100 oz. of gold per Bitcoin? Peter Brandt says it’s inevitable

Financial news headlines saw an explosion of comparisons between Bitcoin (BTC) and gold following the launch of the first spot BTC exchange-traded funds (ETFs) in the U.S. and the parallel rallies of both assets to new all-time highs that followed.

But over the past couple of months, chatter about the topic has quieted down as Bitcoin entered consolidation while gold surged to another record high. According to Bloomberg Intelligence senior commodity strategist Mike McGlone, on a relative basis, the surge in BTC price didn’t exceed the peaks it reached versus gold and the S&P 500 in 2021.

“The January US #ETF launches set records for inflows, enhancing Bitcoin's status as a leading indicator, and the hangover may have implications for risk assets,” McGlone tweeted. “It was a near-perfect storm for the benchmark crypto to make new highs in 1Q, but #Bitcoin didn't exceed peaks vs. #gold and the S&P 500 from 2021.”

“Highly volatile and speculative, the 24/7-traded crypto was rising vs. gold the last time the S&P 500 e-mini future crossed above its 50-week moving average in November, but this time the Bitcoin/gold cross is falling,” he added.

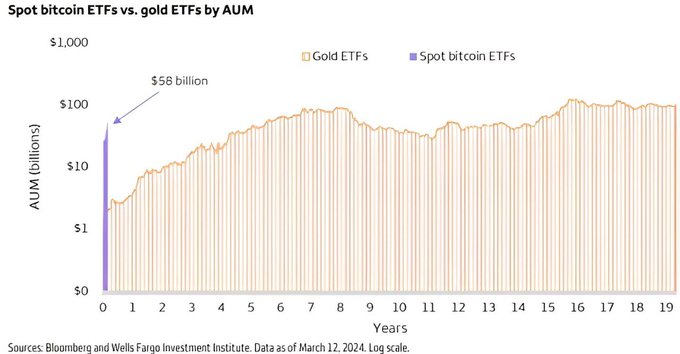

Despite this, most analysts agree that the launch of the first spot BTC ETFs has been a monumental success, with all the ETFs combined surpassing $50 billion in assets under management in record time, taking just 57 days to do what it took gold ETFs 5 years to accomplish.

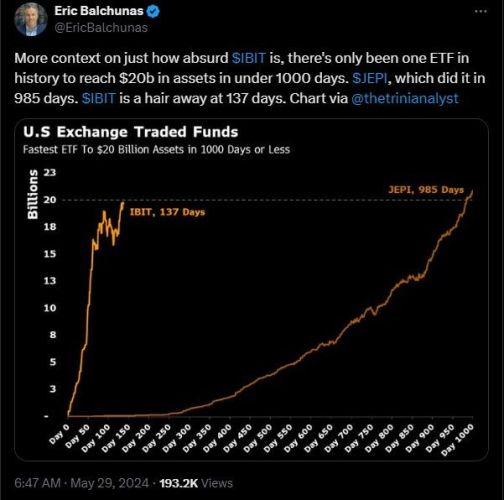

Looking at the ETFs individually, the performance of BlackRock’s iShares Bitcoin Trust (IBIT) stands out as it became the fastest ETF in history to reach $20 billion in assets under management.

After surpassing the Grayscale Bitcoin Trust (GBTC) ETF in AUM earlier this week, IBIT is now targeting the iShares Gold ETF (IAU), which currently holds roughly $29 billion in AUM.

According to Nate Geraci, president of the ETF Store, IBIT could achieve that feat before the end of 2024.

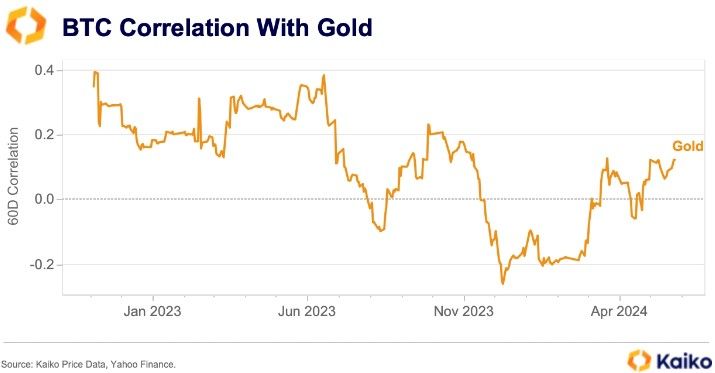

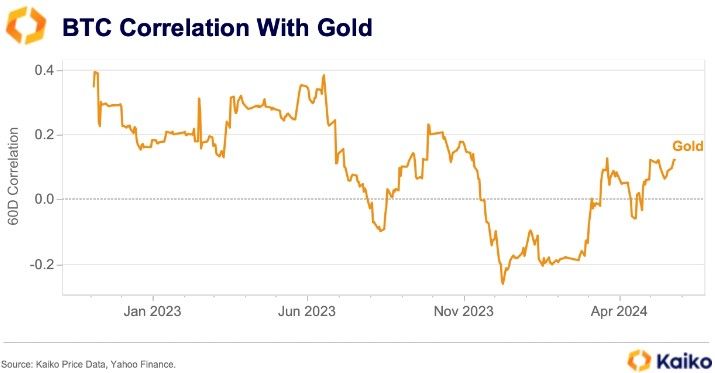

While many analysts have argued that there is room in investor portfolios for both gold and Bitcoin as both offer protection against excessive money printing and currency debasement, data provided by Kaiko shows that the correlation between gold and BTC remains below the 2022 highs, suggesting investors still hold a differing view of the two assets, and Bitcoin may deliver more upside.

“Bitcoin’s 60-day correlation with safe-haven gold has been increasing in April, nearing a yearly high as of last week,” Kaiko said. “However, it remains significantly below its 2022 highs of nearly 50%.”

“Gold has rallied in recent months due to strong central bank demand, even as global gold ETFs have experienced outflows,” they added. “Gold ETF holdings dropped to 3,079 tons in April, the lowest level since February 2020.”

“In contrast, Bitcoin has been primarily driven by ETF demand,” Kaiko said. “Despite Bitcoin’s market cap of $1.3tn remaining low compared to gold’s $16tn, there is significant room for growth. This low correlation and potential for growth boost Bitcoin’s appeal as a portfolio diversifier.”

And according to legendary trader Peter Brandt, while it currently requires around 29 ounces of gold to purchase one Bitcoin, that number could increase to 100 over the next two years depending on how things develop in the markets.

By Jordan Finneseth