by Pawel Wozny

Note: Not financial Advise, please do your own research.

This is making many investors very bullish on Cardano, pushing Cardano from a dollar and two cents all the way up to two dollars and twenty-two cents.

The question is, though, where can Cardano go from here?

How much do you need to retire on Cardano? So, we will mention it. I’ve done a couple of posts similar to this in the past, but They have been slightly different.

So, we will take a look at how much you need to retire based on three different scenarios?

The first is a Bearish Scenario, the second is the Middle of the Pack, and the third is a Bold Case Scenario.

Now, none of these, I think, are outlandish, and we’re going to look at it as. It can all comes true.

If we were retiring in 2030, so keep in mind. So that this is nine years down the line, think about how far we have come in Crypto since nine years ago?

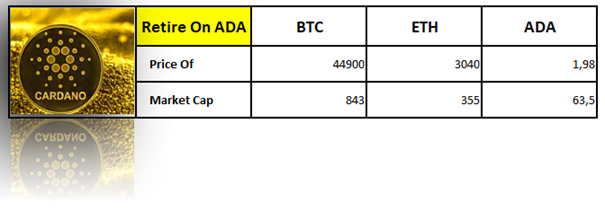

So, let’s take a look say you want to retire on ADA right now price of Bitcoin 44900 Ethereum 3040 Cardano 1.98, give or take, of course; anything can happen. So, these prices could be different we have to make some assumptions.

Let’s say you’re spending about 4000 dollars a month pre-average spending for an individual annual spending forty-eight thousand dollars.

So, we will assume that you need about 960.000 dollars worth of Cardano because we will say that you can make about 5% on that Cardano.

So, 960 times 5% is about 48.000 there we ego. So you can make a couple of different ways, first of all, you can stake your Cardano second of all, you can gain interest.

This is the more bearish case now. It will not be full-out Bitcoins down to zero or anything like that or even that’s at the same price.

I think many people would be very happy. If bitcoin went up to 300000 dollars, but that’s still only half the market cap of Gold. So, that’s why it’s a little bit of a bear case. Because while it has appreciated at a price about 6x in 10 years, which is a great return. This is not close to the market cap of Gold, and it is Gold 2.0. I mean, we’re moving so quickly.

Now it would make much more sense. So I think for Bitcoin to be above 300.000 dollars nine years from now. But again, we will bear the case. So Bitcoin is at 300.000 dollars in that scenario. We’re also going to say that Ethereum is the same weighting as it is now compared to Bitcoin.

It is obviously in billions here. So we will say that Ethereum is about the same weighting or market cap in relation to Bitcoin. So we get to a 2.4 trillion dollar Ethereum now.

Of course, this is much higher than it is now. Of course, that’s more than the entire Crypto space, but that is this scenario.

That would put Ethereum at about 20.000; then, ADA, let’s say, is the same weighting, so we take the same weighting of ADA versus Ethereum. So ADA has not gained anything on Ethereum that put it at about 13.40 cents.

I realize again still great returns compared to any other asset class but still not compared to the past, and Crypto right obviously, that is a much worse return than what we’ve seen in the past from Crypto.

So in this scenario, you would need about 701700 Cardano by 2030. Now, what do you need today? You need a little bit less than that; you need only about 46.200 for the fact that you can stake it or gain interest at about 5% a year for the next nine years.

So, if you are trying to dollar cost average by the end, you want 72.000 dollars. But, still, if you could buy it, all right now. So, you’d only need about 46.000 dollars, so that is the first case again, a little bit more bearish though it’s still great returns.

In that scenario, as I said, you would need about 46.000 dollars if you had it today or 46.000 ADA today. So I should say, and that would be about 90.000 worth, give or take from there.

Let’s go to the middle scenario; Bitcoin has now hit the market cap of awesome Gold. Bitcoin is at 607000, Ethereum is still at about half the market cap of Bitcoin.

So now, instead of this weighting of 355 divided by 843, which is not quite 50.

We have had a 50 of the market cap of Bitcoin is currently in Ethereum also. So that’s awesome 5.7 trillion dollars for Ethereum, that would put Ethereum at about 49.000 dollars ADA. We’re going to say it’s the same weighting from where it is now, so it has not gained on Ethereum at all.

We’re just going to say it stayed about the same both of them have grown a lot, but it has not gained at all on Ethereum. It stayed about the same, which would put ADA at about 32 dollars which is awesome, great return about 15x from here. That means you would need about 30.000 ADA now. If you had it today, that’d be about 20.000 ADA because again, nine years where you’re getting roughly 5% interest or staking rewards add up.

Now bold case scenario this is not like pie in the sky Bitcoin hits 20 000 or 20 trillion dollars ADA hits you know 10 or 20 trillion dollars it’s still not that bullish, but we are more bullish here we’re going to say bitcoin hits the same market cap off Gold. I think that’s a really good number to try to strive for one day Ethereum

We’re going to say, has the flipping it grows to as big as Bitcoin, that’s awesome. We’re going to say the ADA is half the size of Ethereum. So now ADA has a 5.7 trillion dollar market cap that would put the price at 177.

I don’t think that this will probably happen because that is such a large increase from here. That’s nearly a 100 x increase from here, but it could happen. I’m not going to say it can’t and then from there. We can see ADA needed would be 5.400 ADA a to need today because you’re getting the 5% interest or staking 3.500 ADA.

So three different scenarios, of course, it’s going to depend on where you think Bitcoin, Ethereum, and ADA are going to be years from now. So, if I had to guess, it’d probably be somewhere in this scenario.

Maybe Bitcoins 7–8 trillion dollars, of course, it could always be much more than Etherium somewhere in the 30000 dollars range, ADA 20–25 dollars which means you would need about an in-between these two.

So maybe about 30.000 ADA, so that is how you retire on ADA of course, I’m not saying to go put all your money in Cardano; I believe in diversification. I think that is good to hold. If you’re going to hold cryptocurrencies, I think it’s good to keep various cryptocurrencies because they all will have their day. They all have different use cases, so definitely consider diversification again.