Aave's Newest Market: Real World Assets

Aave's Newest Market: Real World Assets

IMAGE: SHUTTERSTOCK

DeFi money market platform Aave today added a new market using real world assets (RWAs) rather than cryptocurrencies.

Previously, Aave users could only borrow and lend cryptocurrencies, with rates adjusting based on market demand.

The initiative is in partnership with Centrifuge, a crypto company that lets businesses tokenize aspects of their operations such as trade receivables and invoices. Once tokenized, these assets can then be used as collateral to borrow cash.

Users can lend DAI, a popular decentralized stablecoin pegged to the U.S. dollar, and earn 2.8% yield, for example. Conversely, users can borrow DAI at a cost of 3.97%. These values fluctuate based on how high the demand is to borrow DAI relative to how much liquidity is available to borrow.

Deposit APR on Aave has fluctuated between 4% and 1% over the past three weeks. Source: Aave.

There are 30 additional markets on Aave that offer the same service.

With today’s launch of RWAs on Aave, another seven permissioned markets have opened up. Permissioned in this context means that interested users must complete know-your-customer (KYC) processing before joining.

Not only does this initiative offer lenders more markets to earn interest on their holdings, but it will also provide the businesses behind each of these markets to access liquidity they may not have had access to traditionally.

“The RWA Market is a much-needed building block not only for protocols such as Aave, but across DeFi as a whole," said Stani Kulechov, found and CEO of Aave. "Knocking down barriers of entry and making DeFi accessible to all is part of the Aave Companies' vision, and we are excited to be fulfilling this through the collateralization of real-world assets, made possible by Centrifuge.”

The principal feature of these markets is the tokenization, which can also be understood as securitization in traditional finance, of a business’s operations.

Built on Centrifuge, Tinlake is the platform that helps businesses do exactly this.

There are currently 11 different RWA markets on Tinlake and range from tokenized real estate, cargo and freight invoices, to payment advances. Once tokenized, investors can then purchase these tokens, which behave similar to bonds and earn a yield on their holdings. This yield can range from 3% all the way up to 10% depending on the market.

This arrangement is beneficial for the businesses involved because it gives them access to financing that would otherwise be impossible or prohibitively expensive. "The RWA Market bridges the regulated world of TradFi to the trustless world of DeFi," said Lucas Vogelsang, the CEO and co-founder of Centrifuge. "Creating an infrastructure to securely onboard RWA that is able to scale has been exciting and we’re proud to see this work pay off," he added.

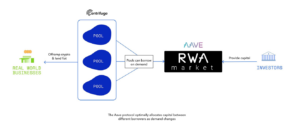

The latest arrangement with Aave’s RWA market operates similarly to Tinlake. Pools, outlined in the graphic below, would be the tokenized RWAs like real estate and invoices mentioned above. A similar arrangement is already live on Maker, the protocol that mints and manages the DAI stablecoin.

Source: Centrifuge.

At current, the only eligible cryptocurrency in this market is USD Coin (USDC). This means that interested USDC holders would deposit their liquidity into the broader RWA market rather than specific Centrifuge markets.

The yield is thus generated from a basket of these markets instead of a single market and is expected to be “similar to USDC yield in the Aave V2 market,” according to a Centrifuge spokesperson. That figure is 3.14%, at press time.

The seven markets in this basket are New Silver (real estate bridge loans), Fortunafi (revenue-based financing), ConsolFreight (cargo and freight forwarding invoices), Harbor Trade Credit (trade receivables), Branch (emerging market consumer loans), database.Finance (branded inventory financing), and Cauris Global Fintech (fintech debt financing).

Holders of Aave’s native governance token, AAVE, can also propose and vote to add more markets.

To kick things off, Centrifuge is also tacking on additional token rewards to deposits via a wrapped version of the protocol’s native CFG token. This token is currently trading at $1.06, according to CoinGecko. Centrifuge will distribute 9,250 tokens per day.

Markethive has infused the power of Inbound Marketing into the News Feed and infused the power of the social network into the Inbound Marketing platform, which means it’s an enhanced Social Network hybrid. It’s where the needs of the entrepreneur, marketer, business, and corporation are not only met but put at the forefront. Click Here to sign up for free and get 500 Hivecoin airdrop.