10 Investment terms every Crypto Investor should know

HODLing, FUD, wen lambo… to the uninitiated, crypto can sound like a Tolkien novel. So it’s understandable that a new investor might feel intimidated or confused when they’re researching this new investment and find a barrage of funny new slang.

Do you need to know them all? Maybe if you want to fit in on Crypto Twitter, but there are a few key terms the everyday investor should know.

Here are ten investment terms that may be helpful when deciphering market signals, researching your next crypto investment or when speaking to a financial advisor.

A bear market is a market in which share prices are falling, and in a bull market, prices are rising.

A bear market is defined by a 20% fall in share prices from their most recent high for a sustained period of time. This can result in a sellers’ market where investors are more likely to want to sell out of their positions.

On the other hand, investors usually invest during a bull market, also called being ‘bullish’. Many investors also see bear markets as a buying opportunity.

Why it matters: Understanding whether you’re in a bull or bear market can impact your decision to buy or sell.

Used in a sentence: “The BTC market is looking bullish.”

BTD is crypto speak for buying low. It’s when investors buy when the price is going down. For instance, a trader might buy the dip if they believe the price of BTC will go up after a downturn, potentially selling their investment for more than they bought it for, or buying it for what they consider to be cheaper prices and holding onto their BTC for the long term.

Why it matters: Investors that buy the dip can possibly sell their investment for a profit if the price rises in the future.

Used in a sentence: “I saw the ETH price dropped significantly, I’m going to BTD”

Diversification is an investing strategy used to manage risk and open up potential opportunities. This is done by including a range of different investments in your portfolio. Ever heard of the expression, “Don’t put all your eggs in one basket”?

Why it matters: Diversification can help spread risk across your crypto investments. If one goes down in value, another might go up remain stable, thereby mitigating your losses.

Used in a sentence: “I’m buying a variety of payment coins, utility coins and stablecoins to diversify my crypto portfolio.”

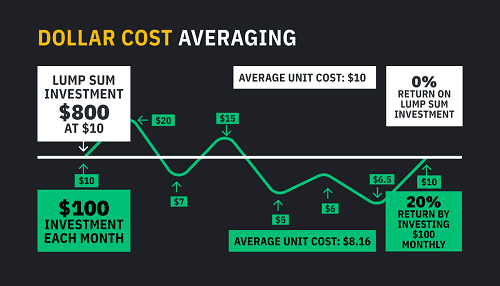

DCA is making regular investments of the same amount at repeated and, usually, scheduled intervals, regardless of the day-to-day price. People who use this strategy argue that it hedges against major market movements, helping to avoid mistiming the market – although it can also limit profits.

Why it matters: DCA is a popular strategy among crypto investors who believe it mitigates the impact of market fluctuations.

Used in a sentence: “I try to minimise the impact of market volatility and make use of DCA.”

Market capitalisation, or market cap, is the market value of a publicly traded company’s outstanding shares. It is calculated by multiplying the number of circulating supply of shares in a company by the current price.

Why it matters: Market cap can be used to compare the popularity and strength of assets. A cryptocurrency’s market cap can be used with other indicators to speculate on how well its performing or if it is likely to grow over time and potentially yield returns.

Used in a sentence: “Bitcoin’s Market Cap was $579.27 billion at the time of writing.”

Pump-and-dump schemes refer to inflating the price of an asset through fraudulent tactics. A group or individual involved in this type of scheme usually promotes, or “pumps”, the value of an asset with false information or hype, and then sells out of their position as the price peaks.

Why it matters: The ability to spot a pump-and-dump scheme is invaluable to a new crypto investor. Remember that if it sounds too good to be true it usually is.

Used in a sentence: “I always do my research and watch out for pump-and-dump schemes.”

Return on investment (ROI) is a measure used to assess an investment’s performance. ROI can be calculated in a number of ways but is most commonly done by dividing an investment’s net profit by its initial cost, and then multiplying that by 100 to get to the percentage.

Why it matters: ROI can be used to make informed decisions about future investments, and can also be used to track the performance of current and past investments.

Used in a sentence: “The potential ROI of some altcoins is attractive, but it’s always best to do your research.”

Risk level refers to the amount of risk a trader is willing to take on – risk being defined by any potential downside in your investments. Every investment involves some degree of risk, but some are considered to be more risky than others. Knowing your risk level will help inform how you would like to build your crypto investment portfolio.

Why it matters: Risk levels can be used to make informed decisions about which investment opportunities aligns with your risk tolerance, and how best to build an investment strategy that works for you.

Used in a sentence: “Diversification is a hedging strategy used by investors with a lower risk level.”

Investor sentiment is an important indication of demand in a particular market and usually coincides with the price being up or down, depending on whether the sentiment is positive or negative. The Fear and Greed Index, for example, uses a number of metrics to build a picture of bitcoin market sentiment. If the index signals Extreme Greed, it suggests there is significant demand for bitcoin. When it’s in Extreme Fear, investors are wary of investing. Some investors believe that a fearful market presents good buying opportunities.

Why it matters: Investors try and gauge market sentiment to see in which direction the markets may move next.

Used in a sentence: “A lot of buyers at the moment points to a greedy market.”

Take a look at our simple guide to bitcoin market indicators to learn how to read the market.

A time horizon is how long an investor plans to hold their investment until they sell. This can be long term, medium term, or short term.

Why it matters: Time horizons determine what kind of assets you invest in and how long you hold your positions.

Used in a sentence: “I have a long-term investment time horizon, so I’m investing in companies and cryptocurrencies that have a strong track record of performance and growth.”

To Invest in Crypto, click HERE

*This information should not be construed as a solicitation to trade. All opinions, news, research, analysis, prices or other information is provided as general market commentary for information purposes only and is not investment advice or recommendation. always obtain your own independent financial advice before investing or trading in cryptocurrency.

(2).jpg)

About: Andries vanTonder

Over 40 years selfemployed

He is a Serial Entrepreneur, an Enthusiastic supporter of Blockchain Technology and a Cryptocurrency Investor

Find me at my Markethive Profile Page | My Twitter Account | My Instagram Acount | and my Facebook Profile.