Image Source: Unsplash

Gold Price News: Gold Jumps Higher After US inflation Comes In Lower Than Expected

Gold prices jumped higher Tuesday, recapturing losses seen at the tail end of last week, after US inflation data surprised on the downside, raising the likelihood that interest rates may have peaked.

Prices rose as high as $1,970 an ounce Tuesday, compared with a low of $1,933 an ounce on Monday. The jump followed the release of data showing that US headline and core inflation rates were lower than expected in October.

This raised speculation that the US Fed may be done with interest rate hikes, and follows comments from Fed Chair Jerome Powell last week suggesting he wouldn’t hesitate to raise rates further if needed, in a bid to bring inflation down to 2%.

Several months of rising interest rates have created a headwind for gold, bringing prices down from highs of well over $2,000 in May, and any signs of a halt to monetary tightening would be expected to support the yellow metal. The latest figures prompted a drop in the value of the US dollar against other currencies, in a bullish move for dollar-denominated assets like gold. Read More

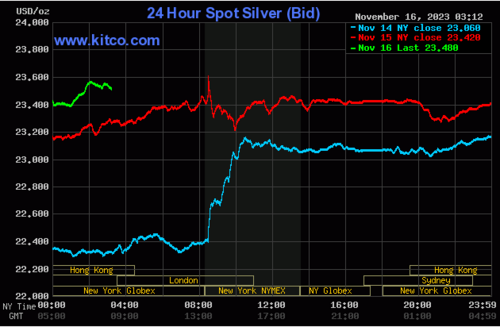

Silver Price News: Silver Surges on Dollar Weakness After US Inflation Slows

Silver prices surged higher Tuesday on the back of a sharp drop in the US dollar. Prices jumped as high as $23.19 an ounce Tuesday, compared with a low of $21.90 on Monday.

The US dollar index weakened to a two-month low Tuesday and US Treasury yields fell sharply, following news that US inflation in October had come in below expectations, slashing the prospects of further interest rate hikes by the US Fed.

The weaker greenback naturally provided a shot in the arm for dollar-denominated assets like gold and silver. Since the inflation figures were lower than expected, this may have prompted short-covering activity in the silver futures market, lifting prices on the day.

However, the market will be watching closely to see if the latest gains can hold, particularly as each rally over the last few months has failed to surpass the previous one, painting a bearish trend for silver in the medium term. Read More

Gold prices holding gains as U.S. PPI drops 0.5%, sees biggest decline since April 2020

The gold market is holding on to solid gains but is seeing little reaction as inflation looks to have peaked following a sharp decline in wholesale prices.

Wednesday, the U.S. Labor Department said its Producer Price Index (PPI) dropped 0.5% last month, following September's revised increase of 0.4%. According to consensus forecasts, the data was significantly cooler than expected, with economists looking for an increase of 0.1%.

"The October decline is the largest decrease in final demand prices since a 1.2-percent drop in April 2020," the report said.

In the last 12 months, headline inflation rose 1.3%, the report said.

Meanwhile, core PPI, which strips out volatile food and energy costs, was unchanged last month, also coming in weaker than expected. Read More

Gold prices dip after U.S. retail sales beat expectations again in October

Gold prices dipped after retail sales came in above market expectations in October, with September’s print also seeing an upward revision.

U.S. retail sales declined -0.1% last month following a revised increase to 0.9% from 0.7% in September, according to the latest data from the U.S. Commerce Department. Economists' consensus calls projected a -0.3% decline in October’s headline number.

Core sales, which strip out vehicle sales, were up 0.1% last month, above market expectations of a flat 0.0% print, and compared to September’s upwardly revised 0.8% reading. Read More

Gold prices pull back after New York Fed survey beats expectations to rise to 9.1 in November

Gold prices dipped after the latest data from the New York Federal Reserve showed surprising improvement within its region's manufacturing sector last month, though the outlook also worsened significantly.

The regional central bank said Monday that its Empire State manufacturing survey's general business conditions index rose to 9.1 in November, well up from October’s negative reading of -4.6.

The data was much stronger than expected, as consensus forecasts were looking for the headline index to remain in contractionary territory at -2.6. October was only the second month the index has been negative since May, after August posted a reading of -19. Read More

Greenlight Capital holds a record amount of gold as David Einhorn worries about market conditions

Growing concerns regarding the health of the U.S. economy and financial markets have prompted David Einhorn’s Greenlight Capital to build a solid safe-haven position in gold, with its stake in SPDR Gold Shares (NYSE: GLD) jumping by 89.22% in the third quarter.

The firm’s third-quarter 13-F filings with the Securities and Exchange Commission show it invested $34.9 million in the world’s largest gold-backed ETF. According to reports, this is Greenlight Capital’s biggest stake in GLD on record.

