.png)

In brief

It’s been a rollercoaster ride for the crypto markets this week. On Monday we saw prices crash in what turned out to be the biggest daily drop in Bitcoin’s history.

Yesterday, the broader market swung the other way, recovering nearly $60 billion in global market cap passing the $1 trillion milestone.

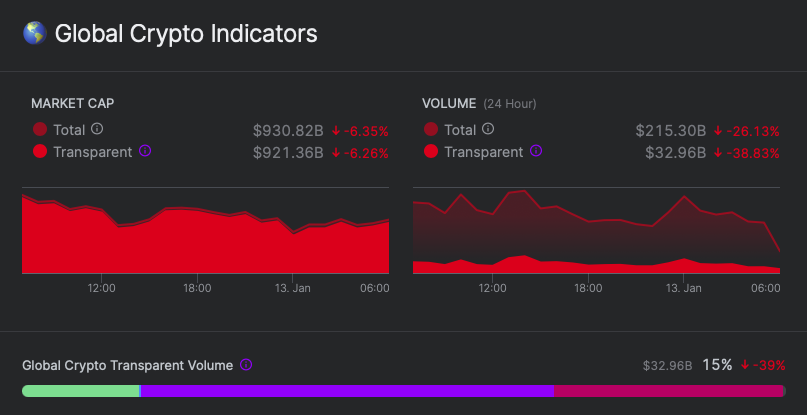

Today we’re back where we started on Monday. Global market cap is back in the low $930s, according to data provided by Nomics and Bitcoin’s price is down 5%. It’s a similar story elsewhere.

Crypto's rollercoaster ride. IMAGE: Nomics

Ethereum is down 8%, Cardano 6%, Litecoin and Bitcoin Cash down 8% and 7% respectively, and Hex, yesterday’s biggest mover, drumped 17% off its price.

But while schmucks like the Market Report clamour to cover these changes, for the Bitcoin whales, it’s just another day at the office, according to BitInfoCharts, a tracking site for the world’s biggest wallet addresses.

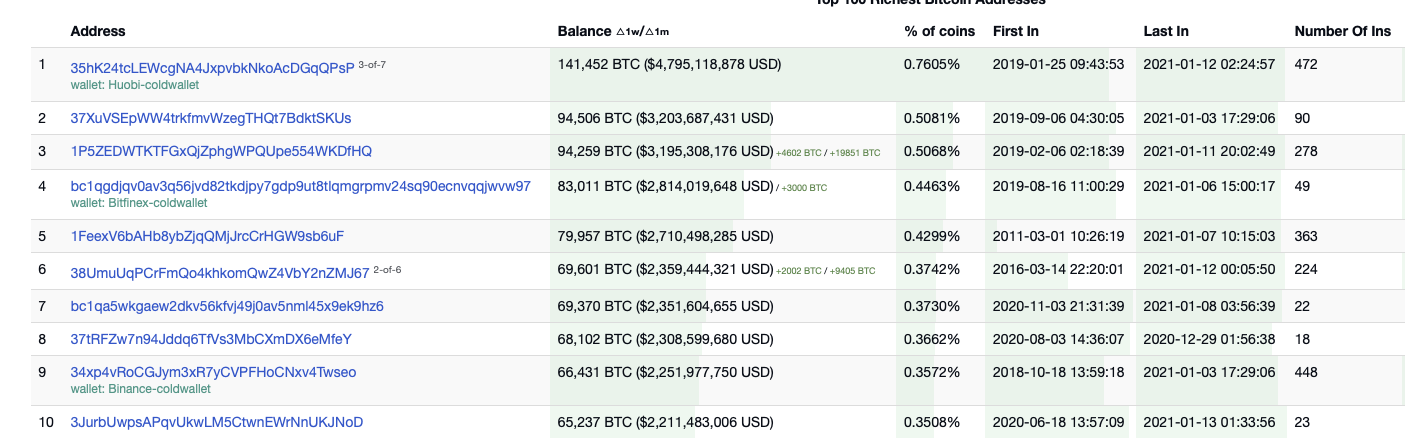

Whale Watching. IMAGE: BitInfoCharts

Of the 10 largest wallets currently being tracked, half have not moved a muscle in recent weeks. Three of those wallets however, have been moving Bitcoin like there’s no tomorrow.

The largest known wallet in the top 10, Bitfinex’s cold wallet storage added 3,000 BTC in the last week, whereas the world’s third-largest wallet, moved 4,602 BTC this week, and just shy 20,000 BTC over the course of the month. Another anonymous wallet followed suit. For reference, that’s more than $8 billion worth of Bitcoin moving in those three wallets alone.

Looking lower down the big wallet charts, in the top 50, only seven wallets took Bitcoin out of these wallets in the last week. What does this mean? It means those mega HODLers appear to have taken a longer-term view of Bitcoin’s price fluctuations and see the current turbulence as little more than that.

Maybe the rest of us should take a note out of their playbook.

The three major indexes on Wall Street closed yesterday with a mixture of optimism and gloom. On the former, the S&P 500 and Dow all went higher, with the S&P now just 0.6% away from its recent all-time closing. If you're a tech stockholder however, things aren't quite as rosy.

The Nasdaq sank as tech stocks came under renewed pressure from regulators. There's been a move back into energy stocks – the laggards throughout 2020 – thanks to crude oil prices passing the $50 barrel mark for the first time in 10 months.

While glancing at what's happening in US politics, you'd have thought that things would be more choppy (see: Donald Trump's historic second impeachment), but investors appear to have largely looked through the recent political turmoil in Washington to what is widely expected to be another big year for markets as the Democrats unveil their significantly larger stimulus package than the Republicans, and the world slowly recovers from the ravages of COVID.