Almost everyone has confused a token with a coin at some point in their cryptocurrency journey.

The fact is that coin and token are very much alike on a fundamental level. They both represent value and can process payments. You can also swap coins for tokens and vice versa.

The main difference between these two comes down to utility. There are things you can do with tokens and not with coins. On the other hand, some marketplaces will accept coins and not tokens.

It's similar to comparing investors and traders - all traders invest, but not all investors trade. Note that most cryptocurrency users usually own both coins and tokens.

Let's go over some of the most significant distinctions between tokens and coins, so next time you're making a reference, you'll know exactly what you're saying.

When Bitcoin first came out, it set the standard for what it means to be a coin. There are clear-cut qualities that distinguish crypto coins from tokens, which are similar to real-world money.

A coin is defined by the following characteristics:

1. Operates on its blockchain. A blockchain keeps track of all transactions that involve its native crypto coin.

When you pay someone with Ethereum, the receipt goes to the Ethereum blockchain. If the same person pays you back later with Bitcoin, the receipt goes to the Bitcoin blockchain. Each transaction is protected by encryption and is accessible by any member of the network.

2. Acts as money. Bitcoin was created for the sole purpose of replacing traditional money. The paradoxical appeal of transparency and anonymity inspired the creation of other coins, including ETH, NEO, and Litecoin.

You can purchase merchandise and services from many major corporations today, such as Amazon, Microsoft, and Tesla, using crypto coins. Bitcoin has recently become an official currency of El Salvador alongside the US dollar.

3. Can be mined. You can earn crypto coins in two ways. One is through traditional mining on the Proof of Work system. Bitcoin hunters employ this method to boost their earnings. The problem with this is that there aren't that many Bitcoins left to mine, so the process becomes more arduous every day.

The other method is Proof of Stake, which is a more modern approach to earning coins. It's lighter on energy consumption and easier to do. Cardano is one of the biggest coins that adopt this system.

Unlike coins, tokens do not have their blockchain. Instead, they operate on other crypto coins' blockchains, such as Ethereum. Some of the most commonly seen tokens on Ethereum include BAT, BNT, Tether, and various stablecoins like the USDC.

If crypto coin transactions are handled by blockchain, then tokens rely on smart contracts. They're an array of codes that facilitate trades or payments between users. Each blockchain uses its smart contract. For example, Ethereum uses ERC-20, and NEO uses Nep-5.

When a token is spent, it physically moves from one place to another. A great example of this is the trading of NFTs (non-fungible tokens.) They are one-of-a-kind items, so a change in ownership must be manually handled. NFTs often carry only sentimental or artistic value, so in a way, they're similar to utility tokens, except you can't oblige any services.

This is different from coins because crypto coins do not move around; only account balances change. When you transfer money from your bank to someone else's, your money doesn't go anywhere. The bank changed the balances of both accounts and kept the fees. The same thing happens with blockchain - the balance in your wallet changes, and the transaction notes that.

Another notable difference between tokens and coins is what they represent. While crypto coins are essentially digital versions of money, tokens can stand for assets or deeds.

You can buy tokens with coins, but some tokens can carry more value than any of them. For example, a company's share. However, since there are usually restrictions to where you can spend a token, it doesn't have the liquidity a coin offers.

Simply put, a token represents what you own, while a coin denotes what you're capable of owning.

On a broader scale of things, tokens existed long before cryptocurrency was a thing. Even today, it has very little to do with crypto at all.

Everyone has used a token at least once in their life. That dinner for two vouchers you got in the mail is a token. Your car title is a token. When you sell your car, you transfer the value of that title to someone else. However, you can't go to Microsoft and buy a computer with that title or dinner voucher.

Another interesting thing about tokens is how easy it is to create one. Some networks like Ethereum provide templates where you can brand your tokens and start trading. This makes it so anyone with little to no technical knowledge can become a market maker. You'll find a high density of this type of activity on decentralized exchanges, such as Uniswap.

