Image Source: Unsplash

Gold Price News: Gold Retreats on Higher Yields & Subsiding Geopolitical Risk

Gold has been in retreat thus far this week, closing under $1968 per ounce to a two-week low. Rising US bond yields, together with some easing of geopolitical risk, appear to be the primary drivers. A slightly firmer dollar completes the picture.

Some of the US bond market euphoria has dissipated this week, with the 10-year US Treasury yields moving up modestly after last week’s hard rally. Speeches on Monday by Fed Governor Cook (dove & voter) and Minneapolis Fed President Kashkari (hawk & voter) have done little to provide clarity on the rate outlook. Nevertheless, futures markets still suggest a better than 50% probability of a US rate cut by May 2024.

With the conflict in the Middle East moving into its fifth week, there are also signs that investors’ perception of geopolitical risk is waning, undermining ‘safe-haven’ gold. Read More

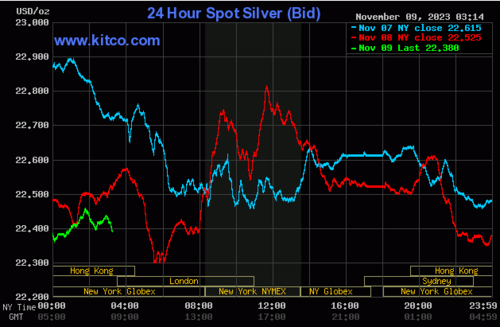

Silver Price News: Silver Slips on Growth Concerns and Rising Yields

Silver has struggled so far this week, failing to hold the pricing surge seen in Friday’s trading and, at $22.5 per ounce, has slipped to a three-week low.

Like gold, silver has been impacted by rising US bond yields, but is also more exposed to incoming data suggesting more fragile growth prospects.

The Federal Reserve remains determined to maintain a ‘higher for longer’ narrative on rates, and for much of the last two years, this has been supported by economic growth (and inflation) which has been more resilient than expected. However, weakness in the US housing market now appears to be spreading to weak job creation and consumer confidence is falling. Recent data from China and the Eurozone have also disappointed.

This dynamic is potentially problematic for silver, given that c. 45-50% of silver usage is linked to industrial applications and economic growth. Read More

The Affect Of Interest Rates On The Price Of Gold

The flawed notion of an inverse relationship between gold and interest rates is based on the idea that, since holding gold does not earn interest, when rates are low or near zero an investor is indifferent between holding gold as an investment or putting funds in an interest-bearing fund or account. Conversely, when rates rise investors are incentivised to move funds out of gold and into money market funds or T-Bills.

Apart from the direct evidence presented below, there are a couple of flaws in that logic. First, sophisticated gold investors view gold as a wealth-preservation asset and not an interest-bearing investment.

The second problem with the mainstream narrative is that, again, sophisticated investors focus on real interest rates, not nominal rates. The “real” rate of interest is defined as the risk-free rate (Fed funds, LIBOR, short-duration T-Bills) minus the rate of inflation.

The actual rate of inflation is as opposed to the highly flawed CPI inflation rate. While the media promotes the narrative that real rates are now positive, applying inflation measures like the Shadow Government Statistics’ inflation measure to the Fed funds rates shows that real rates are still negative. Read More

Gold price reaction if oil hits $150 as the World Bank warns? Rich Checkan weighs in

Gold has seen gains of more than $160 in the last month as tensions in the Middle East continue to escalate following the Hamas attack on Israel on October 7. However, if a third player gets involved in the conflict, the gold price will experience a much more dramatic move higher, according to Rich Checkan, President and COO of Asset Strategies International.

Gold has surged towards the $2,000 an ounce level from the $1,840 level in the wake of the Israel-Hamas war, with the geopolitical war premium in part driving the rally. However, this could be just the beginning if the conflict spills over and gets other actors involved, Checkan told Kitco News on the sidelines of the New Orleans Investment Conference.

"If a state agency gets involved directly in the conflict, not through proxies, I see gold going up dramatically," Checkan told Michelle Makori, Lead Anchor and Editor-in-Chief at Kitco News. "We could see $2,200 an ounce. But I don't see it going significantly higher unless another state player gets directly involved." Read More

China's secret gold purchases mean real reserves 'more than twice' official numbers - Gainesville Coins' Nieuwenhuijs

The People’s Bank of China (PBoC) has been rapidly accumulating gold, which suggests the country is laying the groundwork for significant changes in the dollar-centric international monetary system, according to Jan Nieuwenhuijs at Gainesville Coins.

