By Tim Hakki

Image: Shutterstock

Illustration by Mitchell Preffer for Decrypt

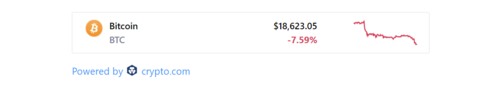

It was merge week. Ethereum’s long-awaited overhaul was finalized without a hitch, but there was no sudden influx of capital, either. Ethereum’s price actually fell 8% to below $1,500 on Thursday, the day of the merge. At the time of writing it trades for $1,376, about 22% cheaper than it was last Sunday.

A day before the merge, Ethereum’s co-founder Vitalik Buterin shared a graph from etherchain.org showing the network’s hash rate has maintained consistency, despite negative predictions from certain forecasters.

The following day, Thursday, Buterin broke the news that the network’s transition to proof-of-stake (PoS) was complete:

Beeple, the digital artist whose NFT collection “EVERYDAYS: THE FIRST 5000 DAYS” sold for an unprecedented $69.3 million through a Christie’s auction, ushered in the new era with a purple vision of Ethereum mining in the future:

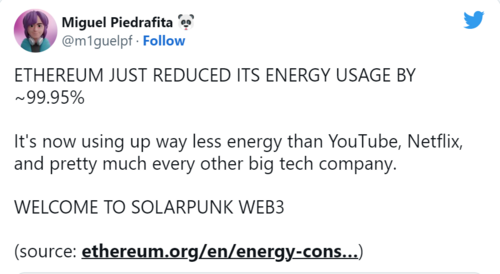

A blockchain developer named Miguel Piedrafita said that after the merge, Ethereum was 99.95% more energy efficient, becoming vastly greener than a typical tech company.

.png)

The upgrade even slightly outdid Ethereum’s energy projections. A report released on the day from the Crypto Carbon Ratings Institute (CCRI), commissioned by Ethereum-centric software firm ConsenSys, claims that Ethereum now uses approximately 99.99% less energy post-merge.

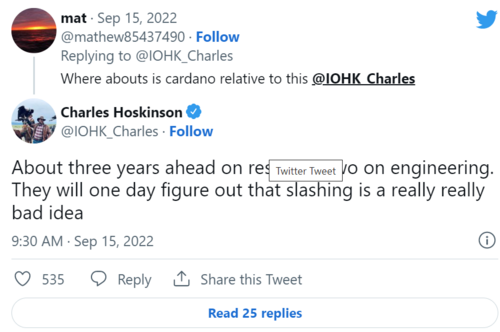

Former Ethereum co-founder Charles Hoskinson, who now heads competitor Cardano—which has a market cap of $16.4 billion—was feeling salty. He posted a meme likening the merge to a nightmare. When someone tweeted him asking where Cardano’s technology stands in relation to Ethereum, Hoskinson let rip with some flagrant self-promotion:

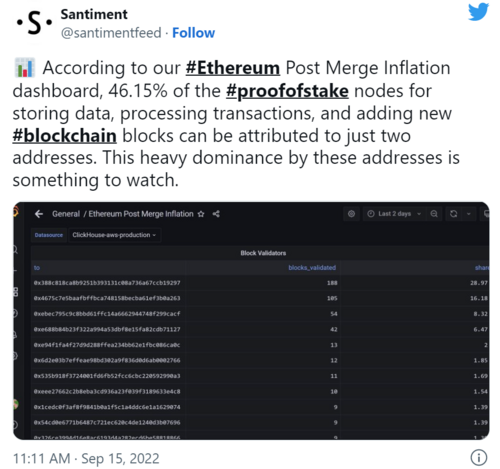

Crypto market intelligence firm Santiment sounded a note of caution over how centralized Ethereum staking had become after the merge.

This was a common complaint. According to Martin Köppelmann, co-founder of DeFi platform Gnosis, popular crypto exchage Coinbase and liquidity staking pool Lido Finance together account for 42% of post-merge Ethereum validators, and the top seven entities control more than two thirds of the stake validating transactions. Köppelmann also ran a poll in which three quarters of 15,885 respondents agreed that Coinbase and Lido’s staking dominance “needs to change.”