The difference between token and coin isn't vast, but it can cause a major headache if frequently overlooked. One quick way to decide which one you should use is to pay attention to what you're buying. If it's a product, most often, you would need coins. If it's a service, there are usually utility tokens you can use.

Interestingly, the way we spend tokens is quite similar to cash. When you pay cash, your money physically moves from your hand to someone else's. But we did mention that only coins represent money, and they don't move at all. Is this a way the financial marketeers toy with our sanity?

That's something to think about the next time you're in a contemplative mood.

| Key takeaways |

| — Coins are any cryptocurrency that has a standalone independent blockchain (Bitcoin, Ethereum, XRP, …) — Altcoins are considered as coins that are not Bitcoin. — Tokens are cryptocurrencies that do not have their own blockchain but live on another blockchain. As they live on another blockchain, they benefit from its technology. (ERC-20 tokens…) We use the word crypto to cover a multitude of currencies, but in fact there’s a difference between coins and tokens. Let’s look closer. Entering the cryptocurrency market can be a complicated and daunting task. You may have heard of Bitcoin, but what about the other thousands of coins and blockchain projects out there? To obtain a better grasp of the crypto markets, it’s easiest to classify cryptocurrencies into two distinct categories: coins and tokens. CoinsCoins refer to any cryptocurrency that has a standalone, independent blockchain — like Bitcoin. These cryptocurrencies are bootstrapped from scratch, and the broader network is designed explicitly to achieve a certain goal. For example, Bitcoin exists as a censorship-resistant store of value and medium of exchange that has a secure, fixed monetary policy. The native token of Bitcoin, BTC (i.e., bitcoins), is the most liquid cryptocurrency in the market and has both the highest market cap and realized market cap in the cryptocurrency sector. Coin projects typically draw inspiration from past technologies or other cryptocurrencies and fuse them into an innovative network catering to a specific purpose. Another example of a coin, Ethereum’s Ether (ETH) is the native coin of a smart contracts platform for creating general-purpose computer programs that run on a decentralized blockchain. Rather than focusing on financial data, Ethereum focuses on arbitrary program data that can cover anything from games to social media. Ether is used for sending/receiving, managing assets, paying gas fees, and interacting with decentralized applications (dApps) on the network.

You might also have heard about Altcoins. Basically, we call Altcoins any coins that are an alternative to Bitcoin. TokensTokens are a unique outlay of broader smart contracts platforms like Ethereum that enable users to create, issue, and manage tokens that are derivatives of the primary blockchain. For example, the ICO craze of 2017 was fueled by Ethereum’s ERC-20 token standard, which is basically a protocol for creating tokens (besides ETH) on the Ethereum blockchain that can be exchanged with each other. Projects would announce or build an application on Ethereum using smart contracts, and issue a native token for use in that application, raising funds directly from investors in ETH in the process. Tokens occupy a unique corner of the cryptocurrency market where they function as “utility” tokens within an application’s ecosystem for incentivizing certain behavior or paying fees. For example, the popular ERC-20 token Dai is part of the MakerDAO dapp on Ethereum. MakerDAO is a way for users to access credit instruments like lending/borrowing using Dai, which is designed to be stable. ERC-20 tokens like Dai can be exchanged for any other ERC-20 token or other Ethereum-based standards (i.e., ERC-721), including the ETH coin. As a result, tokens exist as application-specific tokens within a coin’s broader cryptocurrency/blockchain network, like Dai existing within Ethereum’s ecosystem. Other tokens besides Dai include Maker (MKR), 0x, Augur (REP), Komodo (KMD), and Golem (GNT).

