In brief

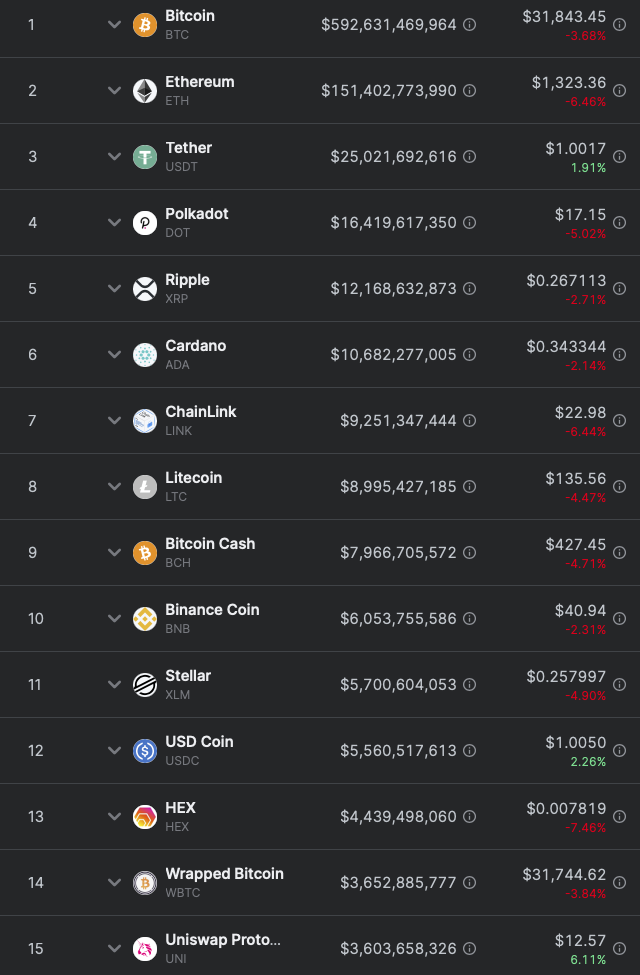

The global crypto market turned red today as almost all currencies saw losses. Globally, assets lost just shy of 6% taking the global market cap below $950 billion.

The biggest losers were Ethereum, down nearly 8%, Chainlink down 8.2% and DeFi project Synthetix racking up 12.2% in losses. In fact, every project was down bar Uniswap, which continued its impressive growth with a 1.3% gain. Not bad considering all other projects in the top 20 (bar stablecoins) lost value.

A sea of red (except for Uniswap). IMAGE: Nomics.

The fervor of early January appears to given way to a more considered approach to investing. Over on the Fear and Greed Index, which had been sat in the 90s at the beginning of the month, has fallen off sharply into the 70s, as investor confidence ebbs.

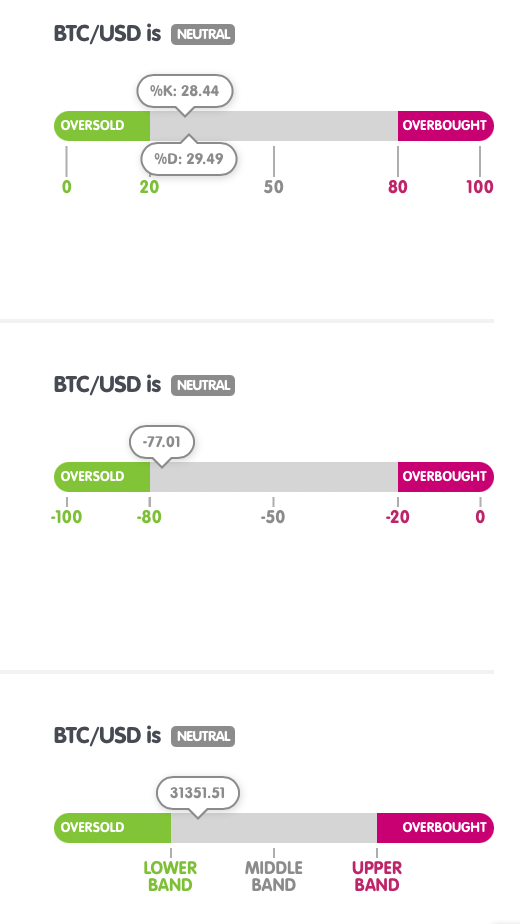

But one man’s loss is another man’s opportunity to pick up undervalued Bitcoin. As sentiment turns more bearish, technical indicators suggest there’s opportunity for acquisition.

The stochastic indicator has BTC against the USD in the high 20s, which is just above the oversold position. The same can be said when looking at the Williams %R and the Bollinger Bands charts, according to analytics site Market Milk.

