By:

Daria Morgen.

A dead cat bounce is a very useful market jargon to know — after all, it is a rather common occurrence, especially in the crypto market.

A dead cat bounce refers to a temporary price recovery of an asset that has been in decline for quite a while. It is characterized by a short-lived nature and always followed by a continued downward trend.

Its name comes from the saying, “even a dead cat will bounce if it falls from a great height.”

A dead cat bounce is a pattern that is really useful in the technical analysis of both crypto and stock prices. It shows a temporary recovery of a bearish asset that is followed by further decline.

The dead cat bounces quite often in the crypto market, so there are a lot of examples of this phenomenon. Here’s an example that took place in January 2022: the BTC price was clearly in decline, and we were in the middle (or at the beginning, depending on whom you ask) of a bear market.

Bitcoin’s price briefly went up to $43K, but instead of a step en route to recovery, it turned out to be a dead cat bounce: BTC promptly went back to losing its value, going down to as low as $33K.

Source: CoinMarketCap

There are two main causes for a dead cat to bounce in the crypto/stock market:

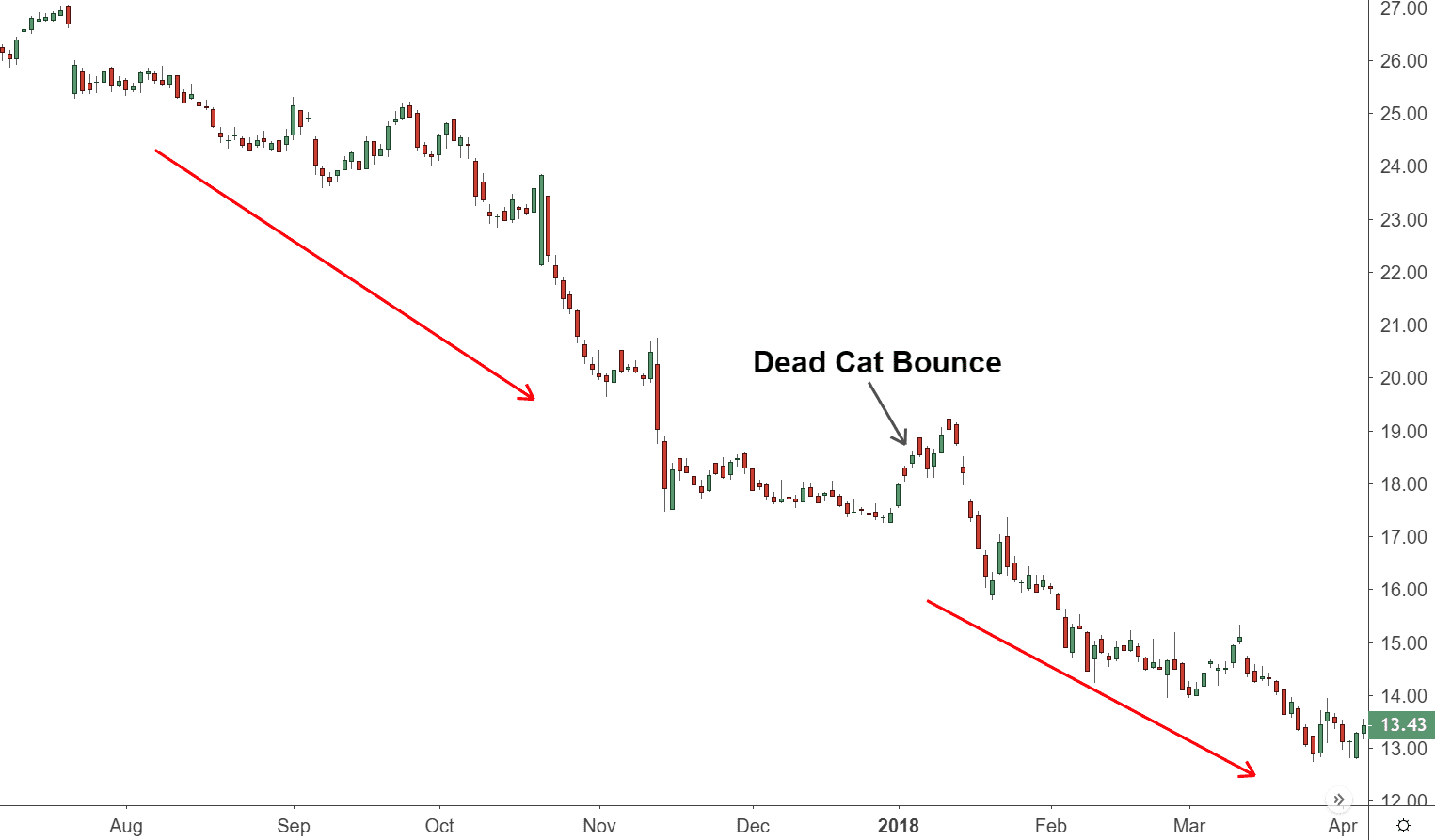

It’s hard to identify a dead cat bounce right from the start while it’s still happening. If there is a bear market, and you think that a stock price or a cryptocurrency will continue to fall in the future, then a brief price rise might be a DCB.

However, not every upward price movement after a prolonged price drop is a dead cat bounce or a market reversal. It could be just a normal fluctuation, especially in the crypto market, where prices are volatile as a rule.

It is easier to recognize a dead cat bounce on a stock price since this asset class usually has a much more stable and easily identifiable fundamental value. Due to their volatility, cryptocurrency prices are a lot harder to predict.

Source: Investopedia

However, even when it comes to identifying a DCB for a stock price, most investors can only be sure it occurred post hoc. One would need not only tons of day trading and market research experience but also a considerable amount of luck to identify a dead cat bounce correctly.

Any dead cat bounce can turn out to be a genuine rally and an upward trend, so beginner investors are usually advised against trying to take advantage of them.

Although dead cat bounces are usually short-lived, they can sometimes last up to a few months. That said, in most cases, a dead cat bounce will only occur for a few days before the asset’s price drops again.

A dead cat bounce is always followed by the continuation of a downtrend that preceded it and a prolonged decline.

The opposite of a dead cat bounce is called a supernova — this term refers to assets whose price goes pretty much just straight up. It often occurs after short squeezes.

The term “dead cat bounce” was coined by a financial writer called Raymond DeVoe Jr.

Earn an unlimited 1.5% back in crypto on every purchase with the BlockFi Rewards Visa® Signature Credit Card.

Disclaimer: Please note that the contents of this article are not financial or investing advice. The information provided in this article is the author’s opinion only and should not be considered as offering trading or investing recommendations. We do not make any warranties about the completeness, reliability and accuracy of this information. The cryptocurrency market suffers from high volatility and occasional arbitrary movements. Any investor, trader, or regular crypto users should research multiple viewpoints and be familiar with all local regulations before committing to an investment.