Bitcoin "mining" refers to the activity of generating new BTC. Image: Shutterstock

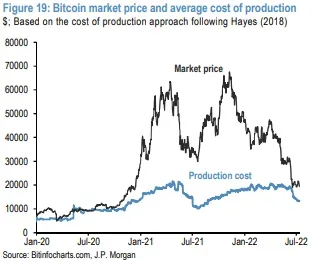

In a recent report seen by Decrypt, investment bank JPMorgan estimates that the production cost to mine one Bitcoin has dropped from $24,000 at the start of June to just $13,000.

Bitcoin’s production cost is an estimate of the average cost for mining one Bitcoin per day. This cost depends primarily on the electricity costs incurred by miners for running their machines, but there are other variables.

So long as the price of Bitcoin holds above this cost, a mining operation remains profitable, and many market observers suggest that production costs also can serve “as the lower bound of Bitcoin’s price range in a bear market.”

According to the New York-based bank, Bitcoin’s bottom could very well be a lowly $13,000, marking a 45% drop from today’s prices.

“While clearly helping miners’ profitability and potentially reducing pressures on miners to sell Bitcoin holdings to raise liquidity or for deleveraging, the decline in the production cost might be perceived as negative for the Bitcoin price outlook going forward,” JPMorgan strategists, led by Nikolaos Panigirtzoglou, wrote.

They based their estimates primarily on the decrease in electricity use as miners deploy more power-efficient mining rigs.

Still, other metrics paint a slightly different picture for the leading cryptocurrency.

According to data pulled from MacroMicro, for instance, the production cost still hovers at a little over $17,700. “When mining costs are lower than Bitcoin’s market value, more miners will join. When mining costs are higher than miner’s revenue, number of miners will decrease,” the data provider’s site explains.

Both entities calculate Bitcoin’s production cost using Cambridge Bitcoin Electricity Consumption Index (CBECI) data. However, the data provided by CBECI depends on the average electricity costs of the miner, which can deviate widely and affect calculations.

Other costs, including infrastructure, hardware, and hiring employees to maintain mining farms, can also vary.

“The cost of production varies greatly based on the kind of rigs, and the cost of power, but also labor costs and facility maintenance,” Zach Bradford, CEO of Bitcoin mining firm CleanSpark, confirmed with Decrypt.

Bradford added that his team’s analysis puts the production cost even lower than JPMorgan’s.

“With the majority of public miners running latest [generation] rigs, and with strategic power management contracts in place, our internal research puts the number closer to $12,000 for public miners,” he said. “But even within a company, it will vary by facility. CleanSpark, for example, has facilities that are lower than that.”

That means that as long as Bitcoin stays above $12,000, public miners would still turn a profit.

Regardless of the differences in production costs, almost all miners have come under pressure following Bitcoin’s catastrophic plunge since November.

