Coinbase is a popular Bitcoin trading platform.

As the price of Bitcoin and Ethereum rose today, shares of companies traded on Wall Street with exposure to cryptocurrencies buoyed upwards as well.

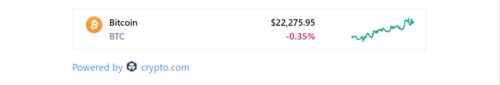

Among cryptocurrency prices, Polygon’s MATIC led the charge, rising 22% on the day, according to data from CoinMarketCap. At the time of writing, Ethereum had climbed 10.5% over the past 24 hours to nearly $1,500, notching weekly gains of over 30%, while Bitcoin rose just over 4.5% past $22,000.

It's a notable shift in what has otherwise been a bleak bear market for investors and traders. Bitcoin and Ethereum are each down close to 70% from their all-time highs as worsening macroeconomic conditions and the threat of a recession has shred investment appetite in risk assets. Today, that appetite appears to have been reawakened, even if only temporarily.

For the publicly traded company Marathon Digital Holdings, Inc.—a digital asset technology business that specializes in cryptocurrency mining—the upwards pressure in digital asset prices sent its stock price soaring 22% to $9.82 from $8.83, as trading volume more than tripled its daily average, according to data from Nasdaq.

Shares of Coinbase jumped 9% on the day to around $59, according to Nasdaq, despite an internal email recently sent to influencers regarding its affiliate-marketing program, which the company said is ending tomorrow because of the bear market in digital asset prices.

Within the past 24 hours, 30% of the volume on Coinbase’s exchange came from Ethereum and 20% of it was Bitcoin trades, according to data from CoinMarketCap.

The company is one of many involved in crypto currently facing financial headwinds amid a decline in the price of most digital assets. Among ones that are publicly traded, both Robinhood and Coinbase have announced layoffs this year, with Coinbase letting go of 18% of its workers last month.

MicroStrategy Incorporated, which holds 129,699 Bitcoins, popped to $246.55 before sinking down to around $227, as the software manufacturer saw its stock price increase by 6% on the day. According to a recent tweet from company CEO Michael Saylor, the company has spent nearly $4 billion in building up its Bitcoin stash.

Bitcoin mining company Bit Digital, Inc. saw an increase as its stock price rose nearly 5% to 1.70, according to Nasdaq.

Riot Blockchain, which also focuses on Bitcoin Mining, saw its shares surge 12% to $6.24 at the time of writing, even though the company recently suspended its operations in Texas amid a heat wave and sold more Bitcoin than it produced in May.

Traders were less bullish on Block Inc., formerly known as Square, as the San Francisco-based payment solutions company’s shares rose just above 1% on the day to $66.81.

The stock trading platform that allows its users to invest in cryptocurrencies, Robinhood Markets, Inc., edged up similarly by 2% to $8.60 on below-average volume.