The increased exposure to gold comes after Einhorn said in his third-quarter letter to investors that he is worried about the market's direction.

He said in the letter that investors are too complacent about the growing threat of rising geopolitical uncertainty.

“The complacent investor view that geopolitics should be ignored might be true, except for the times when it isn’t. We suspect we are in one of those times,” Einhorn wrote in the letter. Read More

Gold price pauses Wednesday after solid gains Tuesday

Gold prices are just a bit weaker and silver higher in midday U.S. trading Wednesday. Gold is seeing some routine profit-taking from the shorter-term futures traders, following this week’s gains. A rebound in the U.S. dollar index and an uptick in U.S. Treasury yields at mid-week are negative daily outside market influences for the yellow metal. Silver is seeing good follow-through strength after posting solid gains Tuesday. December gold was last down $1.80 at $1,964.80. December silver was last up $0.398 at $23.53.

Trader and investor attitudes are more upbeat at mid-week following Tuesday’s U.S. consumer price index report for October that came in at up 3.2%, year-on-year. CPI was forecast at up 3.3%, year-on-year, versus a gain of 3.7% in the September report. U.S. producer price index data for October, released this morning, corroborated Tuesday’s tamer CPI data. October PPI was down 0.5% from September, versus expectations for a rise of 0.1% in the period. The CPI and PPI data fall into the camp of the U.S. monetary policy doves, who want to see the Federal Reserve halt its interest-rate-tightening cycle. Now, more Fed market watchers believe the U.S. central bank will continue to pause on raising interest rates in the coming months.

The U.K. also got some better inflation news today. Consumer prices were 4.6% higher in October, year-on-year, following a rise of 6.7% in September. The October rise in CPI was the slowest in the U.K. in two years. Some analysts are now saying the better U.K. inflation data will end the Bank of England’s interest-rate-increase cycle.

Technically, December gold futures bulls and bears are on a level overall near-term technical playing field. Bulls’ next upside price objective is to produce a close above solid resistance at $2,000.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,900.00. First resistance is seen at today’s high of $1,979.20 and then at $1,985.00. First support is seen at today’s low of $1,958.80 and then at $1,950.00. Wyckoff's Market Rating: 5.0.

Image Source: Kitco News

December silver futures bulls and bears are back on a level overall near-term technical playing field, but the bulls now have momentum. A price downtrend on the daily bar chart has been negated. Silver bulls' next upside price objective is closing prices above solid technical resistance at $24.05. The next downside price objective for the bears is closing prices below solid support at this week’s low of $21.925. First resistance is seen at today’s high of $23.71 and then at the October high of $23.88. Next support is seen at today’s low of $23.095 and then at $23.00. Wyckoff's Market Rating: 5.0. Read More

Image Source: Kitco News

China's gold holdings are 10x reported amounts, the real reason Beijing is secretly hoarding gold - Dominic Frisby

China has been on a full-out gold shopping spree — topping up its gold reserves each month for the last 12 months. However, the official numbers are not even close to the actual amounts China is buying, according to Dominic Frisby, Founder of FlyingFrisby.com.

The latest data out of China showed that its central bank bought gold for the 12th consecutive month in October. The latest purchase was around 23 metric tons, which increased the total holdings to 2,215 tons, the World Gold Council reported.

Overall, China's government has recently been among the biggest gold stockpilers during what looks to be another record-breaking year of central bank gold purchases.

And even though China is already the leader in gold accumulation, the real numbers are much more significant, Frisby told Michelle Makori, Lead Anchor and Editor-in-Chief at Kitco News, on the sidelines of the New Orleans Investment Conference.

The official data from China is meant to acquaint the market with the idea that it has more gold. Read More

Long-term bullish market sentiment still fully intact

Yesterday's significant drop in the dollar was directly related to the release of the October CPI inflation report, revealing muted growth, similar to September's low reading. Despite forecasts by major analysts and economists predicting higher levels, the actual inflation remained below expectations. This outcome strengthens the case for the data-dependent Federal Reserve to extend its pause on rate hikes and potentially end the rate hike cycle earlier than anticipated in the September dot plot.

The CME Fedwatch tool, a widely used probability indicator, now places a 100% certainty that the Federal Reserve will not raise rates at the December FOMC meeting, up from 90.4% a week ago and 69.6% a month ago.

Inflation has continued its decline from 9.1% in June 2022 to the current 3.2% year-over-year level. This steady reduction is seen as evidence that inflation is on track to reach its 2% target, likely contributing to the Federal Reserve's decision to halt the historic 11 consecutive rate hikes. Read More

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.