Coins need to be exchanged with each other through cryptocurrency exchanges because they are built on different, non-standardized code protocols. Conversely, tokens on Ethereum (e.g., ERC-20) can be exchanged through internal applications amongst each other with minimal friction because they are built on standardized code protocols. The question of what is the difference between a coin and a token is one of the most curious questions in the crypto money world. Although it may seem confusing, it has a very simple explanation. To summarize briefly, while the coin is a digital currency with its own blockchain; A token can be defined as an asset that does not have its own blockchain. Here, blockchain should be considered as a highly secure system that distributes encrypted data.

|

The question of what is the difference between a coin and a token is one of the most curious questions in the crypto money world. Although it may seem confusing, it has a very simple explanation. To summarize briefly, while the coin is a digital currency with its own blockchain; A token can be defined as an asset that does not have its own blockchain. Here, blockchain should be considered as a highly secure system that distributes encrypted data.

We will try to explain this situation by giving examples from daily life: your car

Let’s say you’re wanting a new way to get around.Well, the way that I see it, you can either buy your own car and have to manage that car. I keep it up-to-date. Change the oil, replace the tires all that stuff. Its overall responsibility to keep that car because it is yours

Well, the alternative is that you could rent a car. This means you can borrow a car for a monthly payment and in that case, you can use it for whatever purposes, you might need, you just pay the owner the rent for using that car and then you don’t have to worry about any of the issues.

Depending on the different factors in your life, you would have to choose the one that best fits your needs and which one was wiser to go with. For example, you may not have a bunch of cash to buy a new car outright or maybe you were just super busy and you don’t want to take care of the maintenance.

Well, if you think of this analogy it’s pretty much the same as the difference is between a coin and a token.

A coin uses its own blockchain to keep track of all the data, which in our car analogy would be owning the car. When it comes to a token though you are using someone else’s coins blockchain as your infrastructure, while you basically pay rent. When you create a token, you don’t have to create the blockchain. Write the full code or be validated. Instead, you just create the token and it runs on that BlockChain.

The best example for this article would be Ethereum. Ethereum has own blockchain that both stores value and validates transactions.

Ethereum’s team has been working very hard to past few years on improving the entire system. Updating how it works and patching vulnerabilities. An Ethereum token or an ERC20 token uses Ethereum’s blockchain’s capabilities as its backbone and infrastructure.For example, a basic attention token is an ERC20 token built on the ethereum network.

o here’s an important thing, you can’t convert a token straight into a coin. You can create a coin that functions the same way and then create a bridge that will allow users to swap out their previous tokens for the new coins.

In some cases, some coins like Leo are tokens on multiple networks. For example, Leo is on the etherium network, the finance, smart chain Network, and the hive Network.

Another important thing to know is that some coins are represented as tokens on other networks. For example, a few days ago, I bought something called Finance Peg Ethereum token on the Binance Smart Chain. I did not actually buy Ethereum but instead, I bought a representation of Ethereum on the Binance Smart Chain Network that mimics the price of Ethereum. You might be wondering why I did this? Well, a regular Ethereum transaction is around $20 right now. However, a transaction on Binance Smart Chain is only 50 Cents. So it is much more affordable to trade a representation of Ethereum on the Binance Smart Chain Network. You can kind of think about it like if you buy a stock of gold. You own the stock, but all it does is represent the gold. At any time, you can cash out that stock for a piece of gold. So it’s basically gold at least for trading purposes. I hope that this isn’t too confusing. So while that is a simple version of it, there are a few different types of tokens. We can use it to categorize the purpose of each token. Let me go over a couple of examples here and maybe you’ll get the hang of it, if you haven’t already.

