In brief

At the end of the day, prices in free markets typically come down to two factors: supply and demand.

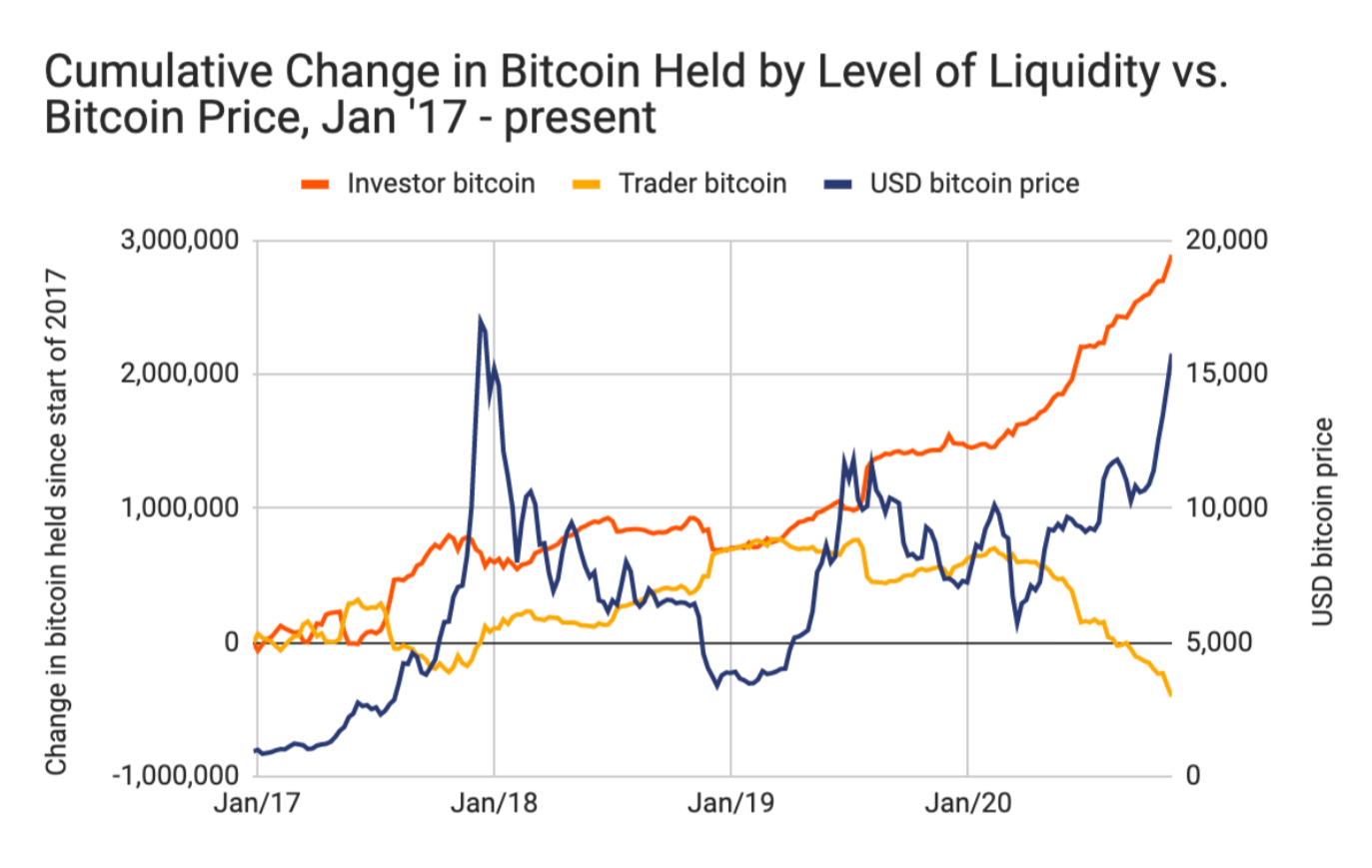

So, it should be no surprise that Bitcoin's recent surge—from under $12,000 a month ago to nearly $18,000 today—is the result of strong demand amid depressed supply. But who wants it? And why exactly can't they get enough?

New research from blockchain analytics firm Chainalysis indicates that institutional investors are primarily to thank (or blame, depending on your perspective) for the supply drought and subsequent price increase.

“While the total supply of Bitcoin grows every day as more is mined, the actual amount available to buy depends on whether holders want to sell or trade it,” it wrote in a blog post today. Currently, 77% of all 14.8 million Bitcoin that have been mined (but not presumed lost) are in illiquid wallets, which it classifies as a wallet that has sent "less than 25% of Bitcoin they’ve ever received."

Bitcoin liquidity and price over time. Image: Chainalysis

“That leaves a pool of just 3.4 million Bitcoin readily available to buyers as demand increases,” said Chainalysis.

It points to corporate investments by Square and MicroStrategy as well as well-publicized statements from hedge fund manager Paul Tudor Jones as indications of increased institutional investment.

That’s benefitted North American exchanges, who have seen increasing net inflows of Bitcoin since January 2020.

“This is what we would expect to see,” said Chainalysis, “as the institutional investors driving the current surge, themselves primarily based in North America and Europe, are more likely to buy Bitcoin on these exchanges for both ease of use and regulatory reasons.”

And when they buy it, those investors hold on to it.