Africa’s Crypto Market has Grown by $105.6 billion in the last Year

.png)

There is much talk of how crypto is a perfect fit for African markets.

Ten years after we launched the first crypto exchange on the continent, is there truth to this widespread belief? A recent study from ConsenSys and YouGov confirmed that Nigeria and South Africa are two of the top five markets globally where the understanding of digital currencies is highest. The joint population of Nigeria and South Africa is nearly 272 million people. Nigeria is expected to grow its population to more than 377 million people in 2050, according to Statista, up from 213 million in 2021 (sourced from Data Commons).

When multinational companies seek data on crypto adoption in Africa, these countries are always the first I am asked about. However, does this data tell the full picture? The data does suggest that, yes, digital currencies can thrive in Africa, but most of this belief is based on the data around the density of mobile phone use and the strong adoption of mobile money.

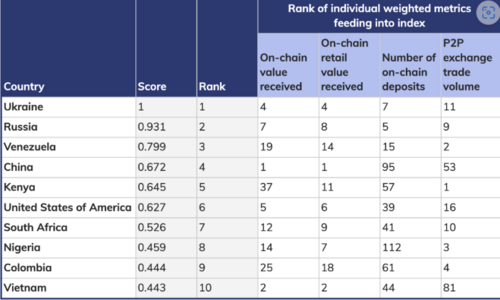

Top 10 Global Crypto Adoption Index 2020 By Chainalysis

With so much familiarity with mobile money, it would seem like African markets are primed for full-scale crypto adoption - but that has not happened in over a decade. This is the wrong question to ask.

Instead, we should ask how soon cryptocurrencies will become a full part of Africa’s exploding fintech landscape.

It is the fintech sector which inherited the leapfrogging innovation of the mobile money pioneers across the continent - and not all of the fintechs want to let crypto in the door.

The statistics show that there is a fundamental shift away from the remaining traditional financial services and towards fintech adoption - especially after COVID - and Africa is building a more efficient and accessible financial ecosystem that outshines nearly every other continent.

Yet, when discussions come up about crypto or web3 adoption in Africa, fintech statistics are often quoted as a proof point instead of the other way around. There are plenty of numbers to choose from, but recently, Disrupt Africa reported that African fintech startups have raised more than $2.7 billion (U.S. dollars) in the last two years, and Finextra/McKinsey reported that African fintech was expected to hit $230 billion in revenues by 2025. Fintechs using crypto are still in the minority.

Tokenization of financial flows is vastly cheaper than building nations. On the back of it, the process itself can spur the growth of real assets. This is where some countries in Africa are finding themselves.

Africa is the second-most-populous continent in the world, with around 1.3 billion people. Due to historic issues with colonialism, civil wars, and harsh terrains, African countries have suffered from infrastructure problems for a long time. This has made financial services less accessible, leading to around 57% of the population remaining unbanked.

At the same time, underdeveloped infrastructure has made Africa a perfect vector for cryptocurrencies, which only require a smartphone to access blockchain networks. We had previously covered Africa’s most populous nation, Nigeria, as the vanguard of crypto adoption for the entire world.

Thanks to the latest research by Chainalysis Insights, we can take a zoomed-out picture of Africa’s crypto adoption and its likely global impact.

According to the World Bank, the median GDP per capita in Sub-Saharan Africa is $1,483. Compared to the European Union, which has a GDP per capita at $33,927, this makes African wealth output 22X lower. Correspondingly, the Chainanalysis report found that Africa’s cryptocurrency market share is the smallest.

In raw numbers, this translates to $105.6 billion worth of crypto assets between July 2020 and June 2021, accounting for 1,200% crypto value growth. Using this metric, Africa has topped peer-to-peer (P2P) payment platforms in terms of transaction volume across all regions.

Not only has Africa’s cryptocurrency market grown over 1200% by value received in the last year, but the region also has some of the highest grassroots adoption in the world, with Kenya, Nigeria, South Africa, and Tanzania all ranking in the top 20 of our Global Crypto Adoption Index.

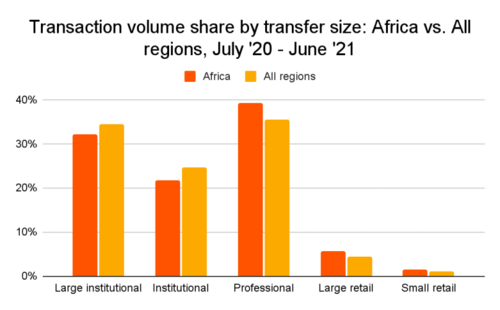

As Chainalysis reports, crypto adoption growth in Africa has been most substantial among retailers and non-institutional traders, which is in stark contrast to the landscape in developed countries where institutional investments are fundamental to the ecosystem.

Africa has topped peer-to-peer (P2P) payment platforms in terms of transaction volume across all regions. Image: Chainalysis Insights

As you can see, Bitcoin continues to lead the way as the dominant and most popular cryptocurrency. Once we factor in that central banks of most African countries are hostile to cryptocurrency exchanges, Africa is left in a situation where P2P platforms are the only viable solution – unless they use VPNs to access servers in other countries.

In the best-case scenario, a central bank may leave the cryptocurrency sector unregulated. For instance, the Central Bank of Kenya issued a notice in December 2015 to not engage in Bitcoin trading, warning that:

“There is no underlying or backing of assets and the value of virtual currencies is speculative in nature. This may result in high volatility in value of virtual currencies thus exposing users to potential losses.”

Interestingly, since that proclamation, Bitcoin has gained over 11,000% in value while Kenyan Shilling (KES) has lost 7% of its value. The Central Bank of Nigeria (CBN) made similar edicts, banning all banks in 2017 from using, holding, trading and transacting in cryptocurrencies. Predictably, its currency Naira (NGN) dropped by nearly 52% in the meantime.

As the most populous African nation with over 201 million citizens, Nigeria was hit hard by Covid-19 lockdowns. Compared to a year ago, food prices have increased by 20%, while the inflation rate seems to be winding down, currently settling at 17%.

Kenya, with its 53 million people, has experienced a similar spike in inflation; though less dramatic at only 6.57% compared to 4.2% a year prior. From these indicators we can conclude that uptick in P2P transaction volume will accelerate unabated, driven by:

On that last note, Africans are already accustomed to using phones for payments thanks to the widely popular M-Pesa that originated from Kenya. When we covered Celo as a blockchain alternative to M-Pesa, we noted that while 11% of Ugandans have a bank account, 43% use a mobile payment account. It is then a small step to go from a fiat-based P2P to a blockchain-based P2P.

“Financial problems the region is experiencing are forcing people to look for new instruments and technologies that can give them some of the economic freedom they currently lack.”

Understanding the world of cryptocurrency

Part of the problem surrounding cryptocurrency adoption in Africa, besides the lack of reliable and affordable internet, particularly beyond urban areas, is the varying level of financial literacy.

Most people are not conscious of investment types beyond the basics like real estate or stocks. Even those who hear about certain billionaires probably don’t know much about how they built their wealth, beyond thinking that it has something to do with money.

The longer it takes this information to get to the general public, especially the younger generation, the less likely they will be to aspire to this in the first place

Money will be money. It has taken many forms, from paper notes to tulips, but its role as a unit of account, store of value, and medium of exchange will remain. As technology develops, cryptocurrencies could be the next iteration in humanity’s experiment with money.

*We are not financial advisors. In order to make the best financial decision that suits your own needs, you must conduct your own research and seek the advice of a licensed financial advisor if necessary. Know that all investments involve some form of risk and there is no guarantee that you will be successful in making, saving, or investing money; nor is there any guarantee that you won't experience any loss when investing.

Always remember to make smart decisions and do your own research!

Buy, store, and manage your investments with confidence

To Invest in Crypto, click HERE

Join Markethive - the only Market Network on Blockchain, click HERE

(9).jpg)

About: Andries vanTonder

Over 40 years selfemployed

He is a Serial Entrepreneur, an Enthusiastic supporter of Blockchain Technology and a Cryptocurrency Investor

Find me at my Markethive Profile Page | My Twitter Account | My Instagram Acount | and my Facebook Profile.