.png)

Welcome to the exhilarating world of cryptocurrency investing. While it can be a thrilling ride, we all know that it’s not without its ups and downs.

In this article, we’ll dive into how understanding your emotions can help you stick to your investment goals and get what you want from the crypto market.

Alright, let’s get real. Cryptocurrencies are known for their price swings, and it’s inevitable that emotions will fluctuate along with them. Fear of missing out on the next moonshot or the anxiety of a market dip can be pretty intense. Acknowledging and handling these emotions is one step towards making smarter decisions in this space.

Imagine Ethereum just hit a new all-time high, and everyone around you is talking about it. The fear of missing out (FOMO) sets in, and you’re itching to buy more ETH. Consider this before jumping in, take a deep breath and remember your long-term strategy. Ask yourself if this decision aligns with your investment plan and risk tolerance. Emotional intelligence comes into play when you can resist impulsive actions driven by FOMO and instead focus on your overall investment goals.

We’re all guilty of biases, aren’t we? Once you learn how to spot these biases though, you’ll have the power to tame them just like seasoned investors.

You notice that a new altcoin is gaining traction on social media, and it’s being hyped as the next big thing. The temptation to invest heavily in it is strong because everyone else seems to be doing it. However, emotional intelligence kicks in when you question the basis of this hype cycle. Instead of immediately going with the herd, you research the project thoroughly, analyse its fundamentals, and evaluate its long-term potential. This way, you avoid falling victim to the herd mentality bias and make informed decisions based on solid research.

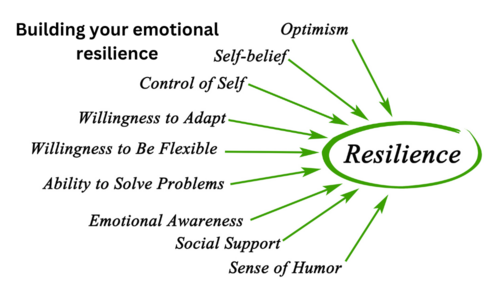

It’s not all rainbows when it comes to investing in crypto. Losses happen, and that’s when emotional resilience steps in.

Your favourite coin, which you believed had great potential, suddenly plummets in value due to negative news. It’s natural to feel disappointed and frustrated. However, emotional intelligence helps you view losses as part of the investment journey. You take a step back, analyse the reasons behind the price drop, and learn from the experience.

To implement these tips, first create a well-thought-out investment plan that outlines your goals, risk tolerance, and strategies. Whenever you’re tempted by FOMO or fear uncertainty (FUD), refer back to your plan, ensuring your decisions align with your long-term objectives. And remember, limit constantly checking price charts, it can lead to unnecessary stress and impulsive actions. Instead, focus on the bigger picture and evaluate your investments based on fundamental analysis and market trends.

Remember, investing in crypto is not just about numbers, it’s about knowing yourself, your goals and the game. So go ahead, be confident, and make those well-informed moves that align with your long-term vision.

To Invest in Crypto, click HERE

Please note that the information in this article is not intended nor does it constitute financial or investment advice. Before making any decision or taking any action regarding your finances, you should consult a licensed Financial Adviser.

(6).jpg)

About: Andries vanTonder

Over 40 years selfemployed

He is a Serial Entrepreneur, an Enthusiastic supporter of Blockchain Technology and a Cryptocurrency Investor

Find me at my Markethive Profile Page | My Twitter Account | My Instagram Acount | and my Facebook Profile.