Court rules that XRP sold on public Exchanges is not a Security, but what could it mean for the Future of Crypto?

A New York court recently ruled that the sale of XRP to retail investors since 2013 could not be considered securities as they did not count as investment contracts.

The victory was a partial one for Ripple, the company behind XRP, as the judge also ruled that sales of XRP to institutional investors did, however, count as securities.

Nevertheless, the ruling essentially said that XRP sold on public exchanges were not securities, which could have profound implications for other cryptocurrencies that the Securities and Exchange Commission in the US (SEC) have labelled securities.

Ripple Chief Executive Brad Garlinghouse said the ruling was “a huge win for Ripple but more importantly for the industry overall in the US.”

The ruling sent the payments cryptocurrency surging more than 60% in the following days, taking along other cryptocurrencies such as Solana, Avalanche, Cardano and Polygon with it. “Investors have been on the sidelines due to the SEC having a very public and harsh view on crypto,” Charles Storry, head of growth at crypto index platform Phuture told CoinDesk. “The Ripple case ruling has been the start of some of that capital beginning to enter the space.”

The US Securities Act was introduced in 1933 to provide transparency about companies selling investments deemed contracts by the SEC, with the ultimate goal of protecting investors.

The SEC is in charge of the securities markets in the US, meaning it oversees the processes behind companies going public and the exchanges that provide the marketplaces where their stocks are traded. Applying the same rules it does to stocks, the SEC says, retrospectively, that many cryptocurrencies are securities under the Howey Test.

As Lydia Beyoud and Allyson Versprille report in the Wall Street Journal, it comes down to “how much it looks like shares issued by a company raising money.” The SEC claims most companies behind cryptocurrency networks have been selling securities without registering with the SEC first.

“Bitcoin is not considered a security because its anonymous and open-source origins mean investor profits are not dependent on the efforts of developers or managers, Carol Goforth, a law professor at the University of Arkansas,” explained to Reuters.

In 1946, the Supreme Court ruled in its landmark decision in the SEC vs Howey and Co. that transactions are investment contracts or securities if:

In other words, an asset is a security when people invest money with the expectation of making more money through that particular company’s efforts. If investors buy Tesla stock, for example, they expect the share price to go up as Tesla sells more and more electric vehicles, or so they hope.

This explains why the SEC has repeatedly said Bitcoin is not a security, as there’s no central company behind the network, while it argues that other crypto networks are, the ones that have centralised companies behind the issuance of these cryptocurrencies, particularly those that have raised money by issuing cryptocurrencies.

Regarding Ripple, the SEC said the company issued XRP to raise funds in the same way that companies issue shares to raise capital.

Judge Analisa Torres ruled that Ripple’s XRP sales on public cryptocurrency exchanges were not offers of securities, because buyers did not have an expectation of profit tied to Ripple the company’s efforts, but were rather “blind bid/ask transactions,” as reported by Reuters. “[Buyers] could not have known if their payments of money went to Ripple, or any other seller of XRP,” the judge said.

As for the ruling around XRP and institutional investors, Ripple “was pitching a speculative value proposition for XRP”, an expectation of profit, according to the Howey Test, and so could be classified as a security.

Judge Torres added that the SEC had not given clear guidance about which digital assets could be seen as securities. “Under Chair Gensler, the SEC has not issued a single rule on crypto assets, nor has it given any clear guidance,” she said.

As Mitchell Martin writes in Forbes, “Although the district court decision is not binding elsewhere and may be appealed, it does indicate that the SEC’s insistence that most digital assets are securities that should be registered – which is impossible to do under current regulations – can be successfully challenged.” The SEC said it’s assessing the ruling and will appeal.

“This seems to poke some holes in the SEC’s arguments that all crypto assets other than bitcoin are securities,” said Adam Blumber, a financial planner and co-founder of Interaxis, a crypto education platform.

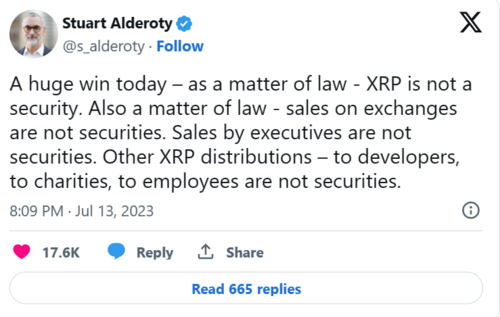

“In its ruling, the Court distinguished between the token itself, and the manner in which it was sold declaring XRP, in and of itself, is not an investment contract. This decision will have profound consequences on how digital tokens are classified in the US moving forward,” said Ripple Chief Legal Officer Stu Alderoty. “The Court’s ruling can now be used by others in the agency’s crosshairs.”

Visit the HERE to learn more about cryptocurrency and investing.

Join Markethive - a Huge Community of Crypto Entrepreneurs (The First Market Network Built on Blockchain) click HERE

NB. We always advises you to obtain your own independent financial advice before investing or trading in cryptocurrency.

.png)

About: Andries vanTonder

Over 40 years selfemployed

He is a Serial Entrepreneur, an Enthusiastic supporter of Blockchain Technology and a Cryptocurrency Investor

Find me at my Markethive Profile Page | My Twitter Account | My Instagram Acount | and my Facebook Profile.