Image Source: Unsplash

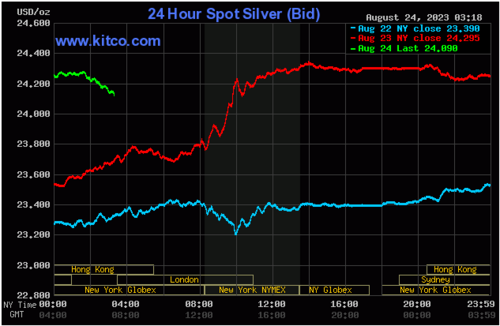

Silver Price News: Silver Extends its Recovery Jumping Above $23 per Ounce

In our last market analysis, we suggested that silver was offering interesting rebounding signals and was trying to consolidate its recovery.

This scenario has been confirmed in the first part of this week. Indeed, buyers have been very active on silver, while the spot price broke the resistance of $23 per ounce, quickly jumping above $23.5.

Moreover, silver significantly over performed gold, showing a return of interest in the grey metal. For many investors, silver prices below $23 appeared as too cheap, especially when considering the growing use from the industrial sector, particularly in the photovoltaic field and in electric cars.

The technical analysis is offering positive indicators too. Read More

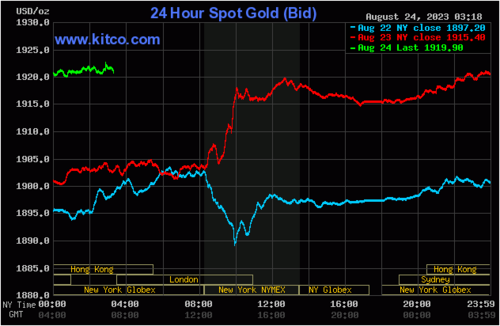

Gold Price News: Gold Toys with $1,900 As Market Awaits Jackson Hole Symposium

Gold posted only fractional gains in the first part of this week. It rose from $1.890 to $1,900 per ounce, while the price per gram surpassed the $61 mark.

This recovery attempt is a positive signal for the metal as it shows that buyers are returning to a more active mode, but we cannot yet consider the current movement to be a proper inversion. What is missing is a major catalyst with the strength to trigger a rise big enough to offset the decline of the last few weeks.

On the macroeconomic agenda later today is the release of the U.S. services PMI for August and New Homes Sales, while tomorrow the attention will shift towards the Initial Jobless Claims. However, the most significant event for most investors is the Jackson Hole Symposium and the speech of the chairman of the Fed on Friday.

Although it is unlikely that Jerome Powell will talk in too much detail about the Fed’s monetary policy plans for the rest of the year, investors will try to find in his words any clues on whether the US central bank is likely to hike interest rates one more time late this year. Any potential doveish or bullish hints in his speech are likely to move markets one way or the other. From a technical point of view, the first key level is placed at $1,900. Read More

Gold price at $6k? This asset is more likely to triple - Hugh Hendry

It is essential to have exposure to real assets in this uncertain macro environment, according to Hugh Hendry, Founder of Eclectica Macro. But Hendry still prefers to hold four times more Bitcoin than gold, and here's why.

From real assets, Hendry's top pick is gold. "I would have 5% of my portfolio [in gold]," Hendry told Michelle Makori, Lead Anchor and Editor-in-Chief at Kitco News. "Why gold? Because for the last 12 years, gold has kept hitting this $2,000. It feels like there's a price barrier, and a lot of people want to own gold, but there's not enough economic stimulus or data to sponsor a consistently higher gold price."

In the months and years ahead, gold will move above this $2,000 an ounce resistance, which is when Hendry will start increasing his 5% position.

"When it gets to $2,000, it fades, and it falls away. But one of these days, maybe, it is going to go $2,100, $2,200, $2,300," he said. "When it breaks the barrier to the upside, I'm buying it."

At the time of writing, December Comex gold futures were trading at $1,923 an ounce and spot prices were at $1,894,50 an ounce.

Despite Hendry's positive outlook on gold, he is more bullish on Bitcoin — with a 20% allocation. Read More

Solid gains for gold, silver as Jackson Hole looms

Gold and silver prices are solidly up in midday U.S. trading Wednesday, boosted by a weaker U.S. dollar index and a dip in U.S. Treasury yields at mid-week. More short covering by the futures traders and perceived bargain hunting are featured in the two precious metals. The technical posture for silver has significantly improved this week, which is inviting chart-based speculators to the long side of that market. December gold was last up $20.60 at $1,946.60 and September silver was up $0.91 at $24.36.

