.png)

Solana is the network behind the SOL cryptocurrency. Image: Shutterstock

It’s been a choppy week for Solana.

The 15th-largest cryptocurrency by market capitalization has lost 41.2% of its value over the past week, according to data from Coingecko.

SOL, Solana’s native token, dropped from $20.16 on November 9 to $14.24 at press time, making it the worst performer among the top-100 cryptocurrencies by market capitalization.

Owing to the week’s bearish price action, SOL is down nearly 94.5% from its all-time high of $259.96 recorded in November 2021, per data from Coingecko.

Solana is a proof-of-stake (PoS) layer-1 blockchain network that allows developers to create decentralized finance applications (DeFi) and non-fungible tokens (NFTs).

Solana offers stiff competition to Ethereum and is often called an Ethereum Killer. But the recent collapse of one of its key backers, FTX, would threaten its title.

On a monthly note, SOL lost nearly $8.5 billion in market value as the native token nosedived, losing more than half of its value over the same period.

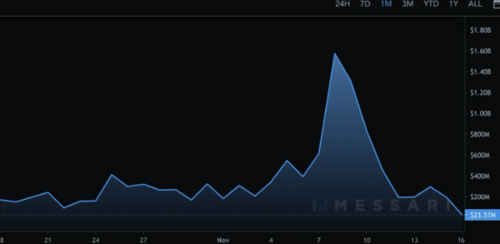

According to data from Messari, SOL’s daily spot trading volume slumped 85% from $1.31 billion to just above $196 million over the past week as investors shied away from the asset. Reduction in daily trading volumes makes the asset insolvent over time.

Solana's daily trading volume over the last 30 days. Source: Messari.

Over $89.474 million of Solana futures positions were liquidated over the past 24 hours, per data from Coinglass. Of the total liquidations, 49.94% of the positions totaling $44.69 million were long trades.

Green bars indicate blown-out long trades. Source: Coinglass.

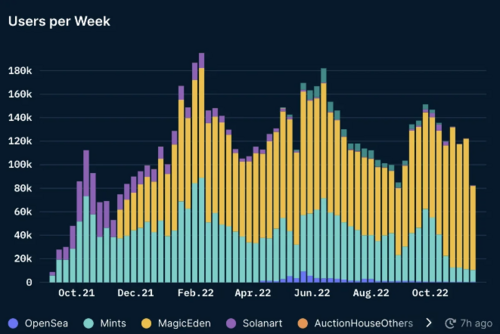

Alongside the ties to FTX, a significant drop in Solana-based NFT activity is also a primary driver behind the token’s fall.

NFTs played a substantial role in the network’s success early this year.

According to data from Nansen, the total weekly users across different NFT platforms on Solana dropped over 33% from 122,410 the previous week to 81,811 this week.

Though Solana has been hit the hardest, the broader crypto market has also taken a hefty blow from the FTX collapse.

The industry’s market capitalization has fallen 8% to slightly above $883 billion over the past week.

Over the past week, leading assets, Bitcoin (BTC) and Ethereum (ETH) have also lost 9.7% and 7.5%, respectively.

DISCLAIMER

THE VIEWS AND OPINIONS EXPRESSED BY THE AUTHOR ARE FOR INFORMATIONAL PURPOSES ONLY AND DO NOT CONSTITUTE FINANCIAL, INVESTMENT, OR OTHER ADVICE.