Bitcoin and Ethereum. Image: Shutterstock

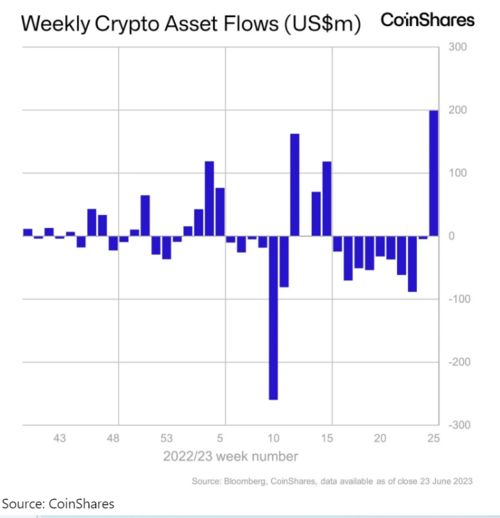

Crypto-based investment products recorded their largest single weekly inflows since July 2022, according to European digital asset management firm CoinShares’ weekly fund report.

Per CoinShares, total inflows across crypto-based investment products hit $199 million; Bitcoin led the pack with inflows of $187 million.

The total assets under management in crypto investment products also reached a yearly high, surpassing $37 billion and erasing the losses since Three Arrows Capital shook the crypto market with its bankruptcy in July 2022.

London-based ETC Issuance GmbH's Bitcoin exchange-traded product, BTCE, topped weekly inflows at $77.3 million.

ProShares' Bitcoin Strategy ETF (BITO) saw the largest inflows in the U.S. at $60.4 million. Launched in October 2021, BITO tracks Bitcoin's price by strategically investing in CME Bitcoin Futures. Following last week's inflow, the fund surpassed $1 billion in total assets under management.

Eric Balchunas, a senior ETF analyst for Bloomberg, wrote in a tweet this morning that BITO also broke its trading volume records on Friday with "half a billion in shares" changing hands, which was "only done about 5 times before."

CoinShares analyst James Butterfill attributed the "renewed positive sentiment" to a recent flurry of spot Bitcoin ETF applications with the U.S. Securities and Exchange Commission.

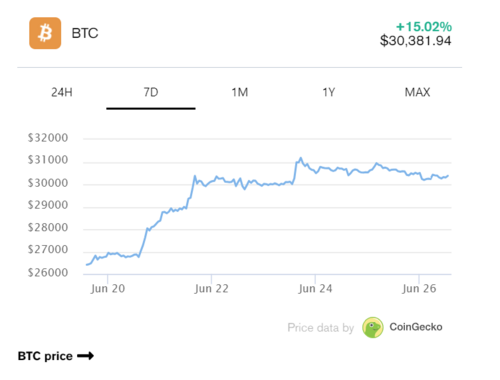

It started with an ETF application from BlackRock, the world's largest investment fund, on June 16, acting as a positive catalyst for the market.

Other fund managers like Valkyrie, WisdomTree, and Invesco followed suit with their own filings within a week of BlackRock's application.

Ethereum (ETH) investment products saw inflows of $7.8 billion versus Bitcoin’s $187 million. Butterfill added that it shows “appetite for Ethereum is lower than Bitcoin at present.”

He also wrote that the positive "sentiment didn't trickle down to altcoins," with only minor XRP and Solana (SOL) inflows.