“The PBoC is in a hurry to buy enormous amounts of gold,” Nieuwenhuijs wrote. “Based on information from industry sources and my personal calculations, total gold purchases by the Chinese central bank (reported and unreported) in Q3 accounted for 179 tonnes.”

He said the PBoC has bought 593 tonnes so far this year, which is a staggering 80% higher than its purchases during the first three quarters of 2022. “Its total estimated gold holdings are 5,220 tonnes, more than twice what’s officially disclosed at 2,192 tonnes,” Nieuwenhuijs said.

“Mainly the Chinese central bank is on a voracious buying spree since 2022, and it’s obtaining way more metal than what is officially reported.” Read More

Key segments of the silver market to see 42% growth through 2033 - Oxford Economics

Demand for silver will continue to grow for the next decade, far outpacing its growth over the last 10 years, according to the latest research from Oxford Economics.

In a research report conducted on behalf of the Silver Institute, the analysts said that three key pillars of global silver demand – industrial, jewelry and silverware – are expected to see total demand growth of 42% through 2033, "effectively double the growth rate over the previous decade, 2014-2023."

The report said that industrial demand will continue to dominate the silver market over the next 10 years, with demand from the sector expected to grow by 46%. At the same time, jewelry and silverware demand are forecasted to rise by 34% and 30% respectively.

The report notes that these three segments of the silver market account for nearly three-quarters of global demand. Industrial applications alone represent more than 60% of total silver demand. Read More

Gold pressured on technical selling, drop in crude oil

Gold prices are lower in midday U.S. trading Wednesday. The sellers are in control today as crude oil prices have slumped to a 3.5-month low and as the near-term technical posture for the yellow metal has deteriorated this week—prompting some chart-based selling from the speculators. Silver is trading higher on some perceived bargain hunting. December gold was last down $13.30 at $1,960.20. December silver was last up $0.246 at $22.83.

U.S. stock indexes are weaker at midday. Risk appetite is creeping back into the general marketplace amid no recent major escalation in the Israel-Hamas war. That's also a negative for the safe-haven metals bulls.

Technically, December gold futures prices hit a three-week low today. The bulls have the slight overall near-term technical advantage but need to show fresh power very soon to keep it. A four-week-old uptrend on the daily bar chart has been negated. Bulls' next upside price objective is to produce a close above solid resistance at the October high of $2,019.70. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,900.00. First resistance is seen at today's high of $1,977.50 and then at $1,985.20. First support is seen at today's low of $1,956.80 and then at $1,950.00. Wyckoff's Market Rating: 5.5.

Image Source: Kitco News

December silver futures prices hit a three-week low today. The silver bears have the overall near-term technical advantage. Silver bulls' next upside price objective is closing prices above solid technical resistance at the October high of $23.88. The next downside price objective for the bears is closing prices below solid support at the October low of $20.85. First resistance is seen at $23.00 and then at $23.50. Next support is seen at today's low of $22.375 and then at $22.00. Wyckoff's Market Rating: 4.0. Read More

Image Source: Kitco News

U.S. government shutdown next week? Markets are underpricing this risk - Danielle DiMartino Booth

There is another U.S. government shutdown deadline looming over the U.S. at the end of next week, and Danielle DiMartino Booth, CEO and Chief Strategist at QI Research, says that markets are currently ignoring this risk.

As of Tuesday, the Republican majority in the U.S. House of Representatives had not reached a consensus on a strategy to maintain federal agency operations, with the November 17th deadline to avoid a government shutdown fast approaching. The Senate, with a narrow Democratic majority of 51-49, is also facing an impasse, which has amplified demands for a stopgap "continuing resolution" to prevent a shutdown.

DiMartino Booth described the U.S. Congress as dysfunctional. "There haven't been any of the concessions that those on the far right have been demanding," DiMartino Booth told Michelle Makori, Lead Anchor and Editor-in-Chief at Kitco News, on the sidelines of the New Orleans Investment Conference. "All these months later, after the debt ceiling was resolved, they're still not getting what they want." Read More

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.