Think ICO or IEO type of crowd funding. ICOs have come under the scrutiny and attention of Government regulators for their speculative nature and many ICOs have turned out to be total scams. IEOs have sprung up to find a bypass to avoid the regulators scrutiny.Think ICO or IEO type of crowd funding. ICOs have come under the scrutiny and attention of Government regulators for their speculative nature and many ICOs have turned out to be total scams. IEOs have sprung up to find a bypass to avoid the regulators scrutiny.

ICO: Initial Coin Offering often in tandem with a crowd funding or MLM offering. Basically you put up some money and in return you are given tokens which are promised to become coins you can trade on the exchanges. The promoters will publish all their plans as white papers and the reason for the funding is to build out the plan, the dream the construct the technology.

But…

New study says 80 percent of ICOs conducted in 2017 were scams. With 50% of them failing to this day within 4 months and because of this overwhelming failure rate the SEC is hammering down and investors are fleeing from them.

And to make it even worse, 86% of all surviving ICOs their coins are worth far less than the investors paid initially.

Simply put ICOs were a good idea ruined by unethical shysters preying on innocent people.

IEO: What is an IEO? An Initial Exchange Offering, as its name suggests, is conducted on the platform of a cryptocurrency exchange. Contrary to Initial Coin Offerings (ICOs), an IEO is administered by a crypto exchange on behalf of the startup that seeks to raise funds with its newly issued tokens.

IEO participants do not send contributions to a smart contract, such as governs an ICO. Instead, they have to create an account on the exchange’s platform where the IEO is conducted. The contributors then fund their exchange wallets with coins and use those funds to buy the fundraising company’s tokens.

The biggest problem of an IEO is the core problem of too few people owning a majority of the token circulation. This happens mainly because an IEO is limited to one or several exchanges. People that don’t own an account at these exchanges are excluded from the sale, resulting in a small number of people getting their hands on the tokens. Accounts at exchanges need background checks, identity verifications, Know-Your-Customer procedures, all of which takes time. So, if you don’t have an account a day or few days before the IEO, you probably don’t have a chance at participating.

The above reason’s risk is associated to price manipulation. But constricting a coin’s circulation to a single or few exchanges opens up more possibilities for price manipulations, because no one can stop the whales. This also increases the risk of pump and dump schemes. This vulnerability will sway off many investors, because of the risks it poses. That’s why when researching the projects that you want to invest in, you have to take notice of the total token circulation. If the token supply is small and/or is distributed uneven and unfair, it’s highly susceptible to price manipulation and token hoarding.

Exchanges do their due diligence when they list a new token. Risking their reputation if they fail to do so, exchanges are very precise when they list a token, examining and researching the project’s whitepaper, product, team and more so they don’t list a scam project. The shear abundance of scam projects stays in the way of exchanges pursuing to do an IEO. If an exchange makes an IEO, then the token will be listed easier at the exchange, which opens up a vulnerability and strips the project of their obligations to deliver a good product.

Centralized exchanges like most of the big exchanges own the private keys of all wallets and making a trade or a transaction only happens on the exchange and not on the blockchain. That way, investors do not truly own their tokens and most of them don’t trust centralized exchanges. This also opens up the possibility of a failure on the exchange’s part.

When an IEO ends, the token trading starts. But because of the nature of IEO crowdfunding, people that want to invest in the project have to wait for the price to drop. Because of the fact that some investors got a big piece of the pie, these whales can choose to sell for immediate profits, destroying the price of the coin and/or profiting on the expense of small-time investors, removing the incentive to trade the token.