.png)

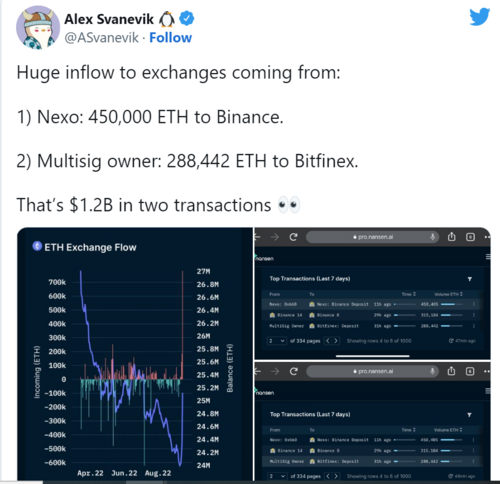

Alex Svanevik, the CEO of crypto analytics company Nansen, noted a sudden huge influx of Ethereum into exchanges.

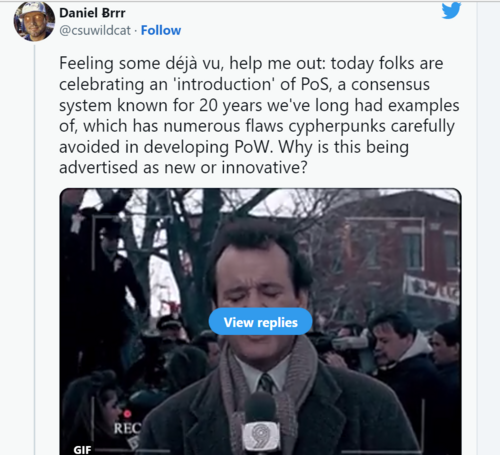

Finally Daniel Buchner, a technical product lead at Microsoft’s Decentralized Identity initiative, likened the merge to Groundhog Day:

It was also a big week for MicroStrategy’s former CEO and current executive chairman Michael Saylor. It wasn’t so much what he said, but what people were saying about him. On Tuesday, Bitcoin enthusiast Udi Wertheimer trolled his 114.3k followers with believable fake news.

Fake or not, it would be wrong to say that Saylor isn’t considering swelling Microstrategy’s 129,699 Bitcoin war chest (worth $2.6 billion at today’s price). Last week, an SEC filing revealed that MicroStrategy has entered an agreement with investment bank Cowen & Co. to sell up to $500 million in shares of its Class A common stock. It may use the proceeds to buy more Bitcoin.

On Friday, the White House released new guidance on crypto. Billed as a “First-Ever Comprehensive Framework for Responsible Development of Digital Assets,” the new guidance uses the recommendations and conclusions of various government agencies after six months of studying the crypto industry.

Saylor shared a lengthy article by crypto investor Nic Carter denouncing the crypto mining climate study done by the White House Office of Science and Technology Policy (OSTP). Carter claims the main weaknesses of the study were unreliable sources, a lack of perspectives from industry experts, and no novel data.

Still, Saylor doesn’t represent everyone, according to “independent Ethereum educator” Anthony Sassano.

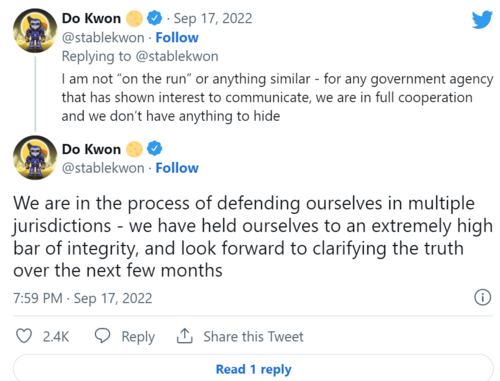

Finally, Terra CEO Do Kwon broke his silence on Saturday after headlines emerged earlier in the week saying that a South Korean court had issued an arrest warrant for him for violating capital market rules. The Korean Ministry of Finance also announced that it was seeking to void his passport. He told followers he’s not on the lam.