Within the intricate framework of the Markethive ecosystem, a fundamental component stands out as a driver of engagement and reward: the Markethive Founding Share Token (MFST). This token is not merely a digital asset but a cornerstone of the platform's infrastructure, intrinsically linked to the revolutionary Initial Loan Procurement (ILP).

Markethive Founding Share Tokens serve two primary purposes: they strategically benefit the entire Markethive ecosystem and its members within the dynamic community. For the company, issuing and acquiring these tokens is essential for capital formation. This capital fuels Markethive's ongoing development, promotes the expansion of its platform and services, and facilitates the realization of its strategic vision for the future of its decentralized social market broadcasting network.

Simultaneously, Markethive Founding Share Tokens present a unique and potentially significant opportunity for wealth generation among Markethive community members. It signifies more than ownership; it symbolizes participation and a direct connection to the platform's growth and success. By acquiring these limited-edition tokens, members secure a stake in the future success and potential value appreciation of the Markethive platform.

In its innovative approach to initial funding, Markethive has chosen to empower its community through the issuance of Founding Share Tokens. This strategic move transcends traditional fundraising methods by directly engaging individuals who believe in the platform's vision. Rather than relying solely on venture capital or institutional investors, Markethive is building a foundation upon the collective investment and support of its users. This approach fosters a powerful sense of shared ownership, transforming the community from passive observers into active stakeholders in Markethive's journey.

As the Markethive ecosystem matures and expands its reach, with increased adoption rates among users and businesses alike, and as its suite of services receives greater industry recognition and acceptance, the inherent demand for these Founding Share Tokens is expected to rise. This heightened demand in the market could result in a significant appreciation of their value, providing token holders with the potential for substantial financial returns on their initial investment.

%20copy.png)

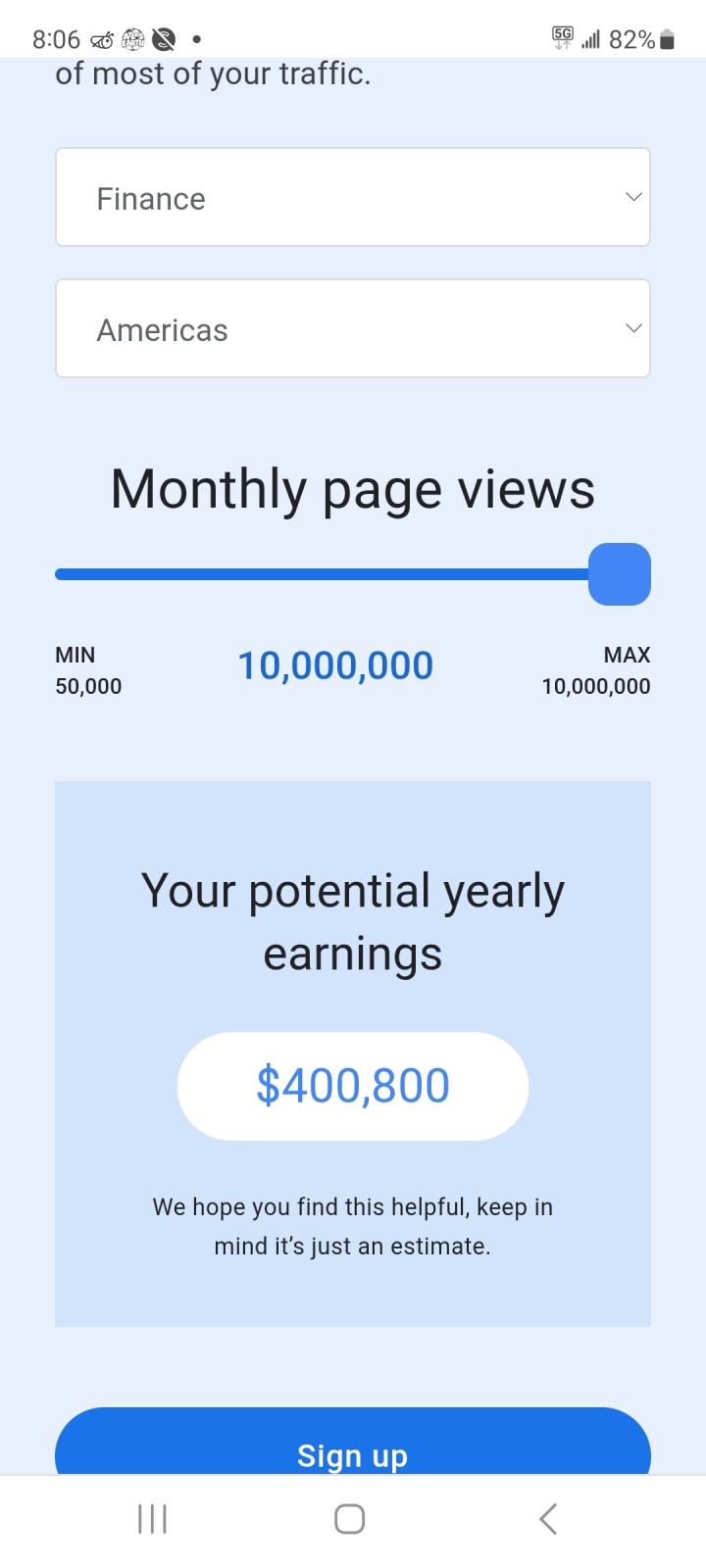

Markethive is offering a limited quantity of 1,000 Markethive Founding Share Tokens (MFSTs) through an Initial Loan Procurement (ILP), also known as Markethive’s Incentivized Loan Program. These rare tokens give holders priority in receiving interest payments from net monthly profits. Individuals or entities can purchase multiple MFSTs outright or acquire them through the Entrepreneur One subscription. Markethive also provides incentives for large purchases and referral bonuses. This inclusive approach ensures that a diverse range of stakeholders can capitalize on this opportunity.