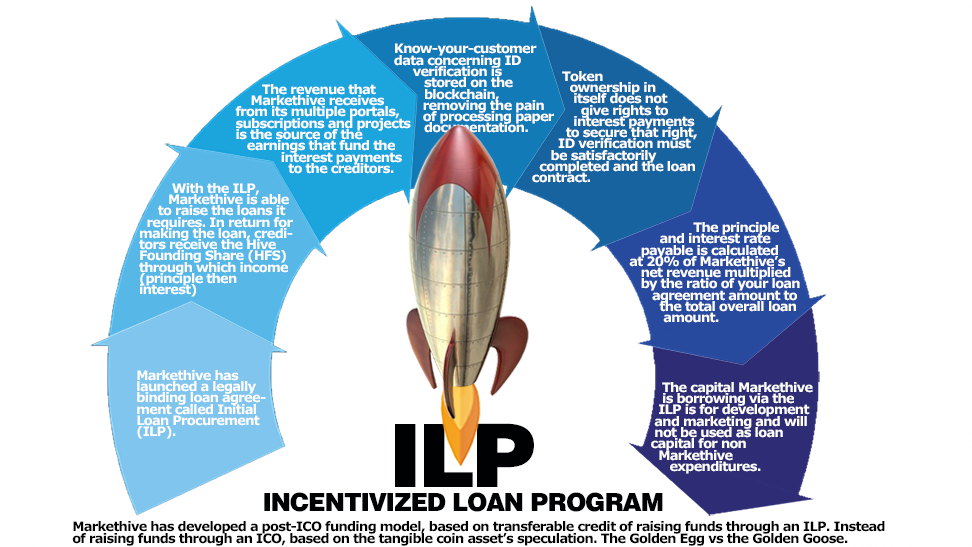

ILP

Not based on speculation but based on performance

Markethive’s ILP means Incentivized Loan Program. Operated independently from or in tandem with crowd funding, the ILPs comparison to the speculative nature of the ICO and IEO ends there. Simply put the ILP means you are lending Markethive money via terms within a smart contract. With attractive interest and loan repayments based on Markethive growth milestones, the ILP also offers and incentive a perk as it is, of a token. This token is based on 1 full token equals one share of about 1000 assigned shares. These shares “share” 20% of the company’s revenue. Revenue projections are based on 4 years of operations with established growth rates in membership signups, revenue upgrades and Alexa growth. In other words, traction.

1 full share is available at $25,000 or fractions of those shares to the single unit 100,000,000th called the BIT. 1 BIT would then be valued at .00025. $100 would acquire 400,000 BITs.

These shares can be traded but more important they will pay out their share of the 20% of the revenue for 20 years based on the ILP token and these tokens will be renewable at term. These shares are also tradeable, assignable and will act similar to a promissory note.

Although Markethive is a global company and will have mining hives and crypto exchanges worldwide, its headquarters reside in Wyoming. Notably, as published in Forbes, Wyoming is the only US state that provides a comprehensive, welcoming legal framework that enables blockchain technology, both for individuals and companies. This is good news for Markethive and its community.

Matthew D. Kaufman of Hathaway & Kunz, LLP, The Wyoming Law Firm™ that was key in the afore mentioned Wyoming legislation is also the Lawyer retained by Markethive, states that “…Wyoming is one of the most blockchain-friendly states in the United States…”

What Are The Benefits Of An ILP?

One of the key benefits of ILPs is the fact they are a form of a loan. These kinds of funds are not taxed as is the case with ICO funding in some jurisdictions where it can be up to 40% as it is seen as income. Due to the crowdfunding aspect of the ILP, it is considered as a loan hence it is completely and totally compliant to the regulatory and UCC code which means it is not a security. The Incentivized Loan Program ™ is within the legal parameters (UCC) that govern the mainstream credit market. Markethive Members who decide to take part in this program are assured that their funds are well protected and cannot dissolve without a trace as seen by some ICO’s (Initial Coin Offering Projects) in the past.

ILPs are also regulatory friendly, in that they can be compliant even with the most stringent regulatory frameworks around the world when it comes to fraud and money laundering. Participants are required to submit identification to show who they are. This solves one of the biggest issues that have seen regulators criticize ICOs severely.

There is no limit to the amount you choose to loan Markethive. The best part is even the small investor can participate by way of the Entrepreneur program at $100 per month. Not only does it unlock the advertising and commerce portals, it earns you a 1/10th share of an ILP for every 12 months that you continuously contribute to the program (limited to the first 1000 Entrepreneur upgrades). That is significant as the ILP will be like a Bitcoin in that it will be able to be broken down into “satoshis” ie: 1 millionth of a coin. So 1 full ILP equals 1 million ILP “satoshis”. This enables Markethive to conduct bounties, rewards, and trading on the ILP. This simply turns the ILP into a cash cow.

SUMMARY ILP:

Very Easy to Participate

Sign up at Markethive.com for a FREE membership and then upgrade to the Entrepreneur level (availability is limited and can end at any given time).

After every continuous year you will receive an additional 1/10 of a full ILP and after 10 years you can accommodate a full ILP token.

Purchase an ILP outright (priorities are given to ILP purchasers)

Thomas Prendergast

Ceo

Markethive

To join for FREE click on the image below: