By Matt Hussey

There was blood on the streets of crypto as a mass market sell off became one of the industry’s biggest ever daily losses.

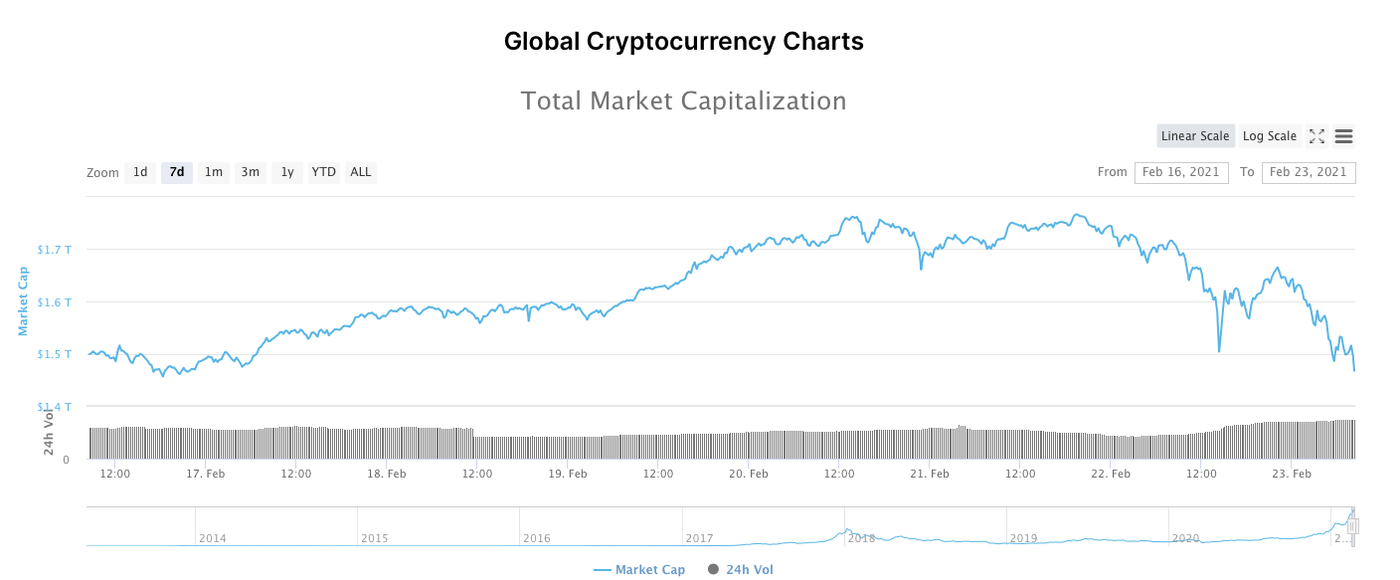

On Sunday, global market cap sat at an all time high of $1.76 trillion. At the time of writing, it’s down to $1.46 and appears to be on a steep downward trajectory.

Global Market Cap in decline. IMAGE: CoinMarketCap

As prices tumbled, trading volume ballooned as investors attempted to bailout. Trading volume is up 60% market wide, with some $243 billion changing hands in 24 hours, according to CoinMarketCap.

The biggest drop was Bitcoin. From highs of $58,000 over the weekend it went to $47,700 in just 19 hours. This was the largest single-day fall Bitcoin has ever seen.

The loss has seen the world’s largest cryptocurrency lose its $1 trillion valuation. At the time of writing, it’s down $96 billion.

Commentators have been quick to point out this is all just part of Bitcoin’s cyclical price movements.

Others expressed relief that the sell off had at last happened, including ardent Bitcoin supporter Raoul Pal.

Why the sudden sell off? While many crypto watchers feel its part of Bitcoin and crypto's normal operating cycle, it’s this column’s contention that big events are often explained by forces outside of the industry in question.

Market Watch has always tried to bind stocks and bonds more closely to crypto as digital money becomes a more integral part of the global financial system and the two become more inextricably linked.

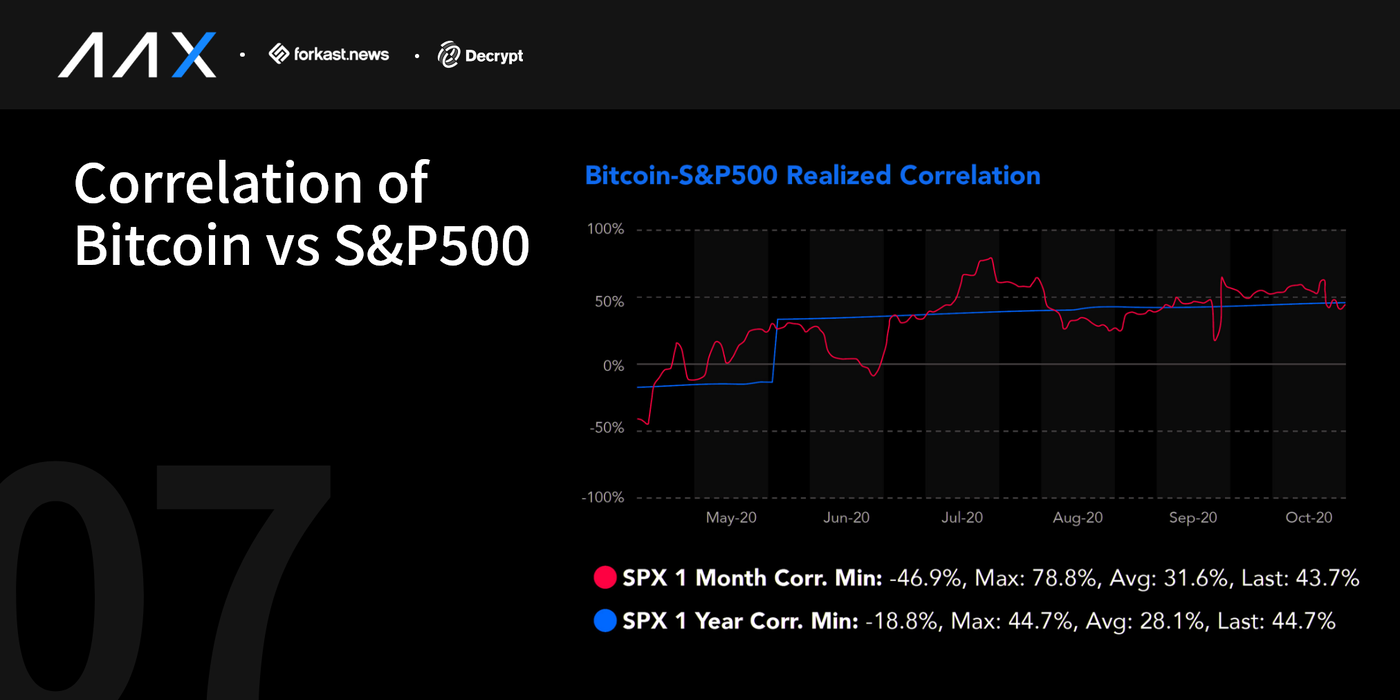

In March 2020, the US stock market tanked as Covid set in. Bitcoin’s price did the same. But then something strange happened: they both bounced back. The correlation between the S&P 500 and Bitcoin started to more closely intertwine.

Bitcoin and S&P 500 correlation. IMAGE: Decrypt

If we look at what happened on Wall Street yesterday, we can see a similar pattern: tech stocks took a bath.

The Nasdaq, the home of big tech stocks closed down 2.46%, which is a lot. Tesla lost 8.5%, Paypal was down 4.6, Apple lost 3%, Microsoft 2.6% and the list goes on. These, along with cryptocurrencies were all havens for investors that had gone looking for assets that weren’t affected by the closing of the global economy.

Your daily dose of cryptocurrency news, learning, gossip, and discussions. Listen

But yesterday, bond yields, one of the less explored and let’s face it, drearier sides of markets suddenly shot up. This is important.

Bond yields act as a useful indicator of the direction of interest rates and, more generally, future economic activity. When bond yields are low, investors tend to go in search of better performing, and typically, more risky stocks elsewhere. Hello crypto!

When bond yields start to shoot up, investors flock back to them, selling off their shares in stocks to park their money in the safety of predictable returns.

Yesterday, US Treasury bonds rose to their highest level in a year. While some investors see this as a positive sign, others see it as a signal that markets are overheating, and that stock market growth may be coming to a close.

"There's good reasons for yields to go up: economic activity. And there's bad reasons: inflation," Mohamed El-Erian, Allianz’s chief economic advisor, told CNBC on Monday. "Economists, even those who have long supported a big fiscal push, are saying be careful. Going big may be too big."

There's renewed fear that Joe Biden's massive $1.9 trillion stimulus bill will push the economic recovery off a cliff, leading to inflation and a devaluation of the US dollar. These fears have been building over the last week.

Mark Zandi, credit-ratings agency Moody’s chief economist said overvalued assets such as stocks, and cryptocurrencies, are the biggest risk to the economic recovery. He said the sky-high valuations that both markets have been experiencing are vulnerable to major crashes that could reverberate through the entire economy.

So while the crypto-believers are content with the notion that "some things just crash" more astute investors would be wise to focus on the bigger picture and plan accordingly.