Every week Merrill Lynch publishes a Capital Market Outlook Letter. The letters provide market commentary, research and analysis, and the occasional investment idea. Merrill Lynch (together with parent Bank of America) is the third largest brokerage firm, managing over $3 Trillion in client assets. When a firm of that size speaks up, you should listen.

Starting around March of this year, they disclosed an investment thesis called FAANG 2.0. It's a fascinating idea and gold plays a prominent role. Let's unpack it.

Transitioning from FAANG 1.0 to FAANG 2.0

The original FAANG acronym described the high-growth, tech-centric companies that accounted for an outsized portion of returns over the last decade, and then catapulted even higher once the pandemic hit. FAANG 1.0 included:

Facebook - Apple - Amazon - Netflix - Google

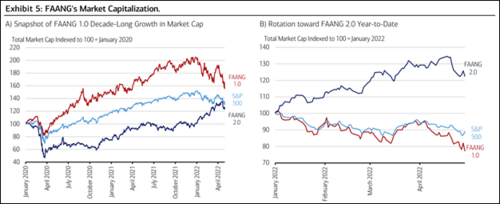

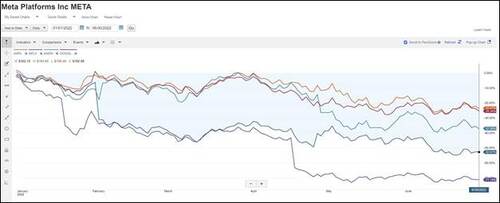

And yet, these companies have experienced meaningful price declines year-to-date.

Merrill has been chronicling the "great rotation" out of FAANG 1.0 and into FAANG 2.0.

What's FAANG 2.0?

If FAANG 1.0 are the new kids on the block, then FAANG 2.0 is the old guard. They include:

Fuels - Aerospace - Agriculture - Nuclear/Renewables - Gold and Metals/Minerals

The reasons to favor FAANG 2.0 in today's market are intuitive. Let's explore a few of the salient points.

Why FAANG 2.0?

Geopolitical tensions

The ongoing war between Russia and Ukraine will drive demand for fuels, agriculture, energy and other "hard assets" such as gold and metals/minerals. It remains unclear how the conflict will resolve and whether it will escalate further. Merrill notes that "gold is now the preferred asset of central banks" in the face of such uncertainty.

Inflationary pressures

They're likely to persist longer than previously thought. And while the focus is typically on what you pay at the pump, world food prices are at all time record highs. For anyone following Keith's work on inflation, it's unlikely the items he highlights (trade war, tariffs, lockdown whiplash, regulatory compliance, and green energy policy) are going to be resolved any time soon.

Supply and Demand Imbalance

There seems to be two primary reasons behind the supply/demand imbalance driving FAANG 2.0. One is the leftover supply chain disruptions from the pandemic. Equipment shortages, labor dislocations, logistics bottlenecks, and higher input costs arestill keeping products from getting to market. Two is simply greater demand than supply for these materials. For example, increased defense spending is driving greater demand for fuels and aerospace. Germany is doubling its annual budget. NATO is requiring all participating countries to devote at least 2% of GDP to defense spending by 2024. Likewise demand for energy alternatives (nuclear and renewables), and EV's is exploding, creating intense demand for the metals/minerals needed to scale production.

This paragraph from the May 2 letter sums up the case for FAANG 2.0 nicely.

In a matter of months, we have gone from a pandemic to Putin; infections to inflation; Big Data to Big Oil; zoom to zinc; masks to mascara; E-commerce to electric vehicles; jabs to javelins; swabs to sanctions; Webex to weddings; boosters to bombs; Non-fungible tokens (NFTs) to liquefied natural gas (LNG); Centers for Disease Control (CDC) to North Atlantic Treaty Organization (NATO); work-from home to work-from-office; the cloud to cobalt; and lite assets to hard assets.

Gold's Role in FAANG 2.0

Gold plays a prominent role in Merrill's FAANG 2.0 investing framework. Specifically, they cite investor concerns over inflation and war as reasons for why the "safe-haven" asset should enjoy consistent demand over 2022. Gold has posted strong YTD performance relative to other assets (gold is up about 1% compared to an average of -41% for the FAANG 1.0 crowd).

Why is gold considered a safe-haven asset?

The answer is simple but profound.

Gold is solvency you can hold in your hand.

In a world that poses significant risks of default, whether from inflationary pressures on businesses, aggravated by higher interest rates, or an escalation between Russia and NATO, gold is the asset you own when you don't want to take that risk.

Merrill's endorsement of gold as a major part of its FAANG 2.0 investment thesis could be a significant driver for gold going more mainstream. Despite many large asset managers paying lip service to the importance of owning gold in a diversified portfolio, and the fact that the benefits of owning gold have been well documented, it still remains one of the most under-owned assets.

There's another way gold could go mainstream though; it's called gold 2.0.

Transitioning from Gold 1.0 to Gold 2.0

What's gold 2.0?

It's gold with yield, specifically a Yield in Gold, Paid in Gold®. We've said it over and over again, everyone should own some physical gold as an insurance against the solvency risks outlined above. But insurance only protects wealth, it cannot grow your wealth. Monetary Metals offers gold with yield—gold 2.0—which protects and grows your wealth.

You can own physical gold, in secure vaults, outside the financial system, with the option of earning 2% to 3% interest, paid in more gold (silver too).

Whether from increased safe-haven demand, or greater demand for gold with yield, the 2020's could be the decade that gold breaks back into the mainstream in a big way.

By Keith Weiner

Contributing to kitco.com