Image Source: Unsplash

Gold Investors need to look beyond rate hikes in 2022 - State Street Global Advisors

After a disappointing year, gold prices are ringing in 2022 on a solid note, trading at a five-week high. According to one precious metals analyst, gold should be on pace to resume its long-term bullish uptrend in the new year.

In a telephone interview with Kitco News, George Milling-Stanley, chief gold strategist at State Street Global Advisors, said that his base case scenario, with a 50% probability, is for gold prices to trade between $1,800 and $2,000 an ounce in 2022. He added that he sees a 30% chance of gold prices pushing above $2,000 to a new record high.

“We see an 80% chance of gold prices staying in the current range to moving higher next year,” he said. “Even with the Federal Reserve looking to tighten interest rates next year, we think gold has a pretty good chance of moving higher.” Read More

Retail Investor see gold hitting record highs above $2,000 in 2022

Retail investors remain significantly bullish on gold prices next year as the precious metal looks to end 2021 with nearly a 4% loss.

Gold prices have seen a solid push higher, moving above $1,800 an ounce on the last trading day of 2021. Spot gold prices last traded at $1,827.95 an ounce; however, the market started the year at $1,898 an ounce.

It has been a relatively disappointing year for the gold market, which saw some pretty volatile moves. Including a flash crash in August that saw the price drop below $1,700 an ounce. Gold prices have struggled to attract bullish attention even as real interest rates fell to historic negative territory, driven by extraordinary inflation pressure.

Analysts note that the rise in consumer prices this past year has been met with expectations that the Federal Reserve will tighten interest rates soon than expected. At its December monetary policy meeting, the U.S. central bank signaled that it would end its monthly bond purchase by March and could raise interest rate three times in 2022. Read More

New Year same price action for Gold

The new trading year begins today. It is too early to make a call on Gold, Silver, and Platinum. However, as the new year begins, we are long Gold and Silver, we would be long Platinum except for its lack of trading liquidity.

Looking at the big picture, my guess is we will see much more volatility in the metals this year. The tight trading ranges from last year will resolve and make more extended moves. Remember all time frames revert to the phases and cycles of all markets.

If I were to make an educated guess, the trading will be much more volatile this year. It would be no surprise to see gold trade down to 1450 and also make new highs this year. I expect both as the ranges should widen. Volume should pick up and prices could be wild. Read More

J.P.Morgan sees gold price unable to withstand the Fed; falling to pre-pandemic levels in 2022

The gold market will not be able to withstand the Federal Reserve's plan to tighten its monetary policy in 2022, according to commodity analysts at J.P. Morgan Global Research.

In its recently published 2022 outlook report, the bank expects gold prices to fall to pre-pandemic levels by the end of next year.

"An unwinding in ultra-accommodative central bank policy will be most outright bearish for gold and silver over the course of 2022," the analysts said. "From an average of $1,765/oz in Q1, gold prices are set to steadily decline over the course of next year to a Q4 average of $1,520/oz." Read More

Demand for electric vehicles will keep copper afloat in 2022

It is safe to say that 2021 was a very strong year for base metals. As inflation kicked in the price of raw materials rose. One major factor was the lack of workers in the mines due to the COVID-19 pandemic. Many developing nations had to close mines and refineries with big infection rates and dampened production levels. Companies like Southern Copper, BHP, and Glencore all reported a reduction in production levels due to the pandemic. Since then things have got better but it is important to watch their production numbers closely for any changes.

In addition to the lack of supply, the electric vehicle boom added to demand. A recent Europen statistic showed that the percentage of new vehicles being purchased fell but the growth in sales of electric vehicles is still managing to grow month on month. In the U.K. alone sales of plug-in hybrid electric vehicles also rose 40% year on year. Read More

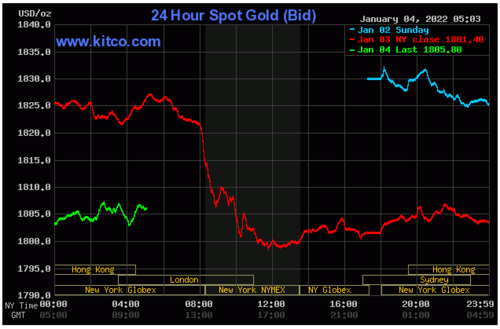

The first trading day of 2022 results in strong declines in both gold and silver

The first trading day contained strong bullish market sentiment for U.S. equities and dollar strength. The dollar gained 0.632 points or a percentage gain of 0.66%. Concurrently U.S. equities all traded to higher ground, with all three major indices closing near their record highs. The Dow Jones industrial average gained 246.76 points, a percentage gain of 0.68%. The NASDAQ composite gained 1.2% or 187.83 points, and the Standard & Poor’s 500 gained 30.38 points taking the index to a record high close at 4796.49.