Traders and investors are anxiously awaiting the Kansas City Federal Reserve’s annual symposium held in Jackson Hole, Wyoming late this week. Fed Chairman Jerome Powell and European Central Bank President Christine Lagarde are set to give speeches. The speeches are expected to provide insights into the future monetary policy direction of their respective central banks.

Technically, December gold futures were up $19.20 at $1,945.30 in midday trading and near the session high. Short covering was seen after prices hit a five-month low Monday. Bears still have the overall near-term technical advantage. However, a four-week-old downtrend on the daily bar chart is in jeopardy. Bulls’ next upside price objective is to produce a close above solid resistance at $1,980.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $1,900.00. First resistance is seen at $1,950.00 and then at $1,965.00. First support is seen at today’s low of $1,926.20 and then at this week’s low of $1,913.60. Wyckoff's Market Rating: 3.5.

Image Source: Kitco News

September silver futures were up $0.89 at $24.335 at midday and near the session high. Prices hit a three-week-high today. The silver bulls have the overall near-term technical advantage and have momentum. A four-week-old downtrend on the daily bar chart has been negated, and prices are now starting to trend up. Silver bulls' next upside price objective is closing prices above solid technical resistance at the July high of $25.475. The next downside price objective for the bears is closing prices below solid support at the August low of $22.265. First resistance is seen at $24.50 and then at $24.75. Next support is seen at $24.00 and then at today’s low of $23.475. Wyckoff's Market Rating: 6.0. Read More

Image Source: Kitco News

Silver prices squeezed 4% higher after Chinese currency intervention

A perfect storm is brewing in the silver market as the expected easing from the Chinese government to support its faltering economy is squeezing shorts in the marketplace and driving prices significantly higher.

September Silver last traded at $24.355 an ounce, up nearly 4% on the day. The precious metal is seeing its best day since mid-July as it regains critical technical levels.

Ole Hansen, head of commodity trading at Saxo Bank, said silver’s current short squeeze started building last week when the People’s Bank of China (PBoC) intervened in currency markets to support the yuan after it hit a 16-year low against the U.S. dollar.

“The stronger yuan forced a focus change in copper, and with that also silver,” Hansen said.

Analysts said that the central bank’s easing measure at the start of the week could provide further industrial support to the precious metal.

The renewed focus on industrial demand came as sentiment in silver was at extremely bearish levels. Three weeks ago, speculative interest turned net-short by nearly 4,000, according to data from the Commodity Futures Trading Commission. Updated data published last week saw bearish sentiment hit its highest level since early March. Read More

Investors should be holding more than 5% in gold as a recession is inevitable - Adrian Day

The U.S. economy has been fairly resilient through the first half of 2023, which is prompting some economists to shift their forecasts and price out any potential recession; however, one market strategist believes that the U.S. is still on track to weaken by year-end.

In a recent interview with Kitco News, Adrian Day, president of Adrian Day Asset Management, said that some economists overestimate the current strength of the economy and the resilience of consumers.

“We always seem to forget that recessions don’t happen overnight,” he said. “Investors keep expecting things to happen immediately, but it takes time for economic conditions to change.”

While consumption has supported activity through most of this year, Day notes that consumers have burned through their COVID savings as credit card debt rose sharply in the second quarter.

Earlier this month, the New York Federal Reserve reported that consumer debt increased to $1 trillion between April and June.

Day noted that not only are consumers using debt to cover their expenses, but they also now face higher interest rates because of the Federal Reserve's aggressive tightening. He added that these are not the signals one wants to see in a healthy economy. Read More

There's a new bullish case to go long gold - Longview Economics

The current run of record central bank purchases has helped support the price of the precious metal, but there’s an emerging new case as to why investors should be long gold, according to Chris Watling, Chief Market Strategist at Longview Economics.

“[A]s we outlined in our recent analysis of central bank/official buying of gold, there’s no clear correlation between the level/growth of their purchases and the direction of the gold price,” Watling said in the company’s latest Commodity Fundamentals Report. “Indeed, apart from the past 18 months since the war, the gold price has been highly correlated with our 3 factor macro driven gold model,” which focuses on TIPS, interest rate expectations, and the performance of the U.S. dollar.

Watling said the key question is why this relationship has broken down over the last year and a half. Read More

Disclaimer: These articles are provided for informational purposes only. They are not offered or intended to be used as legal, tax, investment, financial, or any other advice.