By Stephen Graves and Daniel Phillips

Investors are becoming increasingly interested in Bitcoin. Image: Shutterstock

For many years, the idea that publicly traded corporations might buy Bitcoin for their reserves was considered laughable. The top cryptocurrency was considered too volatile, too fringe to be embraced by any serious business.

That taboo has been well and truly broken, with a number of major institutional investors buying up Bitcoin over the past two years.

The floodgates first opened when cloud software company MicroStrategy bought $425 million worth of Bitcoin in August and September 2020. Others followed suit, including payments processor Block and EV manufacturer Tesla.

But just as institutional adoption of Bitcoin appeared to be ramping up, the 2022 crypto crash struck. The price of Bitcoin plummeted in tandem with tech stocks, substantially denting the value of companies' Bitcoin holdings.

In the wake of the crash, the list of the companies with the biggest Bitcoin holdings has been shaken up, with some firms selling off part of their crypto stashes as the market slumped.

For investors unwilling to buy Bitcoin themselves, buying shares in public companies that hold Bitcoin can be a way of gaining exposure to the asset without the hassle of arranging self-custody. Indeed, some experts think that the extent of MicroStrategy's Bitcoin purchases have made the company a de facto Bitcoin ETF.

MicroStrategy, a prominent business analytics platform, has adopted Bitcoin as its primary reserve asset.

The firm, which produces mobile software and cloud-based services, has aggressively pursued its Bitcoin buying spree through 2021 and 2022, scooping up millions of dollars worth of the cryptocurrency even as the market slumped in 2022. As of July 2022, it holds 129,699 BTC in reserve, equivalent to just over $2.8 billion—though the 2022 crypto crash has wiped billions of dollars of value from its crypto stash.

At one point, MicroStrategy CEO Michael Saylor said, he was buying $1,000 in Bitcoin every second.

Unlike other CEOs who typically shy away from discussing their personal investments, Saylor has made it public that he personally holds 17,732 BTC—currently worth over $387 million.

As per data from BitInfoCharts, this positions Saylor among the top 100 Bitcoin owners—assuming it is all held within a single address. It’s something of an about-face for the MicroStrategy CEO, who in 2013 claimed that Bitcoin’s days were numbered.

Bitcoin distribution by number of addresses. Image: BitInfoCharts

On New Year's Eve, 2020, Morgan Stanley revealed that it had purchased 10.9% of MicroStrategy.

Speaking in the wake of the 2022 crypto crash, Saylor doubled down on his decision to use Bitcoin as a reserve asset, rather than gold. "If it's not going to zero, it's going to a million," he told CNBC. "It's obviously better than gold at everything gold wants to be, and if it was just worth what gold's worth, it'd be $500,000 a coin."

The largest institutional holder of Bitcoin to be directly involved with the crypto industry, crypto-focused merchant bank Galaxy Digital Holdings holds 16,400 BTC, according to bitcointreasuries.org—worth just over $357 million at current prices.

Founded by Michael Novogratz in January 2018, the company has partnered with crypto firms including Block.one and BlockFi. Novogratz is, unsurprisingly, a keen advocate for Bitcoin. In April 2020, he noted that stimulus measures announced in response to the coronavirus pandemic were driving interest in cryptocurrencies, calling it Bitcoin's "moment" and arguing that "money doesn't grow on trees."

However, later in the year, Novogratz argued that the cryptocurrency's volatility meant that gold was a safer bet, stating that, "My sense is that Bitcoin way outperforms gold, but I would tell people to hold a lot less than they do gold. Just because of the volatility." That proved to be sensible advice; following the 2022 crypto crash, Novogratz stressed that, "Bitcoin is not going away as a macro asset," while conceding that the sector had taken "a complete and total old-school ass-beating."

In September 2021, Galaxy Digital launched a joint proposal for a spot Bitcoin ETF; to date, the U.S. Securities and Exchange Commission has only approved Bitcoin futures ETFs.

Crypto brokerage Voyager Digital holds 12,260 BTC according to bitcointreasuries.org, worth around $267 million at current prices. The firm aims to provide a one-stop shop for trading digital assets, and in May 2021 reported quarterly revenue of $60.4 million, up 16x from the previous quarter. "We saw exponential adoption of cryptocurrencies as a recognized and investable asset class," said CEO Steven Ehrlich at the time.

Voyager Digital became one of the most significant casualties of the 2022 crypto crash, however; after halting trading on its platform due to "current market conditions," the company revealed a $661 million exposure to struggling crypto investment firm Three Arrows Capital, in both Bitcoin and USDC, and subsequently filed for bankruptcy.

A Tesla Cybertruck. Image: Tesla

Electric vehicle manufacturer Tesla joined the ranks of companies holding Bitcoin in December 2020, with an SEC filing revealing that the company invested "an aggregate $1.50 billion" in Bitcoin.

Tesla sold 10% of its Bitcoin holdings in Q1 2021; according to CEO Elon Musk, this was "to prove liquidity of Bitcoin as an alternative to holding cash on balance sheet."

The company's Bitcoin play followed months of speculation, after CEO Elon Musk took to Twitter to discuss the cryptocurrency. In late 2020, MicroStrategy's Saylor offered to share his "playbook" for Bitcoin investing with Musk, after arguing that a move into Bitcoin would be doing Tesla shareholders a "$100 billion favor."

However, Musk and Tesla have had an on-off relationship with Bitcoin. After announcing that Tesla would accept payments in Bitcoin for its products and services in March 2021, just two months later the CEO abruptly announced that the company would no longer accept the cryptocurrency for payments.

The sell-off leaves Tesla with 10,725 BTC in its portfolio (around $233 million), per bitcointreasuries.org, sending it plummeting from second place to fourth place in the rankings.

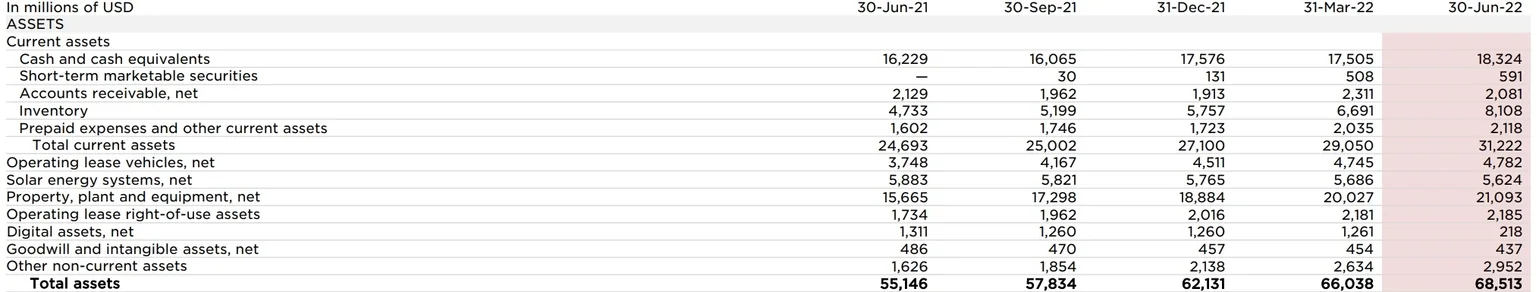

According to Tesla's Q2 balance sheet, its digital asset holdings amounted to $218 million in the second quarter of 2022, down from $1.26 billion in the previous quarter.

Tesla's unaudited Q2 2022 balance sheet. Image: Tesla

Musk, who's emerged as a keen advocate of Dogecoin over the course of 2021, has announced that Tesla will enable Dogecoin purchases for some Tesla merchandise, and stressed that the company hasn't sold any of its Dogecoin during his Q2 2022 call with analysts.

Bitcoin mining company Marathon Digital, unsurprisingly, is also a large holder of Bitcoin, with 10,055 BTC in its corporate treasury (worth around $218 million at current prices). The company, which aims to build "the largest Bitcoin mining operation in North America at one of the lowest energy costs," originated as a patent holding firm (and was often referred to as a patent troll) before its pivot into crypto mining.

Citing the "rapidly increasing use of fossil fuels for Bitcoin mining and transactions", Musk revealed that the company wouldn't be selling any of its Bitcoin holdings, and would consider using it for transactions again once mining "transitions to more sustainable energy." He later clarified that the company would resume using Bitcoin for transactions once miners are using 50% clean energy.

In July 2022, the company revealed that it had sold "approximately 75%" of its Bitcoin in its Q2 2022 quarterly update, with its balance sheet showing sales from digital assets amounting to $936 million. In a call with analysts, Musk stated that, "We were uncertain as to when the Covid lockdowns in China would alleviate, so it was important for us to maximize our cash position," adding that the company is, "open to increasing our Bitcoin holdings in future, so this should not be taken as some verdict on Bitcoin."

Marathon Digital eventually aims to have over 199,000 Bitcoin miners churning out 23.3 EH/s a day by 2023, a 600% increase from its December 2021 hash rate. That month, the company placed a mammoth order of 78,000 Antminer mining machines from Bitmain, to be delivered throughout 2022.

Despite rising electricity costs and a slump in the price of Bitcoin, Marathon remains committed to mining the cryptocurrency; in June 2022 it claimed to be, "fairly well insulated and well-positioned" thanks to low operational costs and fixed pricing for power that enable it to mine Bitcoin for around $6,200 a coin.

Alongside Tesla, Block, lit the fuse for institutional investment in Bitcoin with its October 2020 investment of $50 million in the cryptocurrency.

Since then, the payments company has continued to invest in Bitcoin, revealing that it had scooped up another $170 million worth in its Q4 2020 earnings statement. It was, perhaps, unsurprising, considering that CEO Jack Dorsey is an enthusiastic advocate for Bitcoin (even running his own Bitcoin node).

At the time, the company described the investment as "part of Square’s ongoing commitment to bitcoin," noting that "the company plans to assess its aggregate investment in Bitcoin relative to its other investments on an ongoing basis."

With its holdings now amounting to 8,027 BTC, worth $174 million at current prices, Block hasn't changed its tune on Bitcoin.

In March 2021, the company's CFO Amrita Ahuja argued that "there's absolutely a case for every balance sheet to have Bitcoin on it," in an interview with Fortune, while reaffirming the company's commitment to holding the cryptocurrency "for the long term."

In May 2021, the company reaffirmed its commitment to its Bitcoin buying strategy, following an interview in which Ahuja had said the company had no plans to make further Bitcoin purchases. Block has also made further efforts to build out the Bitcoin ecosystem, launching a $5 million fund to further crypto education and leaping to Bitcoin's defense with a white paper defending the cryptocurrency's environmental impact.

The company is also getting involved with Bitcoin technology, announcing plans to plans to develop a Bitcoin hardware wallet in July 2021, while in October 2021, Dorsey tweeted that the company was considering building Bitcoin mining rigs.

The company changed its name from Square to Block in December 2021, in an apparent reference to the blockchain technology that underpins Bitcoin. The rebrand followed Dorsey's announcement a week earlier that he was stepping down as Twitter CEO to focus on the payments company.

Canadian crypto mining firm Hut 8 holds 7,406 BTC, worth $161 million. In June 2021, the company was listed on the Nasdaq Global Select Market under the HUT ticker, with the company's SEC filing noting that it's "committed to growing shareholder value by increasing the number and value of our bitcoin holdings."

The company also explained that it generates fiat income by leveraging its reserve of self-mined and held Bitcoin, "via yield account arrangements with leading digital asset prime brokerages."

Like other crypto businesses, Hut 8 has seen its stock price tumble as a result of the crypto crash, from highs of $20 in November 2021 to under $3 in July 2022.

Another crypto mining outfit, U.S.-based Riot Blockchain holds 6,654 BTC, worth $144 million at today's prices.

With its valuation surging from below $200 million in 2020 to highs of over $6 billion in 2021, the Nasdaq-listed company went on an aggressive expansion drive. In April 2021, it spent $650 million on a one-gigawatt Bitcoin mining facility in Rockdale, Texas; describing the purchase as a "transformative event" that would make the company the "largest publicly-traded Bitcoin mining and hosting company in North America, as measured by total developed capacity."

In April 2022, Riot revealed further plans to expand in Texas, with the announcement of a further one-gigawatt mining facility in Navarro County. Following the 2022 crypto crash, CEO Jason Les told Yahoo Finance that Bitcoin mining will "continue to flourish in the United States," and that "even though Bitcoin mining economics have gone down, there's still tremendous opportunity here."

Nevertheless, Riot's share price has tumbled since its all-time high of over $70 in February 2021; as of July 2022, it was trading at under $7.

Arguably the best-known crypto firm in this list, crypto exchange Coinbase went public in a direct listing on the Nasdaq in April 2021.

The move was hailed as a landmark for the crypto industry, though that hasn't been borne out by Coinbase's declining stock price; having debuted at $381, by July 2022 COIN was trading under $75.

Ahead of its listing, in February 2021, Coinbase revealed that it held $230 million in Bitcoin on its balance sheet; by July 2022, its Bitcoin holdings had slipped to $98 million (4,482 BTC).

Germany-based venture capital firm Bitcoin Group SE brings up the rear of the list, with relatively modest holdings of 3,947 BTC, worth just over $86 million at today's prices.

Its investments include crypto exchange Bitcoin.de and Futurum bank, which merged in October 2020 to form "Germany's first crypto bank."

The move followed the German parliament's decision to enable banks to sell and store cryptocurrencies, with Bitcoin Group SE managing director Marco Bodewein highlighting the opportunity to introduce the bank's institutional investors to crypto's "high returns and safety features."