In fewer than a week, three banks have failed. In an effort to avert more panic, U.S. government authorities have stepped up to backstop losses. In addition to the possibility that other banks will fail, there are legitimate questions about whether it was the proper decision to bail out two poorly run institutions with serious irregularities while allowing the third to fail.

So, should you withdraw funds from your bank and hide them under your mattress or invest in cryptocurrency?

Crypto and traditional banking are two very different options for storing your money. While banks are a familiar and trusted option, crypto, such as bitcoin, is a decentralized and volatile digital currency. So, the question arises, should you keep your money in Bitcoin or a bank?

This article will help you consider the options of either keeping your savings balances in cryptocurrency or in the bank. We will start by looking at what Bitcoin is before moving on to why people choose to use it as an investment vehicle and how they can use it safely and securely.

Image source: https://bitcoinbriefly.com/21-million-bitcoin/

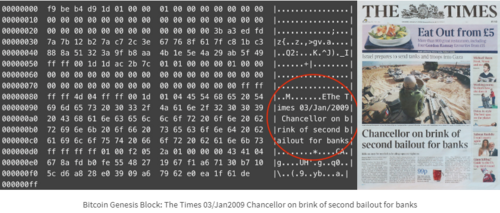

As many have already stated, the early financial crisis of 2008, known as the great recession, gave rise to the creation of bitcoin. The very first block of the blockchain came with a message concerning bailouts for banks. In contrast to the tightly entwined public and private banking sectors, it was created to remove third parties as an intermediary from the internet money system by making users accountable for their own keys.

The 2008 financial crisis was a significant event that shook the global economy, causing widespread unemployment, foreclosures, and bank failures. It highlighted the shortcomings of the traditional financial system and the need for alternative systems that could provide excellent stability, security, and decentralization.

Bitcoin was created as a decentralized digital currency that operates outside the traditional financial system. Its underlying technology, blockchain, allows for peer-to-peer transactions without intermediaries like banks. This gives users more control over their money and eliminates many fees and delays associated with traditional banking.

While Bitcoin's creation was not a direct response to the financial crisis, it is often seen as a product of the growing dissatisfaction with the traditional financial system and the need for more transparent and secure alternatives. Bitcoin was initially created as a response to the flaws of the traditional financial system. Still, it has since grown into a global phenomenon with unique characteristics and potential benefits.

One of the key advantages of Bitcoin is its decentralized nature. Unlike traditional currencies, which governments and financial institutions control, Bitcoin is not controlled by any central authority. This makes it more resistant to government or institutional manipulation and potentially more secure from hacking or other types of cyber attacks.

Another advantage of Bitcoin is its potential for anonymity. While Bitcoin transactions are not completely anonymous, they offer privacy that is not always available with traditional banking. This can be particularly useful for individuals concerned about their financial privacy or living in countries with strict financial regulations, such as China or Russia.

Bitcoin's potential as a global currency has also been touted as a potential benefit. With Bitcoin, sending and receiving payments across borders is possible without currency conversions or other barriers. This could make it easier for people to conduct business internationally and help level the playing field for small businesses and individuals.

While Bitcoin was not explicitly created as a response to the 2008 financial crisis, it is viewed by many as a potential solution to some of the problems highlighted by the crisis. Its decentralized nature, the potential for anonymity, and global accessibility make it a unique and potentially valuable addition to the financial landscape.

A systemic banking crisis can be extremely damaging. They tend to push the affected economies into deep recessions and sharp current account reversals. Some situations were contagious and quickly spread to other countries with no apparent weaknesses.

The many causes of banking crises include unsustainable macroeconomic policies (including large current account deficits and unsustainable government debt), excessive credit booms, large capital inflows and weak balance sheets, and various political and economic requirements resulting in political paralysis.

In September 2008, a global financial crisis caused by the collapse of housing markets led to a worldwide recession. The United States has recovered, but the rest of the world is still in recovery. This global financial crisis is the second largest in history and is predicted to be even bigger than the first.

Experts are worried that the United States is heading towards another global financial crisis, but it will be much worse this time. Many factors lead experts to believe that it will be more challenging to recover from the economic recession this time. Some of the reasons are increased global debt, over-leveraged banks, low economic growth, and rising oil prices.

There are concerns that the recent bank collapse and other economic crises could lead to another global financial crisis, as noted by several news articles. According to a report by The Guardian, the global banking system is reeling from a series of shocks over the past week, prompted by the collapse of California's Silicon Valley Bank. This has stoked fears that this is the start of a more severe crisis.

Similarly, an article by ABC News states that the potential next phase is a global credit crunch, which could lead to another worldwide financial crisis. However, regulators and central banks are pulling out all stops to prevent that.

In addition, an article by The New York Times notes that the banking crisis hangs over the economy, rekindling recession fears, and even optimistic forecasters on Wall Street in recent months have said that the chances of a recession had risen ten percentage points to 35 percent.

However, it is important to note that the situation is still developing, and it is difficult to predict with certainty whether or not we are on the verge of another global financial crisis. It will depend on the effectiveness of the measures taken by regulators and central banks to mitigate the risks and prevent the crisis from spreading.

Money saved in a bank account is typically considered a safer option for storing the value as it is backed by government guarantees, such as deposit insurance, which can protect a certain amount of funds in case of a bank failure. Bank accounts also offer the convenience of easy access to funds, as well as potential interest earnings. However, these are currently quite low in many countries due to low-interest rates.

On the other hand, Bitcoin has shown the potential for significant gains over the long term, and it also carries the risk of substantial losses, particularly in the short term. Bitcoin is not backed by government guarantees, which means there is no protection for investors if the value of Bitcoin were to decline sharply or if their Bitcoin were to be lost or stolen.

Bitcoin's status as a safe haven asset during times of crisis varies depending on the situation. Cryptocurrencies acted as a store of value during the COVID-19 crisis and as a safe haven. Also, before the pandemic, Bitcoin served as a safe haven, a hedge, and a diversifier versus a range of international currencies.

However, Bitcoin's volatility remains a concern as it can experience massive price swings, making it a risky store of value asset in the short term. On the other hand, money saved in the bank may provide stability and security, but its value may be affected by inflation, changes in interest rates, and other economic factors.

Whether to use Bitcoin or money saved in the bank as a safer store of value is subjective and depends on an individual's risk tolerance and investment goals. However, it's important to note that Bitcoin's status as a safe haven asset during times of crisis is not guaranteed and may vary depending on the situation. It's essential to consider each option's potential benefits and risks carefully and to seek the advice of a financial professional before making any investment decisions.

Today's bank failures are incredibly unusual and would likely result in a great deal of anxiety, as was the case with the collapse of Silvergate Bank, a free-floating entity cut off from the rest of the economy. How distinct can private and public interests truly be when SVB and Signature participated in both the ups and downs of the Fed policy-created tsunami of cheap money?

Considering the previous and recent economic upheaval, should you retain your money in a bank if the U.S. government is formally bailing out banks, or should you seek a better alternative?

Ultimately, the decision of where to keep your money depends on your individual circumstances, risk tolerance, and financial goals. It may be helpful to speak with a financial advisor or conduct additional research to make an informed decision.