Technical indicators. IMAGE: Market Milk

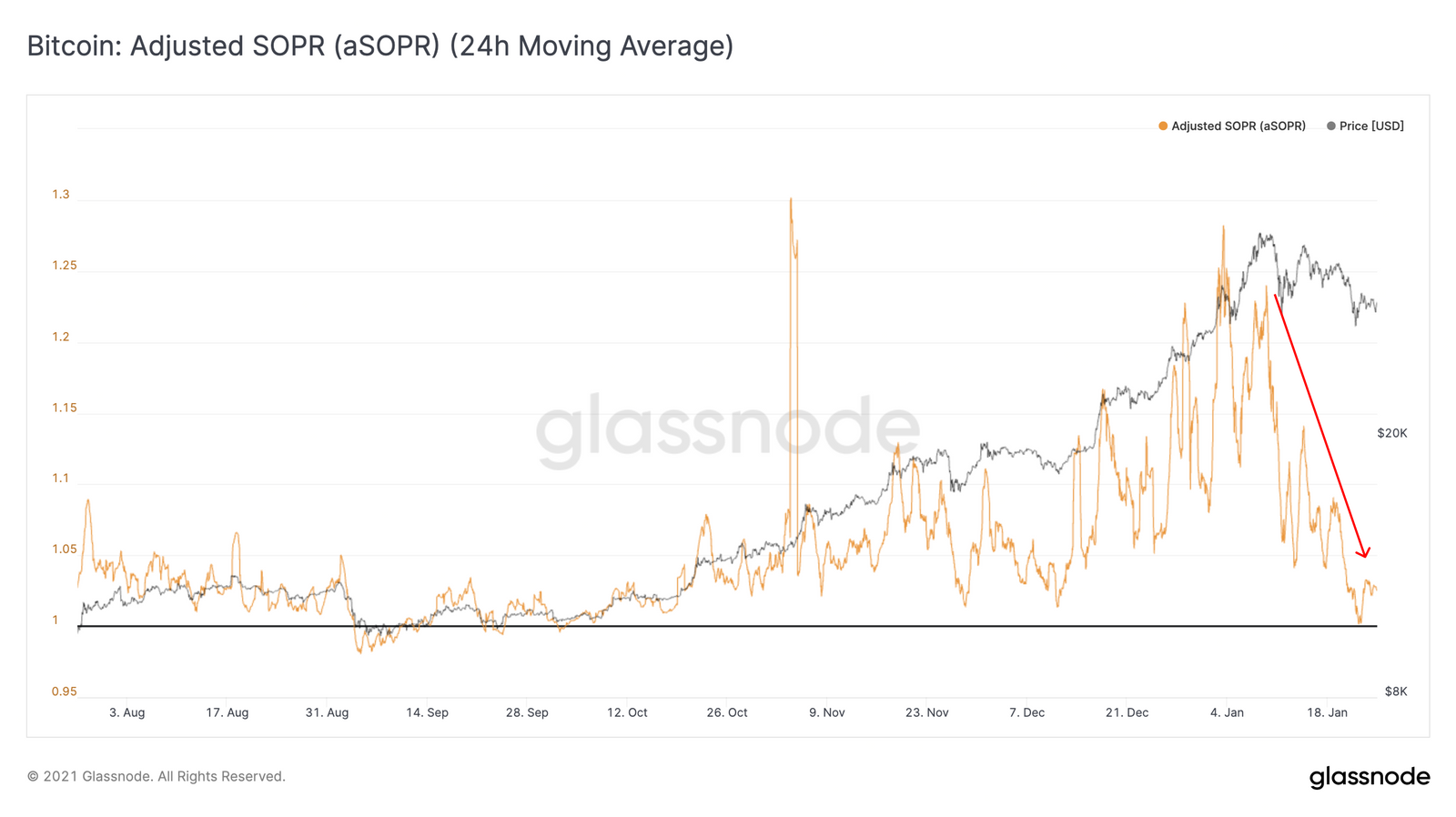

Indeed, according to a report published by data aggregator site Glassnode, the decline in Bitcoin and asset prices more broadly is unlikely to continue as investors would have to sell their holdings at a loss.

According to Bitcoin’s aSOPR, or Spent Output Profit Ratio, a measure of the profit ratio of assets when they were last moved on chain, BTC is now settling back into a more settled rhythm.

“In order for SOPR to go lower, investors would have to be willing to sell at a loss, which is unlikely given the current shape of the market,” says the report.

Bitcoin's aSOPR chart. IMAGE: Glassnode

According to Glassnode’s own version of the Fear and Greed Index, the Net Unrealized Profit/Loss chart, Bitcoin is still in rude health as an investment asset. The pull back from $40,000 is seen as a consolidation rather than capitulation.

So while today might be bad news for day traders, the overall outlook appears to be, “it’s just another day in crypto land.”

It was a double whammy on Wall Street yesterday, as both the S&P 500 and Nasdaq hit record closing highs at the end of the regular session.

Tech stocks drove the rally on the back of what is expected to be positive earnings reports from tech giants Apple and Facebook. Tim Cook's Apple closed up 2.7% yesterday, Facebook was up 1.28%, Microsoft and Google were also up too. Yesterday's best performer was Tesla, which gained 4.12% in a day's trading.

Get Daily Digest for the best of Decrypt. News, original features and more.

There's also broader positive sentiment in the markets around the expected $1.9 trillion fiscal stimulus due to be passed by the Biden White House. While news yesterday emerged that the bill will likely be delayed until mid-March, as Biden looks to unify the Senate by allowing more debate about the size and scope of the bail out, the outlook still points to a bumper year for the US economy.