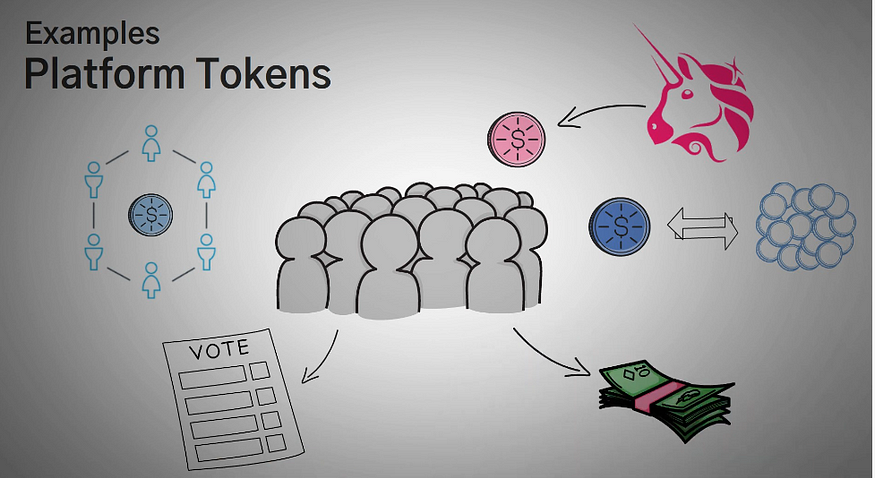

Platform tokens are created to support a decentralized application on the blockchain. For example, Uniswap is a decentralized application that allows users to swap out Ethereum tokens or other ethereum tokens. And even though they are a decentralized app, they also have their own token. The Uniswap token. This token is given out to those who invest in their platform. And it has the promise that eventually token holders can vote on changes in the future. And maybe even earn some of the profits from the trades.

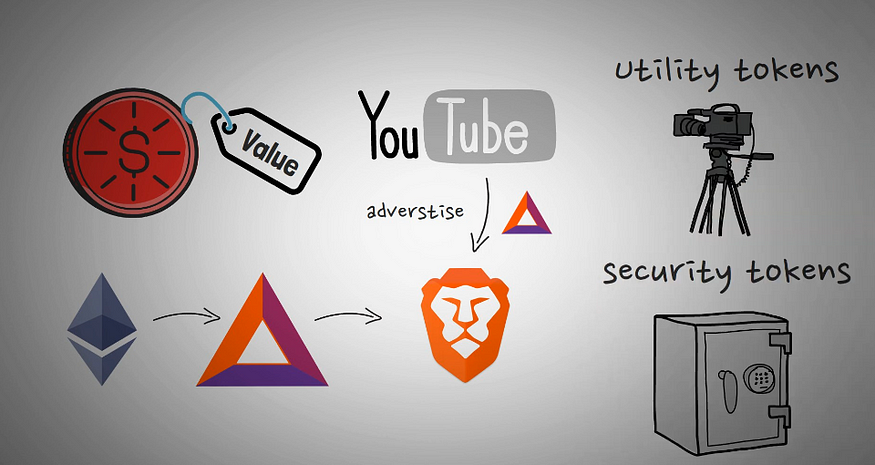

Security tokens are minted to represent ownership of another asset. For example, say you wanted to buy gold but you didn’t actually want to hold the goal, someone could create a token that is tracked to the price of gold. So instead of actually owning the gold, you own, a representation of it, which technically would be much safer because it is much more difficult to hack it. A theory and token than it is to break into someone’s house.

The tricky part here is that there should be A real asset behind it. For example, I can create a goal to token, ask you to invest in it, and not have any gold.