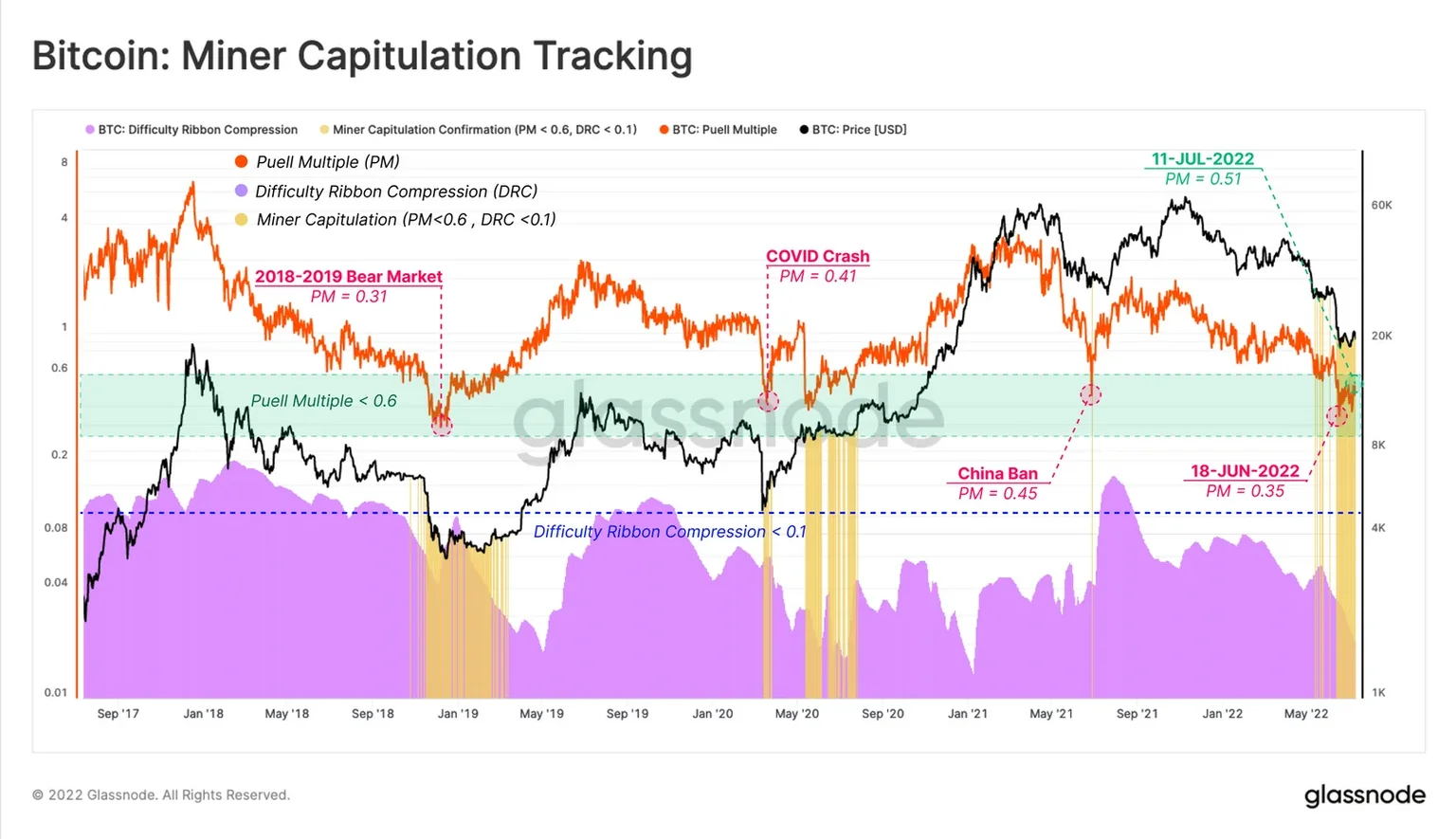

Glassnode has outlined this stress using something called the Puell Multiple.

This mathematical model measures the overall income for Bitcoin miners; when the metric is especially low, miners are earning less on average and are more likely to either sell Bitcoin holdings or shutter some machines. These days, they’re certainly earning a lot less than in the past.

“Bitcoin miners are earning just 49% as much as the 12-month average. This implies miner income stress is a likely factor,” Glassnode wrote in a recent report.

Events like the COVID crash, China’s crypto ban, and recent price action all correlate with a low Puell Multiple, as well as broader miner capitulation.

As the Puell Multiple (orange) drops, the risk of miner capitulation (yellow) rises as miners become less profitable and may be forced to sell their holdings. Image: Glassnode.

Recent headlines also confirm as much.

Last month, publicly traded Bitcoin miner Core Scientific Inc. sold nearly 7,000 Bitcoin at an average price of $23,000. Similarly, Algo Blockchain also sold roughly $15.6 million in the leading cryptocurrency to cover costs.

From a quick glance at their stock prices, public mining companies have also been hugely affected by the brutal cryptocurrency bear market.

Marathon Digital Holdings is down 73% year-to-date, Riot Blockchain Inc. is down 73% year-to-date, and Core Scientific Inc. shed 81% year to date. And if Bitcoin continues to tumble, so too could these figures.