ending wars, a creeping expansion of the welfare state, unsustainable public deficits, and the accelerating debasement of the currency.” Read More

How gold price gets to $10k: BRICS expansion, gold-backed currency, monetary reset - Willem Middelkoop

The BRICS formal invitation of Argentina, Egypt, Ethiopia, Iran, the United Arab Emirates, and Saudi Arabia to join the bloc moves the world a step closer to a "very dangerous phase" for the U.S. and the next major conflict, according to Willem Middelkoop, Founder and CIO of the Commodity Discovery Fund.

"I don't feel comfortable by all these developments, and we shouldn't call it World War III right away, but we're moving towards a very dangerous phase," Middelkoop told Michelle Makori, Lead Anchor and Editor-in-Chief at Kitco News. "This BRICS conference is the next step in a financial economic war. And I'm afraid it's all connected, and I'm not the only one who has warned of a possible World War III scenario."

The new BRICS memberships will take effect from January 1, 2024. However, out of the six new members, Saudi Arabia is yet to officially confirm, with the country’s Foreign Minister Prince Faisal bin Farhan stating, “We await further details” and “based on this information and in accordance with our internal procedures, we will make the appropriate decision.” Read More

ADP jobs report reveals an economic slowdown, a bullish factor for gold

ADP released its monthly private sector employment report which revealed that an additional 177,000 jobs were added in August and that personal income was up 5.9% when compared to the previous year. This report comes after the jobs opening report by the Bureau of Labor Statistics which showed 8.3 million positions remained unattended. The report also revealed that the number of individuals who quit (quit rate) has slowed to a level of 2.3%, to levels not seen since before the pandemic.

According to Ian Shepherdson of Pantheon Macroeconomics, “The quits rate, which is a much better guide to future wage growth than the openings-to-unemployed ratio, clearly signals sharply slowing wage growth, consistent with an array of other indicators. Given that the full effects of the Fed's tightening to date is yet to work through into the labor market, this suggests to us that any further rate increases would be overkill."

The range in gold futures on Wednesday, Thursday, and Friday of last week was tepid with a defined intraday high on all three days at approximately $1950 to $1955. Yesterday's report which revealed a softening of job openings resulted in a surge in moving gold of approximately $20, today gold had a fractional gain when compared to yesterday of approximately $5.00. Read More

Live From The Vault - Episode: 137

No Coincidence - Indonesian VP Endorses Sharia Gold Launch During BRICS Summit

In this week’s episode of Live from the Vault, Andrew Maguire covers the latest developments on the intensifying paper versus physical gold battle and the ongoing central bank gold-buying sprees as Kinesis powers gold adoption in Indonesia.

The precious metals expert and whistleblower provides an update for silver stackers before revealing the global ramifications of the BRICS summit, their upcoming commodity-backed currency poised to compete with the US dollar.

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.