To better understand the potential returns, consider this conservative example: If Markethive generates a total net profit of $50 million within a specific period, a noteworthy 20% of this amount is designated for distribution among MFST holders. With a fixed total supply of 1,000 Founding Share Tokens in existence, calculating an individual token's profit share becomes straightforward. In this scenario, each MFST would yield a substantial profit of $10,000 for that month.

This mechanism establishes a direct correlation between Markethive's financial performance and the rewards received by MFST holders. As the Markethive ecosystem expands, attracts more users, and generates increased revenue streams, the potential for higher net profits grows, consequently leading to potentially larger profit distributions for each MFST.

The MFST token of the ILP is divisible into its smallest unit, a BIT, which represents one hundred millionths of a token. This fractionalization enables Markethive to facilitate bounty programs, distribute rewards, and conduct trading activities on the MFST. As a result, the ILP becomes a significant source of revenue and a cash cow for the participating community.

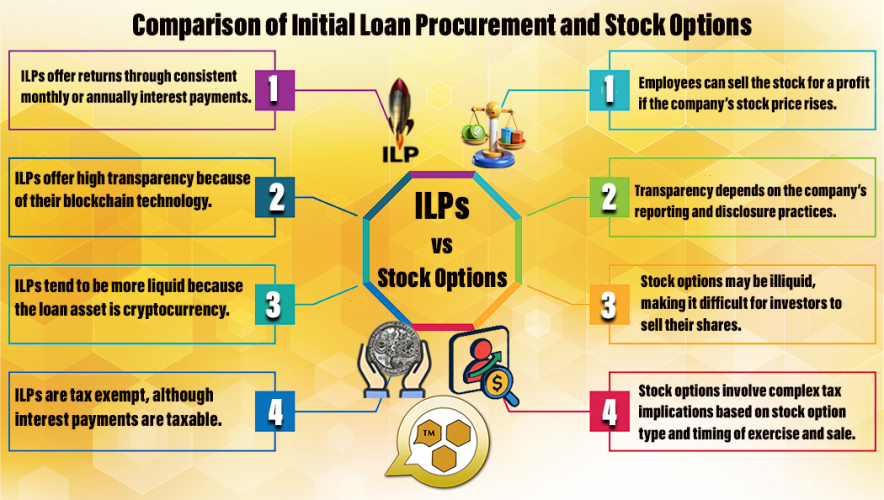

Initial Loan Procurements (ILPs) provide a crowdfunding approach for companies, particularly those in the blockchain sector. Unlike Initial Coin Offerings (ICOs), which involve the creation and sale of speculative tokens, ILPs enable companies to secure funding by entering into legally binding loan agreements with investors who lend money to the company in exchange for interest payments.

These agreements are referred to as Smart Contracts. They are technologically advanced, digitally encoded loan agreements that autonomously create legally binding contracts under the Uniform Commercial Code (UCC) for debt instruments. Recorded immutably on a blockchain, they provide transparency and security. Notably, due to their structure and compliance with the UCC, they are not classified as securities, which has distinct regulatory implications and streamlines secured lending, potentially reducing intermediary involvement.

Stock options are a common component of compensation packages, particularly in startups. They align employees' interests with those of shareholders by allowing them to buy a set number of shares at a fixed "grant price" or "strike price." This price remains constant, regardless of market fluctuations, for a specified period defined in the option agreement. The exercise timeframe is crucial and often involves a vesting schedule, which allows options to become available gradually over time or upon reaching specific milestones, promoting long-term commitment and performance.

When the stock price exceeds the grant price, the option holder can profit by exercising their options, buying shares at the lower grant price, and selling at the higher market price. Alternatively, they may hold the shares, anticipating further increases in value. They instill a sense of ownership and shared success, incentivizing employees to contribute actively to the company's prosperity.

ILPs stand out in the investment landscape due to their fundamental classification as debt obligations rather than equity stakes. This seemingly technical distinction carries profound implications for investor security, particularly in adverse circumstances. Because ILPs are considered debt, they offer a crucial safety net that is often absent in traditional equity-based investments, so there’s no downside.

One of the most significant advantages of this classification becomes apparent when a company issuing the underlying assets faces legal challenges or financial distress. In such cases, the treatment of debt obligations significantly differs from that of equity. Creditors holding debt instruments, like those underlying ILPs, typically have a higher priority in recovering assets compared to shareholders. Thus, in the event of a company's bankruptcy or serious legal issues resulting in financial write-downs, the portion of an ILP related to that debt can often be written off as a loss for the company.

The ability to write off the investment at the company level serves as a form of indirect protection for ILP investors. Although the underperforming or legally troubled asset will undoubtedly influence the value of the ILP, the debt write-off mechanism can mitigate some of the losses that might occur with equity investments in the same situation.

This distinctive feature provides ILP investors with a significant layer of protection, enhancing the overall security of their investment and offering a degree of insulation from the full impact of severe financial or legal challenges faced by the underlying entities. This inherent safety mechanism makes ILPs an appealing option for investors seeking a balance between potential investment growth and a measure of capital preservation.

.png)

This mechanism effectively aligns the financial destinies of early adopters with the overall prosperity and expansion of the Markethive network. Consequently, the decision to acquire Founding Share Tokens is presented not merely as a transaction but as a strategic entry point for Markethive community members to actively partake in the platform's foundational success and to position themselves to potentially reap considerable benefits from its future trajectory in the dynamic world of decentralized Market Networks.

.png)