By Tim Hakki

Image: Shutterstock

This week in coins. Illustration by Mitchell Preffer for Decrypt.

Despite the ongoing cypto bear market, many top cryptocurrencies posted double-digit percentage gains over the week.

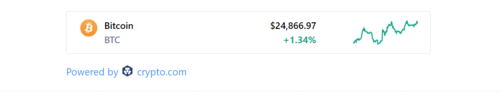

Bitcoin had no such luck. Bitcoin only rose 5.5% over the last seven days and currently trades for $24,460 according to CoinMarketCap.

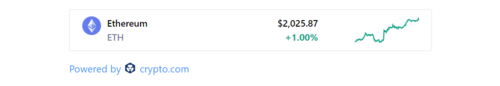

Ethereum rallied much harder. The No. 2 cryptocurrency and leading blockchain for high-functionality smart contracts is up 16% in the past week to $1,984 at the time of writing, after peaking at $2,012 late on Friday night.

The excitement around ETH is all about the upcoming merge, when Ethereum will transition to a more energy-efficient proof-of-stake (PoS) blockchain. Goerli, Ethereum’s third and final testnet, successfully switched over on Wednesday evening.

On Monday, Glassnode data revealed that Ethereum derivatives traders are “extremely bullish” for September, the month of the merge, but will lean bearish by October.

On Coinbase’s most recent company earnings call, the company reiterated its emphasis on staking as part of its business model leading up to the merge. A recent letter to shareholders says: “In early August, we began offering Ethereum staking for institutional clients for the first time. We’ll continue to add more assets for staking for both our retail and institutional clients going forward.”

Bitcoin and Ethereum prices reacted positively to this month's inflation reading from the Consumer Price Index (CPI) on Wednesday. Inflation remains unchanged from last month at 8.5%, a clear sign that the U.S. Federal Reserve’s historic interest rate hikes this year are keeping prices under control.

Several so-called “Ethereum killers," aka layer-1 blockchains with high-functionality smart contracts, posted large rallies: Avalanche (AVAX) blew up a staggering 55% over the week, until it gave up a lot of its gains on Friday night as ETH was rising. Much of the momentum was thanks to the hefty growth of NFTs on the blockchain. By Saturday morning, AVAX was up just 15% in the past 7 days and trading at $29.53.

Other Ethereum rivals that grew over the seven days: Solana (SOL) rose 14% to $46.32; NEAR Protocol surged 18% to $5.89, and FLOW grew 11% to $2.92.

In addition, Chainlink (LINK) rose 15.4% to $9.16, and Ethereum Classic (ETC)—which hit a four-month high this week—is up 16% to $44.25.

There were no major losses among the leading coins.

The chill of crypto winter showed little sign of abating this week.

On Monday, Singaporean exchange Hodlnaut joined fellow lenders Vauld and Celsius and Singaporean exchange Zipmex on the list of crypto companies that have suspended customer withdrawals due to “recent market conditions.”

Earlier this year, Hodlnaut received In-Principle Approval (IPA) from Singapore’s Monetary Authority (MAS) “to provide digital payment token (DPT) services as a Major Payment Institution.” The lender has now reportedly informed Singapore’s Monetary Authority (MAS) that it is withdrawing its license application and as a result, no longer providing its Token Swap feature.

On Tuesday, German crypto bank Nuri filed for insolvency, saying the move was “necessary to ensure the safest path forward for all our customers.” Despite the proceedings, Nuri said that customers still have “guaranteed access” to their euro accounts and crypto wallets.

The bank said the measures were due to “significant macroeconomic headwinds,” specifically the pandemic and Russia’s war on Ukraine, as well as “various negative developments” in the industry “including major cryptocurrency sell-offs, the implosion of the Luna/Terra protocol, the insolvency of Celsius and other major Crypto funds.”

On Tuesday, Zipmex announced it was unfreezing withdrawals for Bitcoin and Ethereum. Users have been able to withdraw Bitcoin since Friday; Ethereum holders will have to wait till next Tuesday, August 15.

Finally, at a hearing in Celsius’s Chapter 11 bankruptcy proceedings on Friday, attorneys representing a committee of unsecured creditors moved to block Celsius’s attempts to sell its mined cryptocurrency. The lawyers wrote in a court filing that they first need more insight into how selling Celsius’s Bitcoin mining will be carried out and how the proceeds from the sale will be used.

Celsius Mining is the Bitcoin mining subsidiary of Celsius Network. On July 14, a day after the parent company filed for bankruptcy, the mining operation also filed for bankruptcy.

Celsius has previously said that it will use its mining operation to pay back creditors. At the start of the bankruptcy proceedings in July, Celsius was given approval to spend $5 million to jumpstart its mining operation, a move which drew criticism from the U.S. Department of Justice and now the creditor committee.

The committee also said it is launching a “broad-ranging investigation” and expects to invoke Bankruptcy Rule 2004.

All in all, a good week for crypto, but not so good for a few crypto companies.