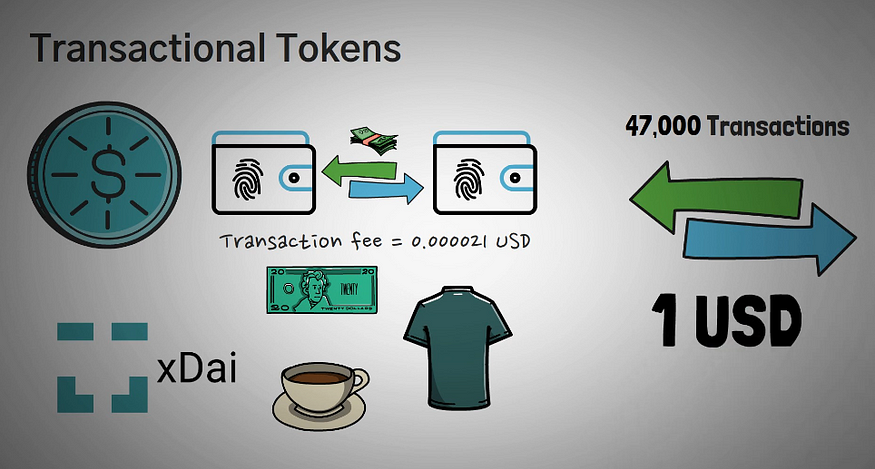

Transactional Tokens are used as a fast and easy way to transfer money. If we think of the coin X die, it is currently paid to the United States dollar and it’s easy for people to pay for say, maybe coffee or buying that shirt. You like it at the local store, you can use it the same as cash. However, the expenses of it are super low right now, the transaction fee is 0.000021 USD and that is ridiculously low to give you an idea of how cheap that fee is

47.000 transactions and only pay 1 USD and fees for them all. Try doing that on PayPal through a bank wire. :)

Utility tokens have a value tied to their ownership. For example, a basic attention token is an ethereal token that can be used to advertise on the brave browser. In other words, if I wanted to advertise this YouTube channel on the brave web browser, I can do so very easily with my basic attention token. In other words, utility tokens can actually do something but security tokens don’t do anything, you just buy them and hold them. But a utility token, can actually be used for a commercial intent.

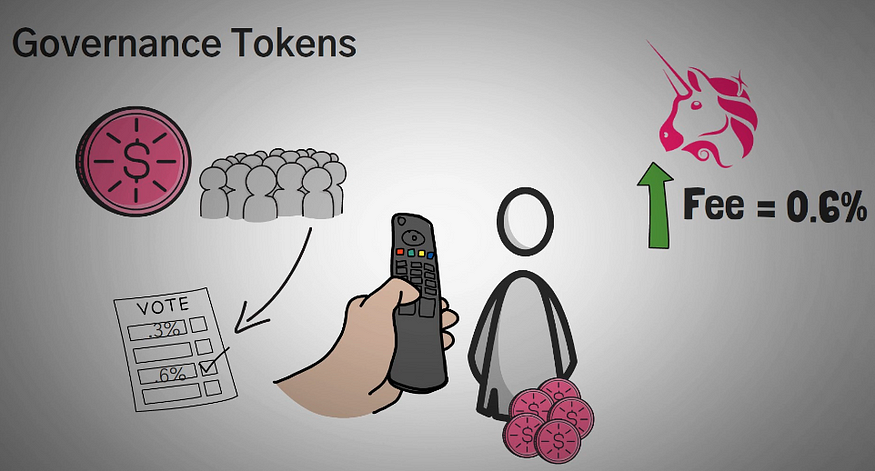

Governance tokens allow token holders to vote on certain things. For example, Uniswap could be a governance token and a future version of the Uniswap Exchange. Token holders could choose to vote to raise the fee of a Uniswap trade from .3%, 2.6 percent, and everyone with a token would be allowed to vote on that. Change the decision with the most votes chooses the winner. So, you actually have more voting powered by holding more tokens. Obviously, there’s a pretty good reason to hold more tokens by holding more. You can actually control the platform or but this comes up with the problem of the authority being centralized.

But we’ll save that with another article. Now that we’ve went over the different types of tokens. Hopefully, you understand why we need them and how some of the work. If you’ve enjoyed this article we highly recommend checking out some of our other articles which are created in a similar animated manner.

Zeniq Token is so promising as its the first to have real value behind it besides the trust from the community, Like fiat originally is backed by gold, Zeniq coin is backed by billion $ tokanization projects on Zeniq next gen decentraliced blockchain.

################################################################

Join Markethive with a high alexa rank