The combination of a strong performance in U.S. equities, U.S. dollar strength, and rising interest rates vis-à-vis U.S. debt instruments pressured the precious metals lower across the board. Palladium had the largest percentage drawdown giving up 4.45% or $85.10, with the most active futures contract currently fixed at $1827. This puts the differential between gold and palladium approximately $26 apart. Silver lost 1.85% in trading today or $0.43 taking the most active March Comex futures contract to $22.92. Platinum also sustained a loss just over a full percentage point with the most active Comex contract currently fixed at $954.90 a decline of 1.17%. Read More

Dollar hits one-month high vs yen as Fed rate bets lift U.S. yields

The U.S. dollar reached its strongest level in more than a month against the Japanese yen on Tuesday, lifted by a jump in Treasury yields overnight as traders bet on an early Federal Reserve interest rate hike despite surging COVID-19 cases.

The greenback rose as high as 115.395 yen for the first time since Nov. 25, as long-term Treasury yields leapt 12.5 basis points overnight to touch 1.6420% for the first time since Nov. 24.

Money markets have fully priced in a first U.S. rate increase by May, and two more by the end of 2022. The dollar index, which measures the currency against the yen and five other major peers, held close to the one-week high of 96.328 reached on Monday. Read More

Gold, silver hit hard by rally in USDX, higher U.S. Treasury yields

Gold and silver futures prices are sharply lower and near-daily lows in midday U.S. dealings on this first trading day of 2022. Bearish daily elements that include a solidly higher U.S. dollar index sharply rising U.S. Treasury yields today are negatives for the precious metals. Also, mostly higher stock indexes Monday suggest still-scant trader and investor risk aversion in the marketplace at present—and that's bearish for the safe-haven metals. February gold futures were last down $29.60 at $1,799.00 and March Comex silver was last down $0.487 at $22.87 an ounce. Read More

Gold price tanked last year, can Fed make metal even worse in 2022?

The Federal Reserve's monetary policy will be key in guiding gold's price action in 2022, especially after the hawkish shift at the end of the year. This leads to a key question — can gold handle a more aggressive central bank after an already lackluster year?

At the December meeting, the Fed announced that it would be doubling its tapering pace to $30 billion a month, which would conclude the Fed's asset-purchasing program in early 2022. The central bank cited problematic inflation and a strong economic recovery as the main reasons for the shift in policy.

When the Fed announced its accelerated schedule, gold ended up making unexpected gains as most of the information was already largely priced in.

It is "really appropriate" to make this monetary policy shift due to the current state of the U.S. economy, inflation, and wages, Fed Chair Jerome Powell told reporters in December. "Price increases have now spread to a broader range of goods and services," he said. Read More

Gold trades marginally higher ahead of the EU open

Gold and silver are mixed this morning. The yellow metal is 0.19% higher after a tough session on Monday. Silver has dropped -0.22% and trades under $23/oz. Elsewhere in the commodities complex, both copper (-0.77%) and spot WTI (-0.17%) are trading lower.

In the indices, the Nikkei 225 (1.77%) and ASX (1.95%) rose while the Shanghai Composite (-0.20%) underperformed. Futures in Europe are pointing towards a positive open.

In the FX space, USD/JPY was the biggest mover pushing 0.38% higher and in the crypto space, BTC/USD is 0.21% in the black. Read More

State Street Global Advisors Head of Gold Strategy outlines the bullish case for gold

State Street Global Advisors Head of Gold Strategy George Milling-Stanley kicked off his recent interview by saying "I think that we're going to see better performance than we've seen in 2021. I think, to put 2021 in perspective, it's important to remember that gold was coming off two banner years. The price went up 18% in 2019. It went up another 24% in 2020.". George Milling-Stanley framed his case for a bull market in 2022.

When talking about the ETF GLD Miling-Stanley said "We've lost about $10 billion to redemptions from GLD in 2021 so far, but that comes after a year in 2020 when we were up $15 billion. So we're still running pretty well if you take the two years as an average." Read More

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.